FA Back 3.21 - Release notes

FA Back 3.21 provides you with many new features. You can now add a credit to a portfolio, set up account interest and capitalize it, run limits on look-through positions and choose a method of the TWR calculation. In the bookkeeping, we have added the possibility to run postings with multiple conditions and you now also have an audit trail on postings and posting rules.

Portfolio credit

Why?

Previously, FA Back didn't support adding credit to the end-client portfolios. You can now trade with agreed credit.

Who is this for?

This feature is for advisors and asset managers who would like to provide the end-users the possibility to trade with credit.

Details

We added a new feature to enhance our portfolio capabilities - now you can set up credit for portfolios. If you want your customers to be able to make more trades than their account balance allows, you can activate this feature for them.

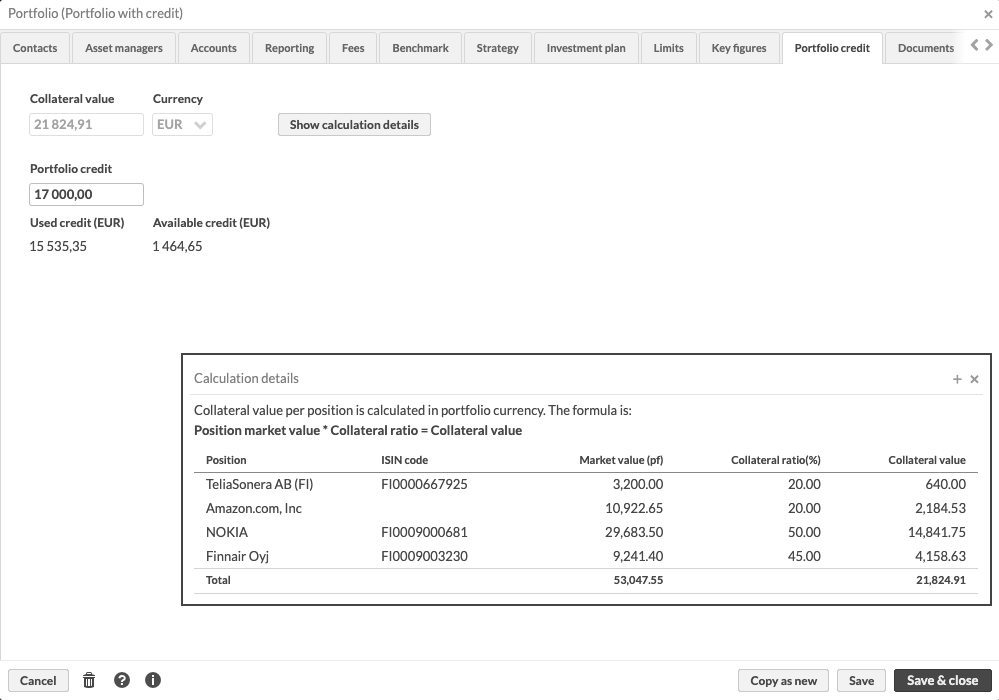

To determine the portfolio credit size, we've introduced a way to calculate the collateral value of the portfolio. You can use this value as a base when deciding the credit size. Simply set up a Collateral ratio for the securities you want to include in the calculation.

Here's how it works: the feature considers the current assets in the chosen portfolio and calculates a collateral value based on the market value of securities and the collateral ratio. Once you have the collateral value, you can work with your client to set an appropriate credit size for the portfolio.

As you make trades in the portfolio, you can track the used and available credit either through Key Figures or from the Portfolio's credit tab.

Example:

A customer owns security FA Inc. with a market value of 100.000€. The collateral ratio for FA Inc. is 40% which will give the customer a collateral value of 100.000*0,4 = 40.000€. The advisor or portfolio manager agrees with the customer on a 35.000€ portfolio credit. The customer doesn’t have any cash on their credit account but they can still use 35.000€ to place trade orders. The customer places a trade order for 10.000€. The available credit will show 25.000€ and used credit 10.000€.

Use this functionality together with the account interest feature to collect interest for the used credit.

|

Learn more: Provide credit to your clients and Set up and capitalize accrued interest on account.

Calculating and capitalizing accrued interest

Why?

With the implementation of Portfolio credit, we needed a better way to set up account interest and capitalize accrued interest than the one we previously had. The new solution is flexible and easy to use with all types of accounts.

Who is this for?

This feature is for the users who set up accounts and account details for the customers.

