Set up CGT calculation

To have CGT figures calculated in the system, you need to mark CGT-applicable securities and portfolio types and define the CGT calculation rules.

Mark CGT-applicable securities

CGT calculation can depend on the security being sold – for example, government bonds are often CGT-exempt, while shares and funds are typically taxable. To mark CGT-applicable securities, use one of the methods:

Open securities one by one in the Security window in FA Back and select CGT-applicable.

Import the "CGT-applicable" value for multiple securities in the CSV file. For details, see Securities and market prices import.

Define CGT-applicable portfolio types

Depending on the country's legislation and your business, different types of investments can be subject to or exempt from CGT. For example, trades within tax wrappers aren't subject to CGT. In FA system, CGT-applicable and CGT-exempt investments are kept in different portfolios that belong to different portfolio types.

Choose the portfolio type(s) that are CGT-applicable and mark them accordingly:

Go to Preference → Portfolios → Portfolio types in FA Back.

For the portfolio types that are subject to CGT, select CGT applicable.

Save the changes.

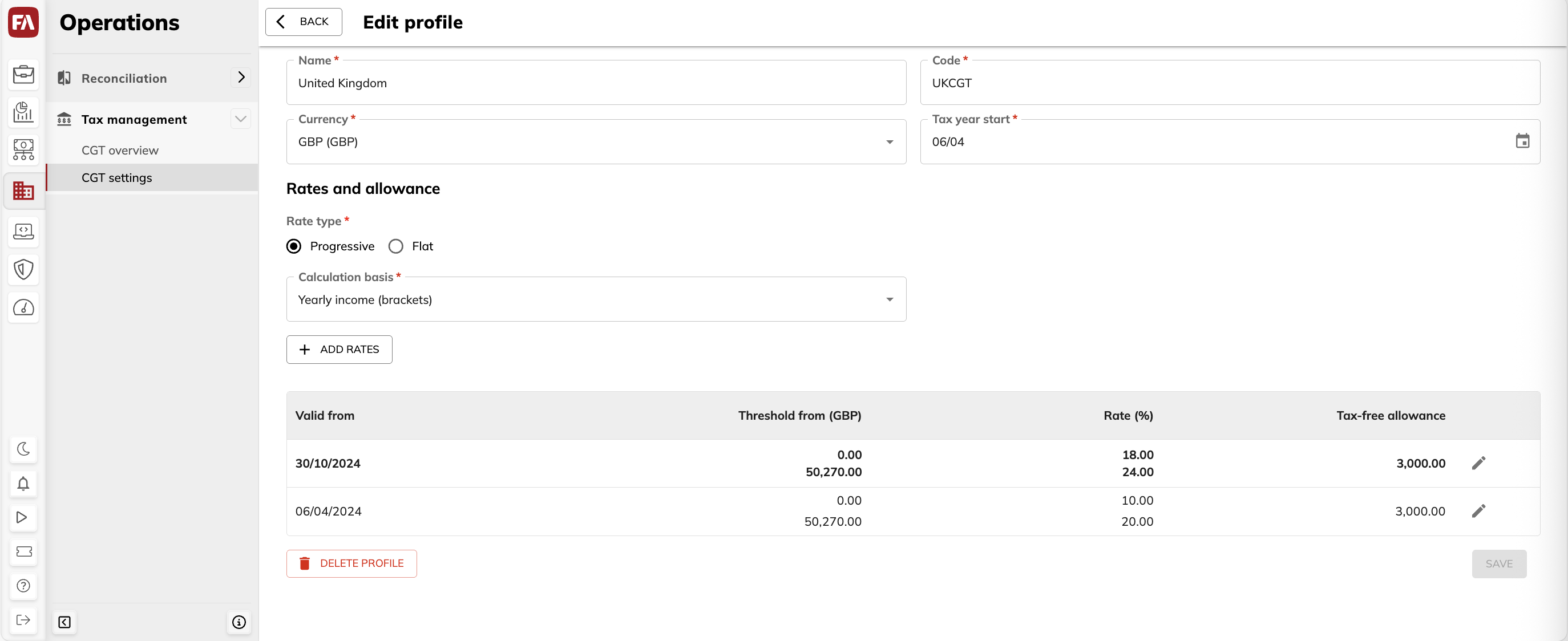

Configure CGT rates and allowance

Capital gains taxation differs a lot depending on the country. SFor each jurisdiction you work with, configure CGT profile setting the key parameters such as rate type, rate percentage and tax-free allowance:

Go to Tax management → CGT settings in FA Operations and click Add profile.

Add a CGT profile and fill in the fields:

General information: Name, Code, Currency and Tax year start.

Calculation details in the Rates and allowance section.

For field descriptions, see CGT profile.

Save the changes.

|

CGT profile

The CGT profile defines how capital gains are taxed.

- Name

The CGT profile name, for example, "Finland CGT".

- Code

The CGT profile code, for example "CGTFIN". The code is used by the system to identify the profile.

- Currency

The currency in which the gain and tax are calculated. Note that CGT currency and portfolio currency in FA system must match. If you work with portfolio currencies that differ from the CGT currency and want to use currency conversion, set up a portfolio structure as described in Set up CGT calculation for portfolios in non-CGT currency.

- Tax year start

The first day of each tax year.

Flat rate and allowance

- Rate type

Rate type: choose "Flat" for a single fixed rate.

- Valid from

The date starting from which the rate is applied.

- Rate

The rate percentage.

- Tax-free allowance

The yearly amount of profit from assets subject to CGT that is exempt from taxation. The profit above the tax-free allowance is taxed.

Progressive rates and allowance

- Rate type

Rate type: choose "Progressive" for the rate based on the realized profit or on yearly gross income estimate.

- Calculation basis

The base for the progressive tax rate:

Realized profit above the tax-free allowance. The calculation is tiered: different portions of the profit are taxed at different rates, depending on which bracket they fall into. Example: €30,000 taxed at 30%; anything above taxed at 34%.

Yearly gross income estimate. The calculation is applied with brackets: a single tax rate – corresponding to the yearly income bracket – is applied to the entire profit amount.

The estimated yearly gross income amount entered in the customer's CGT information: for details, see Fill in customer's information.

- Valid from

The date starting from which the brackets are applied.

- Threshold from

The minimum yearly gross income or realized profit at which the rate applies.

- Rate

The tax rate (%) to apply to profits.

- Tax-free allowance

The yearly amount of profit from assets subject to CGT that is exempt from taxation. The profit above the tax-free allowance is taxed.