Details

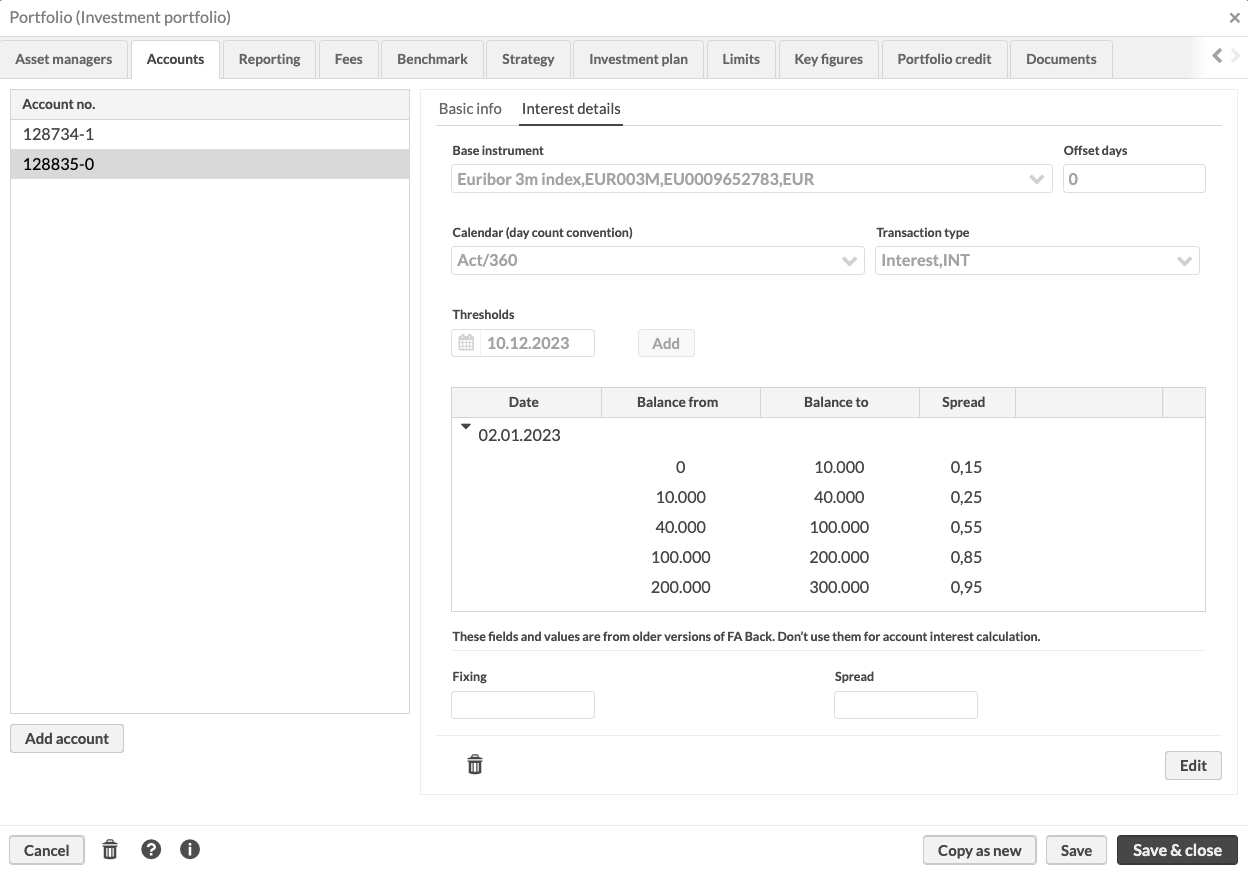

The new feature enables you to select the interest rate setup from various options. You can also choose to include thresholds to define different spreads on different balances:

Flat interest rate on the whole amount

Floating interest rate on the whole amount

Floating interest rate + a spread on the whole amount

Flat interest rate + different spreads depending on the account balance

Floating interest rate + different spreads depending on the account balance

As a floating interest rate, you can use rates like Euribor 3 months. For a flat interest rate, you can create a base instrument (security) with a market value of, for example, 2%. To be even more flexible you could in addition add thresholds with spread to have different interest rates depending on the account balance of the account.

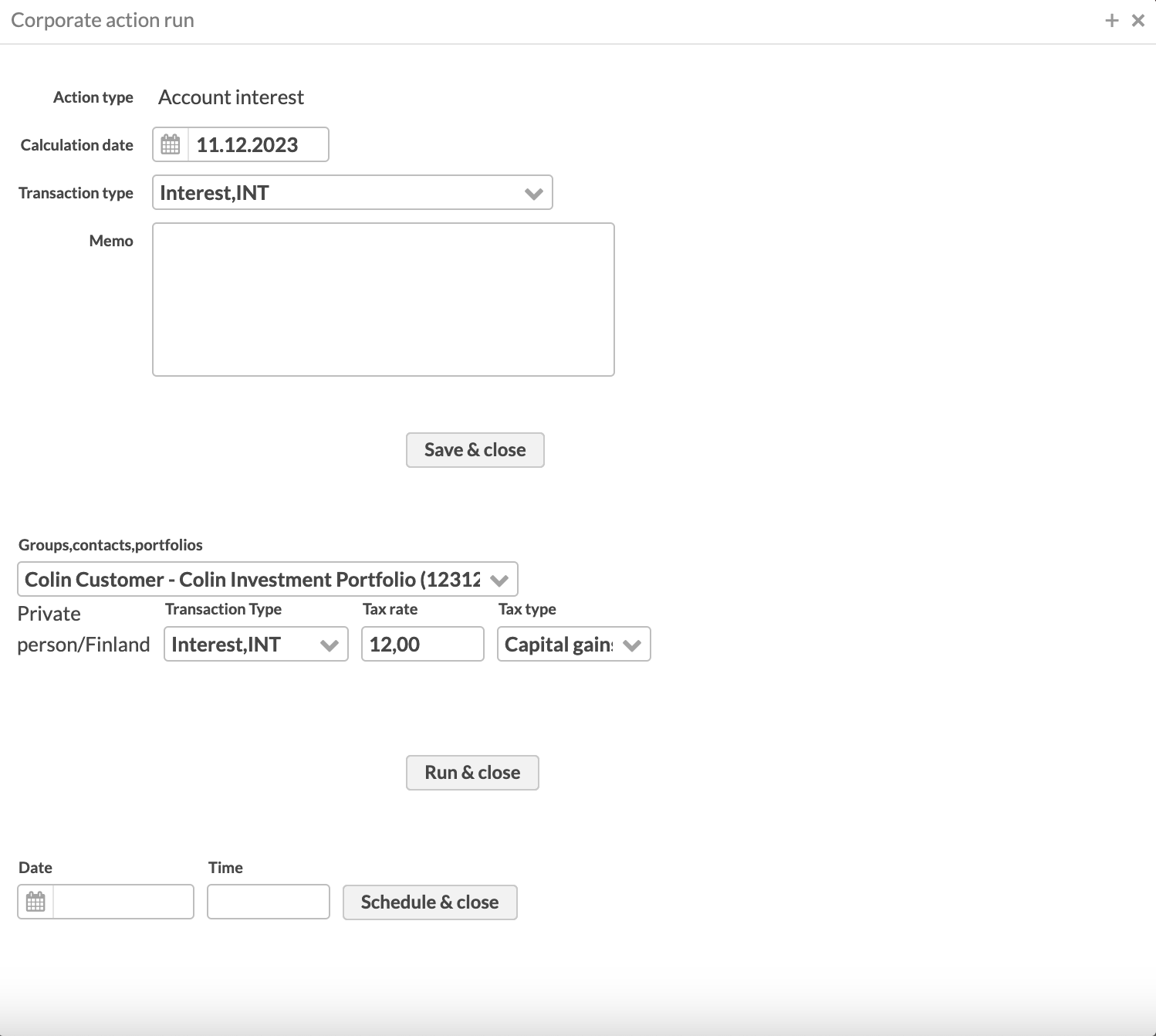

Interest is calculated on a daily basis, and you can track the accrued interest in the Overview in the Accrued interest column. When it's time to capitalize the interest, you can run an interest payment similar to fee calculation, and the interest is capitalized on the account, resetting the accrued interest calculation to zero.

Account interest works with all account types; cash, credit, and other accounts.

|

|

Learn more: Set up and capitalize accrued interest on account, Portfolio window, Fees and interests view.

Option to calculate accrued interest for bonds up to the start or end of analyzing day

Why?

Previously, FA calculated accrued interest on bonds up to the date being analyzed, excluding interest accrued on the current day. When calculating NAV, there might be a preference to include the accrued interest for the current day as well.

Who is this for?

This feature is for back office and fund company employees who set the configurations for portfolios.

Details

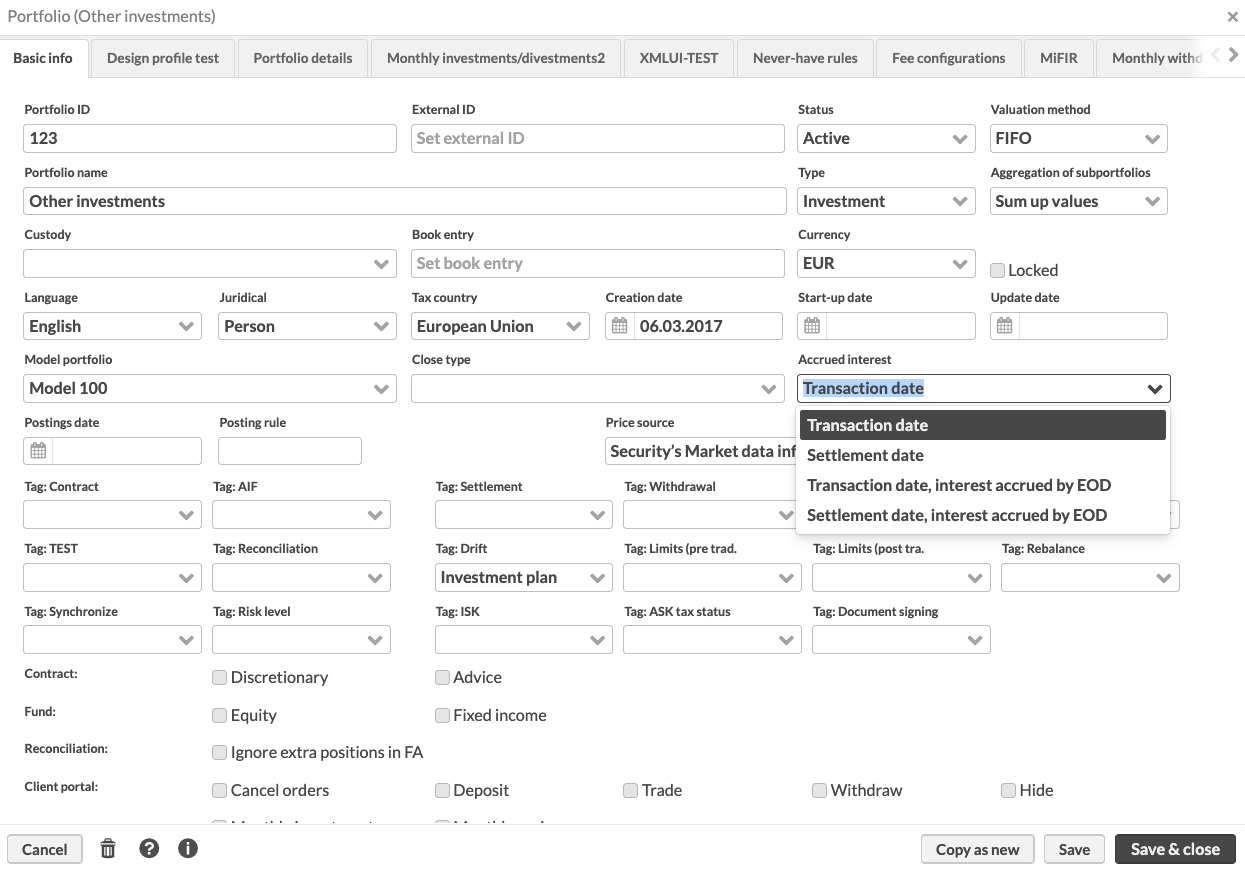

We have added two new options to the Accrued interest field for portfolios:

Transaction date, accrued interest until end of day

Settlement date, accrued interest until end of day.

With either of these options, the calculation includes one more day when analyzing a bond with accrued interest. The Accrued interest field for portfolio is used only for bonds, not for accounts accrued interest calculation.

|

Learn more: Portfolio window.

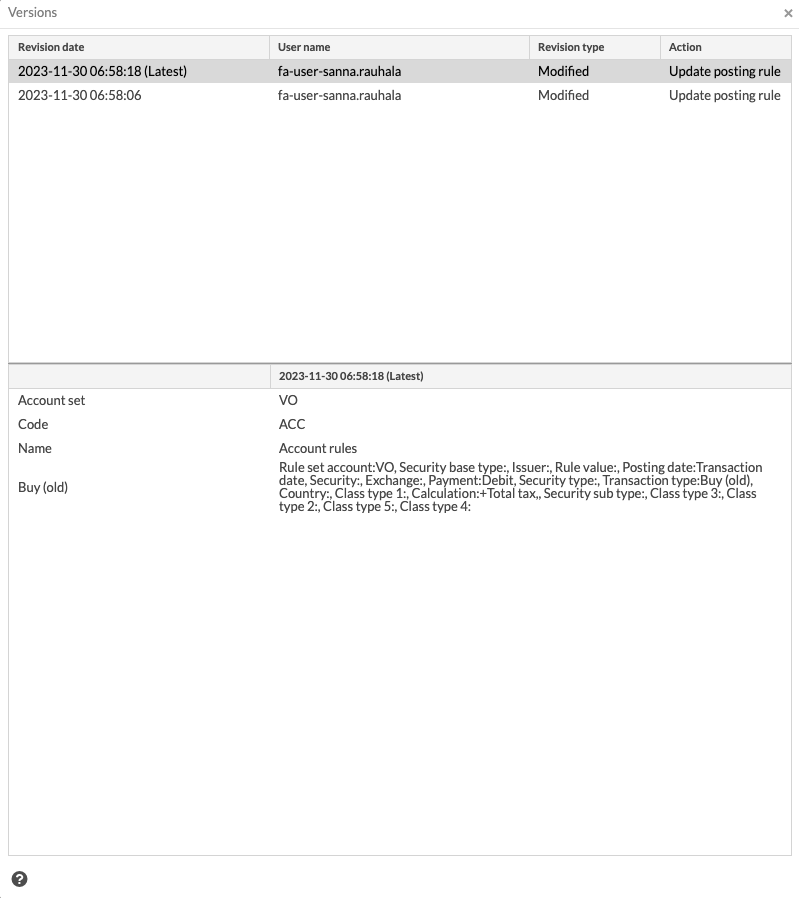

Audit trail on postings and posting rules

Why?

This feature is added to aid compliance efforts, allowing users to track and identify changes made to postings and posting rules.

Who is this for?

This feature is for users who use FA Back for creating postings.

Details

Previously, postings were technically audited, but posting rules were not. We have introduced a Versions view where users can review and track changes made to both posting rules and postings.

|

Learn more: Track data modifications through versions.

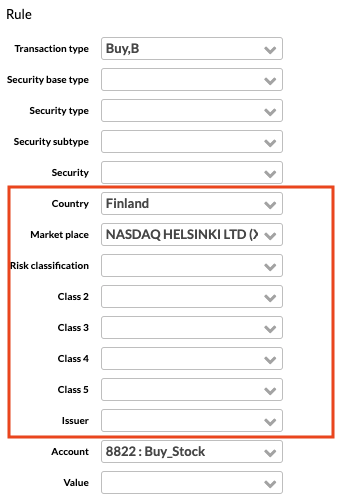

Running postings with multiple conditions

Why?

Previously, users could specify posting rules with only a single condition. We aimed to broaden this capability, allowing users to define more specific posting rules.

Who is this for?

This feature is for users who create bookkeeping posting settings in FA Back.

Details

Now, you have the flexibility to define your bookkeeping rules with greater precision by choosing from multiple conditions: Country, Market place, Class 1, Class 2, Class 3, Class 4, Class 5, and/or Issuer. The rule is applied only when all selected options match

|

Learn more: Preference - Bookkeeping.

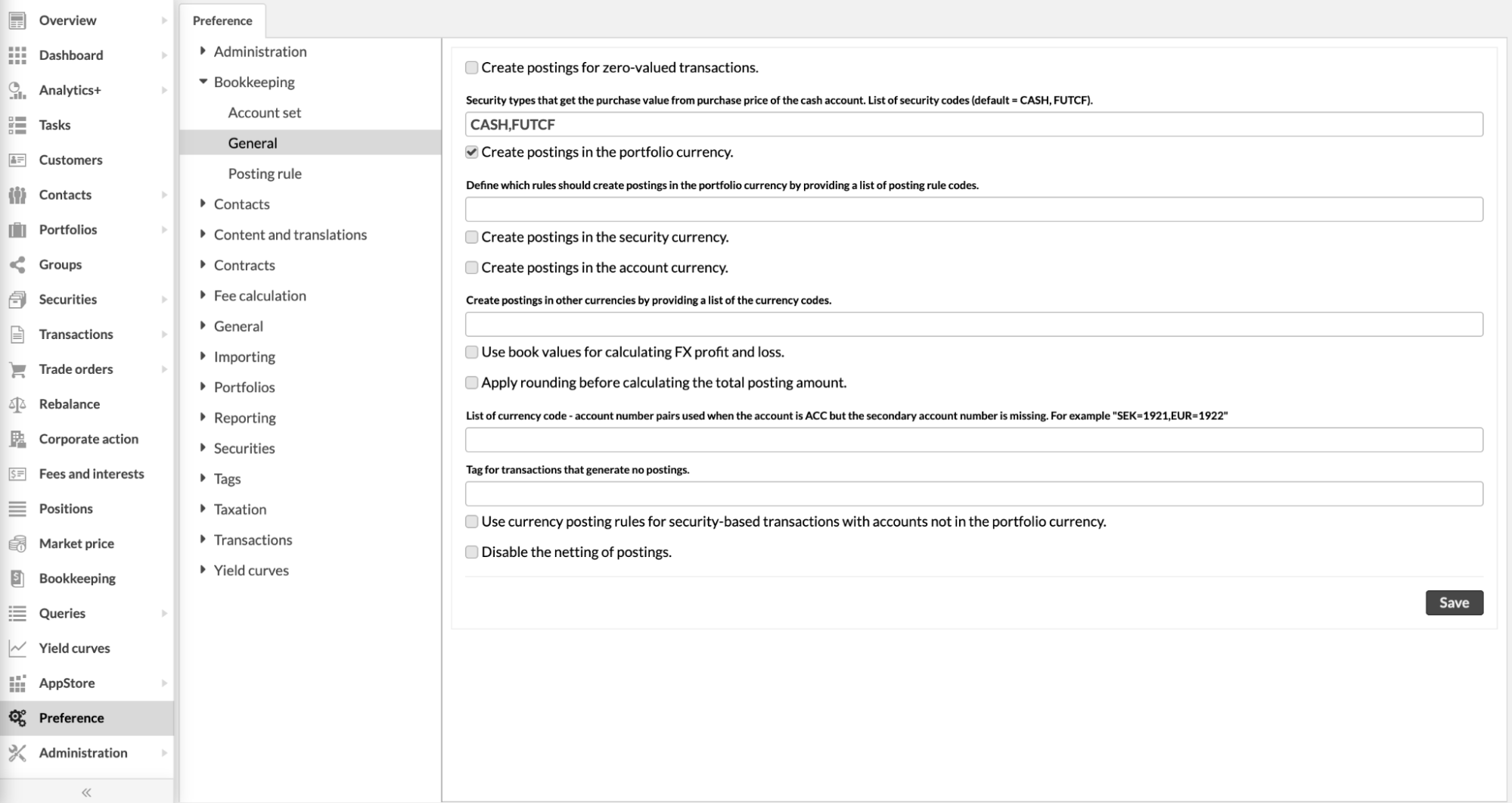

Posting rules are configured and handled in FA Back

Why?

Previously, some of our bookkeeping posting generation processes were configured in a non-intuitive manner through an extension package. We aimed to simplify this.

Who is this for?

This feature is for users responsible for administering general bookkeeping settings.

Details

In this quarter, we've centralized the features for generating bookkeeping postings, making them less dependent on extension packages. This not only enhances the performance of generating bookkeeping postings but also brings the added benefit of a more standardized and user-friendly configuration process. Now, you can find these settings in FA Back under Preference → Bookkeeping → General.

|

Learn more: Preference - Bookkeeping.

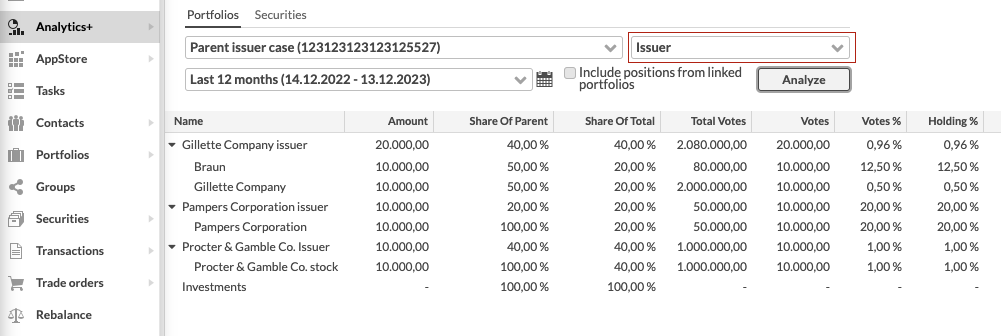

Parent company grouping in Analytics+ and in limits

Why?

Previously FA Back was able to analyze investment limits only on the issuer level and did not consider the issuer’s parent company.

Who is this for?

This feature is for users that need to produce specific authority reporting such as Solvency II or Flagging reporting. This feature is also for fund companies with UCITS funds.

Details

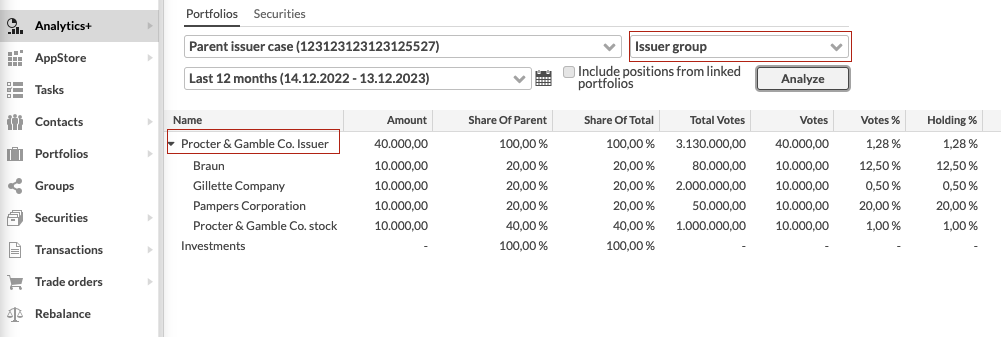

This feature is handy when analyzing portfolios or investment limits because it allows you to analyze based on a group of companies. Now, you can analyze portfolios by selecting an issuer group as the security-related parameter. The system will group the analysis by the parent company if the issuer has a linked contact set. If a linked contact is missing, the grouping will work the same way as with the issuer grouping.

Consider a scenario with a parent company and subsidiaries where one of the subsidiaries has issued a security you hold. With this enhancement, you can group them together and view metrics like your holding percentage or aggregated voting rights at the parent company level.

Additionally, you can now run limits on the issuer parent level, and the values will be aggregated. This is particularly useful in situations where Flagging reporting is necessary.

|

|

Learn more: Contact window, Analytics+.

Running limits on look-through positions on the issuer level

Why?

Previously, running limits on look-through positions at the issuer level was not an option. This enhancement is particularly valuable for fund-in-funds scenarios.

Who is this for?

This is for users who need to run limits on issuer level on a look-through positions, such as fund companies with feeder and master fund structures.

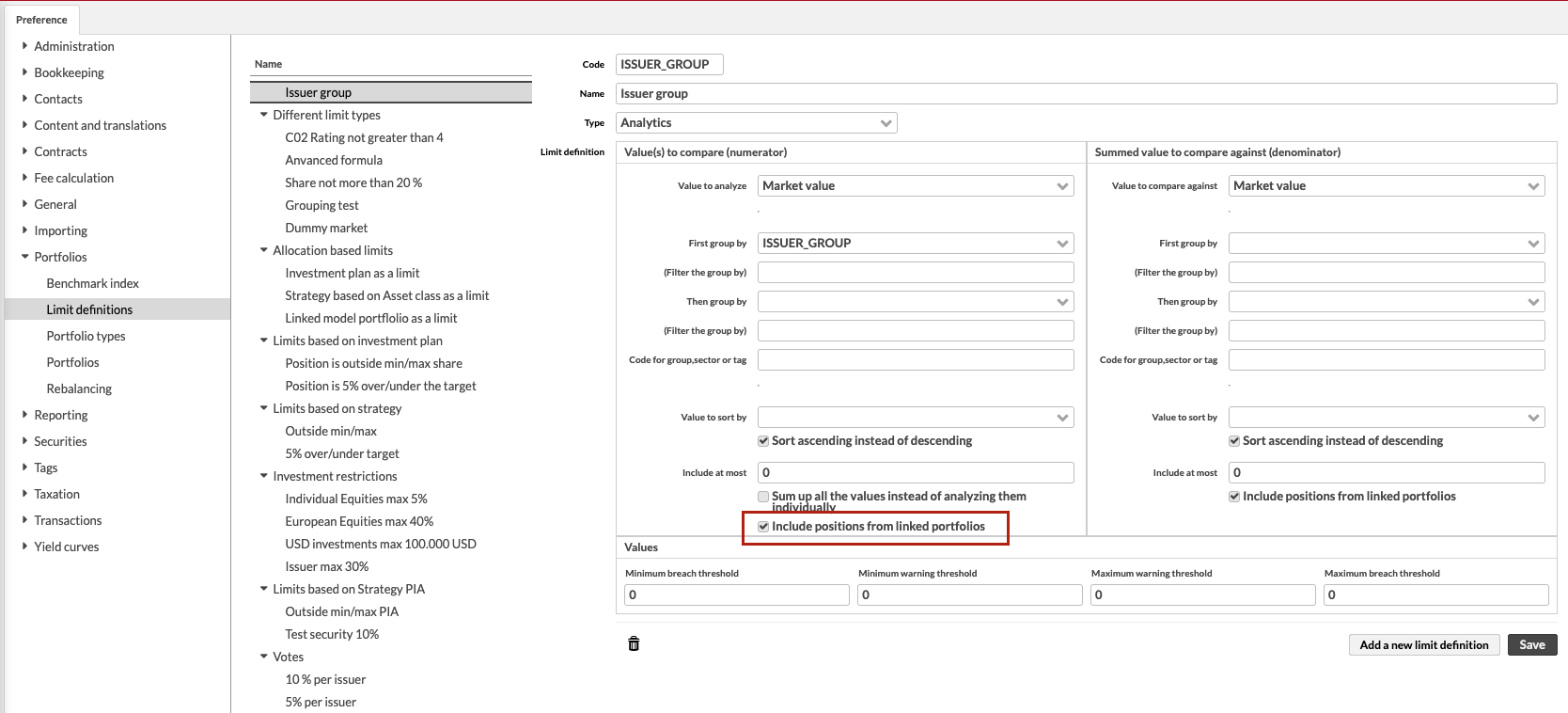

Details

Now, you can create limits that consider positions from a linked portfolio. For instance, if you have a feeder-master fund structure, you can check limits on the feeder fund based on the issuer of the securities the master fund has invested into. Although analyzing the issuer at this level was possible in Analytics+, the ability to run limits was lacking until now.

|

Learn more: Limit definitions based on Analytics.

Alternative methods to treat net cash flows in TWR calculation

Why?

Previously, FA offered a single method for treating cash flows in TWR calculation. We've expanded the options, giving you a broader set of choices for cash flow treatment in TWR calculations.

Who is this for?

This feature is for users who want to treat cash flows differently than how they previously have been treated in FA.

Details

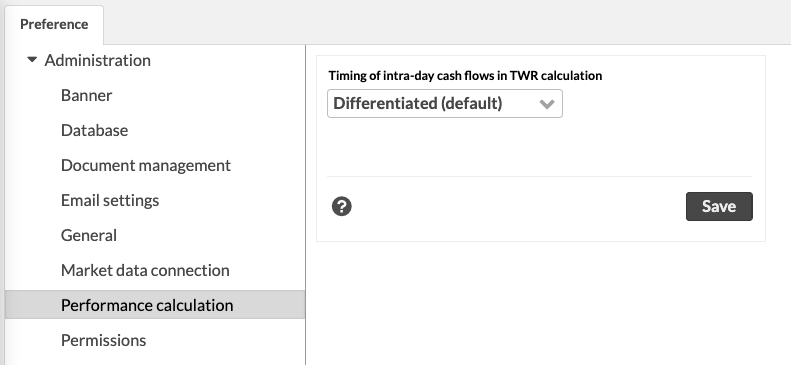

To provide flexibility in choosing how net cash flows are treated in TWR calculations, we've introduced new possibilities. You can now select the cash flow timing from four options, accessible in Preferences → Administration:

Differentiated (default): Positive cash flows from the start of the day, negative cash flows from the end of the day. This was the only option until version 3.21.

Start of day: All cash flows from the start of the day.

End of day: All cash flows from the end of the day.

Simple Dietz: Half of the net cash flows from the start of the day and half from the end of the day.

|

Learn more: Preference - Administration.

More flexible FIFO override functionality

Why?

Our FIFO override functionality has been quite limited with a lot of restrictions. There was a need to have a more flexible FIFO override functionality that would allow the user to override FIFO with only part of the amount.

Who is this for?

This feature is for everyone who has the FIFO valuation method and needs to produce reports for the customers.

Details

We have opened up the possibility to use FIFO override functionality by reducing the number of rules and validation around this. Now you can add or remove a fraction of the lots.

To increase the amount on an existing lot without creating a new lot, use the transaction type Equalization credit (EQCR) together with the override FIFO field in the transaction or trade order. Add the external ID of the existing lot you want to increase.

To decrease the amount of a specific lot without leaving out anything from the FIFO chain, use equalization debit (EQDE) transaction type with override FIFO.

You can also use this functionality to import transaction history from another system that doesn't have the same order on lots as we have in FA.

Fixes

Accounting

The bookkeeping view crashed when there weren't any postings. Now it doesn’t crash anymore.

APIs

We fixed a bug affecting certain GraphQL API calls that fetch position data, specifically when listing positions containing accrual or accrued interest.

If you import key figures to a portfolio with script or with a decision table, the imported values are now correctly available also in GraphQL.

Close manual from Market data info tab is now available in GraphQL.

Analytics

When using look-through analytics, underlying positions now show their calculated Amount field properly. Previously the Amount field was not calculated due to a bug.

Data Aggregation

When importing s.coupons to a bond you now need to import the data with date in correct format. Previously there was no validation on the date and this resulted in some errors when opening extra info for bonds or versions for bonds.

Fixed an issue where importing a security, contact or portfolio file with the same item on several rows resulted in duplicate securities, contacts or portfolios. Now only one security, contact or portfolio will be created and the second row in the import file will update the first entry.

Fee Management

On the Fee and interests view, you can now filter the transaction type column by “contain” logic. Previously it was based on “start with”.

The Run column is now wider and the caption is fully visible.

Market Data Connectors

Resolved a bug in the nightly report calculation that incorrectly updated prices when multiple update codes were present for a security. Prices were only updated until the earliest price change for the security, causing subsequent overwriting of close dates with earlier change dates (e.g., close 1 overwritten by close 2, close 2 overwritten by close 3, and so on).

Portfolio Management

The Portfolios view now works correctly also in cases when the environment contains portfolio Key Figures whose code is a number.

The Portfolios view now shows correctly key figures whose code is a number.

Portfolio-specific benchmark and General benchmark tabs in the Portfolio window are now visible for a user with portfolio view permission.

If a security has two spaces in the security code they are now correctly shown in the lower part of the Position view.

Made some small text changes to the threshold table for accounts.

Fixed an issue where tags with the same name as a role-restricted tag were hidden after saving.

When you make an exchange where you carry over the original trade amount from an ADD lot you now see the TWR for the period the security is held.

Report Calculation

FA Back now calculates purchase price and lots correctly after creating offsetting add and remove transactions using the close portfolio process on a single portfolio.

Other

Keycloak login events showed the wrong user name on FA Back application logs, now the correct user name is shown.

The business day calculation logic can now accurately manage cases where the holiday calendar parameter is missing.

Updates to FA Back 3.21

FA Back 3.21.1 - Release notes

FA Back 3.21.1 is an update to FA Back 3.21. This update includes the following fixes:

In the Corporate action view, you now only see corporate actions in the table. Account interests are removed and now only visible in the Fees and interests view.

You can now correctly import representative tags for a primary contact.

Added logic that always formats dates in audit logs with the date and time instead of just a date.

Accrued account interest calculation introduced in FA Back 3.21 is now also considered in Analytics+ when calculating performance.

Extended account information now correctly shows the balance on the accounts if there is an unsettled transaction.

FA Back 3.21.2 Release notes

FA Back 3.21.2 is an update to FA Back 3.21. This update includes the following fixes:

Fixed an issue with synchronizing data about a user's linked contact, when external identity providers are used. This resolves an issue with the small minority of features or customizations that query linked contact information from our pm2_user table. The issue was, that this synchronized linked contact record was sometimes being removed during logins.

Now you can correctly make capital calls based on commitments also in situations when the price is not 1 and the transaction type has “Paid in capital type” as amount. The remaining commitment is now correctly calculated.

We improved the TWR calculations when making an exchange that carries over original trade amount from an ADD lot. Now, the system shows the TWR in the period source security and the purchase value correctly. Due to caution this functionality is not automatically enabled in this minor version but can be separately enabled if needed. We plan to enable this fix by default in the 2024 Q1 release.

We have added a new transaction type effect “Purchase price effect” called “Reduce, keep original purchase time”. This should be used when recording a spin-off as an Exchange corporate action. It keeps the FIFO chain by moving the FIFO chain information from the old security.

We fixed an issue in the extended "Override FIFO" logic that caused the opening date of extended lots to be incorrect.

FA Back 3.21.3 - Release notes

FA Back 3.21.3 is an update to FA Back 3.21. This update includes the following fixes:

Fixed an issue where the login icon and some other icons on the right side of the window were displayed incorrectly.

Report calculation entries no longer spam the logs when no market data is available for a security before a given date. This issue appeared in the 3.21 version.

Fixed a performance issue in fetching the latest close price when valuating positions on a given date. The latest close price is now fetched faster.

You can now successfully run a limit definition that is based on values in custom fields in your portfolio, even when there is no previous limit analysis result.

FA Back 3.21.4 - Release notes

FA Back 3.21.4 is an update to FA Back 3.21. This update includes the following fixes:

Running deferral processes with the setting "Do not create transactions, only postings" works now.

The upgrade script for bookkeeping configurations ensures that, during the upgrade process to version 3.21, the correct values are set. Previously, some of the values were incorrect.

FA Back 3.21.5 - Release notes

FA Back 3.21.5 is an update to FA Back 3.21. This update includes the following fixes:

Business process monitoring is now less vulnerable to faults and monitored processes are no longer disrupted.

Fixed an issue that prevented a user from importing trade order changes via API to their representee when the user had limited visibility enabled. The issue appeared when the representee had more than two representatives and the user was one of them.

In Strategy analyzer, the portfolio performance indicating total benchmark return showed incorrect results in some cases when multiple strategies were used on the same portfolio. The error occurred if two strategies had the same initial allocation date, only one of the strategies had an additional allocation date, and the analysis period included the additional allocation date.

Fixed an issue that caused unsettled transactions to have a double effect on account balance in the extended position info in Overview.

Collateral ratio is now shown correctly in Securities view as a column.

Account interest calculation logic introduced in FA Back 3.21 now correctly considers the security multiplier while fetching the base rate price.

FA Back 3.21.6 Release notes

FA Back 3.21.6 is an update to FA Back 3.21. This update includes the following fixes:

Fixed an issue where only transactions from one portfolio or contact were shown in a report. This happened when generating a report package or a combined report package run via a scheduler against a saved transaction or trade order view, with the output type “one report (background)”.

Fixed an issue where extensions sometimes stopped working after multiple extensions were updated in quick succession.

Fixed an additional issue to the fix that was done in 3.21.5 that prevented a user from importing trade order changes via API to their representee when the user had limited visibility enabled. The issue appeared when the representee had more than two representatives.

Fixed an issue that caused an externally hosted FA Client Portal custom version to stop working due to CORS issues.

Changed the Vaadin UI framework version.

FA Back 3.21.7 Release notes

FA Back 3.21.7 is an update to FA Back 3.21. This update includes the following fixes:

We fixed an issue that prevented posting creation if the system had a specific combination of bookkeeping preferences: “Use currency posting rules for security-based transactions with accounts not in the portfolio currency” and the security type was included in “Security types that get the purchase value from purchase price of the cash account”.

The running number in the No field is now created automatically for manually created postings.