Handle accrued fees and capitalization

If you calculate and charge management fees from clients based on portfolio market values, return or fixed amount per portfolio, you can use FA’s Fee calculation module. Calculation is done based on the daily values, and the calculation frequency is based on your contracts.

In this scenario the fees are accrued when calculation is done (for example once a month) and money is taken out from a real bank account, capitalized separately (for example once a year).

Get started

Link fee formula and fee value to client portfolio

Read the instructions in the Fees and interests section in FA Back reference.

See the standard formulas and linked cost types here: Standard formulas and linked transaction types

Define accounts

Add an accrued fee account:

accrued fee accounts with the Accrued fee tag.

Define a bank account for capitalisation:

accounts from which you will capitalise money with the Fee capitalization tag.

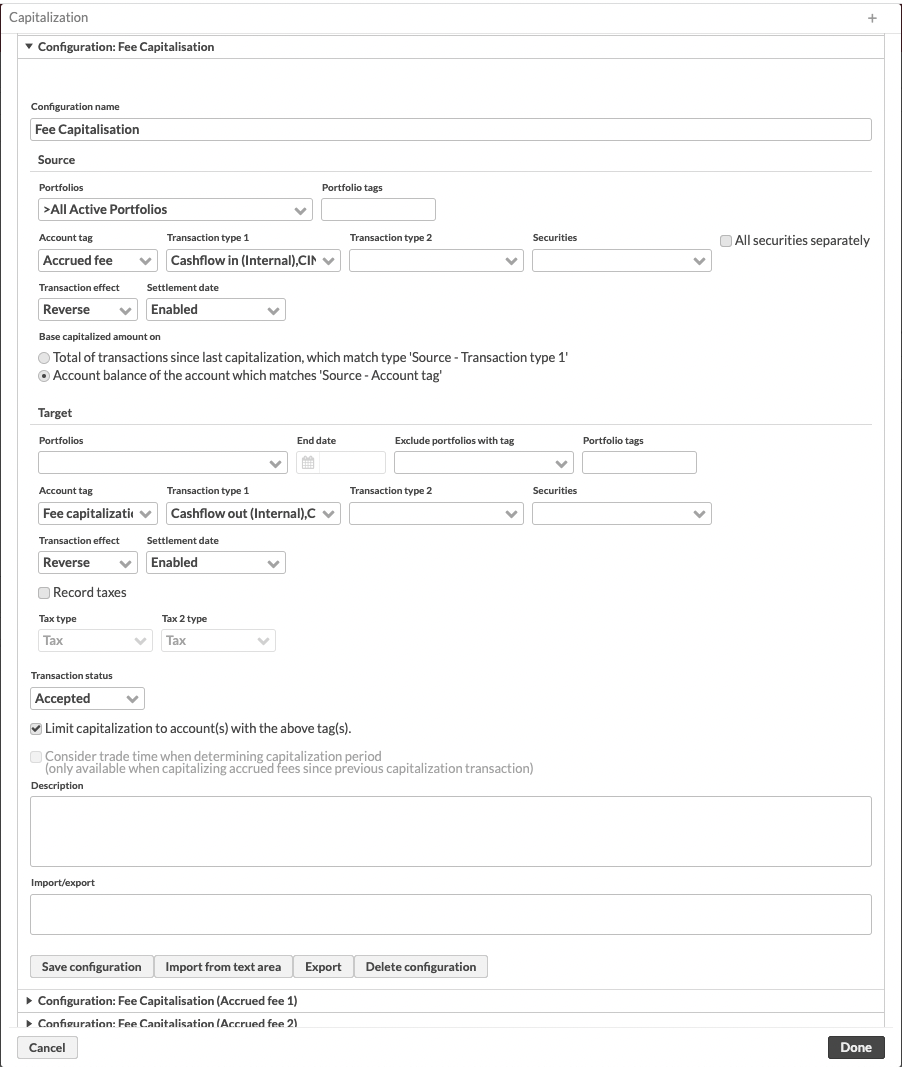

Define capitalization parameters

Open capitalization configurations from Tools → Fee calculations → Fee capitalization...

Select the portfolio group for capitalization (It is ok for example to add all active portfolios, when we limit the capitalization to the tagged accounts only).

Use the Accrued fee and Fee capitalization account tags for source and target, respectively.

Define transaction types and effects like described in the screenshot below.

Usually the accrued fee accounts (with account tag Accrued fee) have a negative account balance, so if you use Cashflow in (Internal) transaction type, the balance is reset to 0.

The target account is the cash account from which the fee is capitalized. This account should have tag Fee capitalization and transaction type Cashflow out (Internal). If you only wish to reset the accrued fees to zero and not make a corresponding capitalization booking, leave the Transaction type 1 selection empty under Target.

Accrued fee calculation and fee capitalisation

Calculate fees

Go to the Portfolios view.

Search for the portfolios for which you want to calculate fees; to calculate for all portfolios, click Show all (fees are calculated only if a formula is linked to the portfolio).

Choose Fee calculation → Management fee / Performance fee at the bottom of the page.

Define the parameters (if needed; sensible defaults are pre-selected for most parameters):

Calculation date - The date up to which fees are accrued.

Account tag or Use default account or same currency account - Account tag for the fee accrual. If a tag is chosen, the fee is accrued to the account with the given tag. If the checkbox is chosen, the default account is used.

Transaction type - The fee transaction type.

Status - The status for created fee transactions (Accepted, Not finished or Deleted). You can use Accepted transactions to automatically deduct the account balance, or you can use Not finished transactions and approve them later after checking the balance.

Tags to add to calculated portfolios and Tags to remove from calculated portfolios. Use these, if you want to tag or untag the portfolios.

Memo - Notes that are visible under the calculation run in the Fee calculations view.

Run in security level - Advanced setting that you should not select for regular cost formulas.

Set settlement dates - Fill in the settlement date on the generated transactions.

Set taxes using default tax rates - Automatically add applicable taxes, such as value-added tax, based on the configurations done in Preference → Taxation → Default tax rates.

Do not save resulting fee transactions, but store the accrual in portfolio key figures instead - Track the accrual as portfolio key figures instead of an accrual account. This way the fee does not affect the portfolio value, but you can stay up to date with what kind of fees have been accrued.

Create task - Create a task with the calculation details in the Tasks view.

Click Calculate.

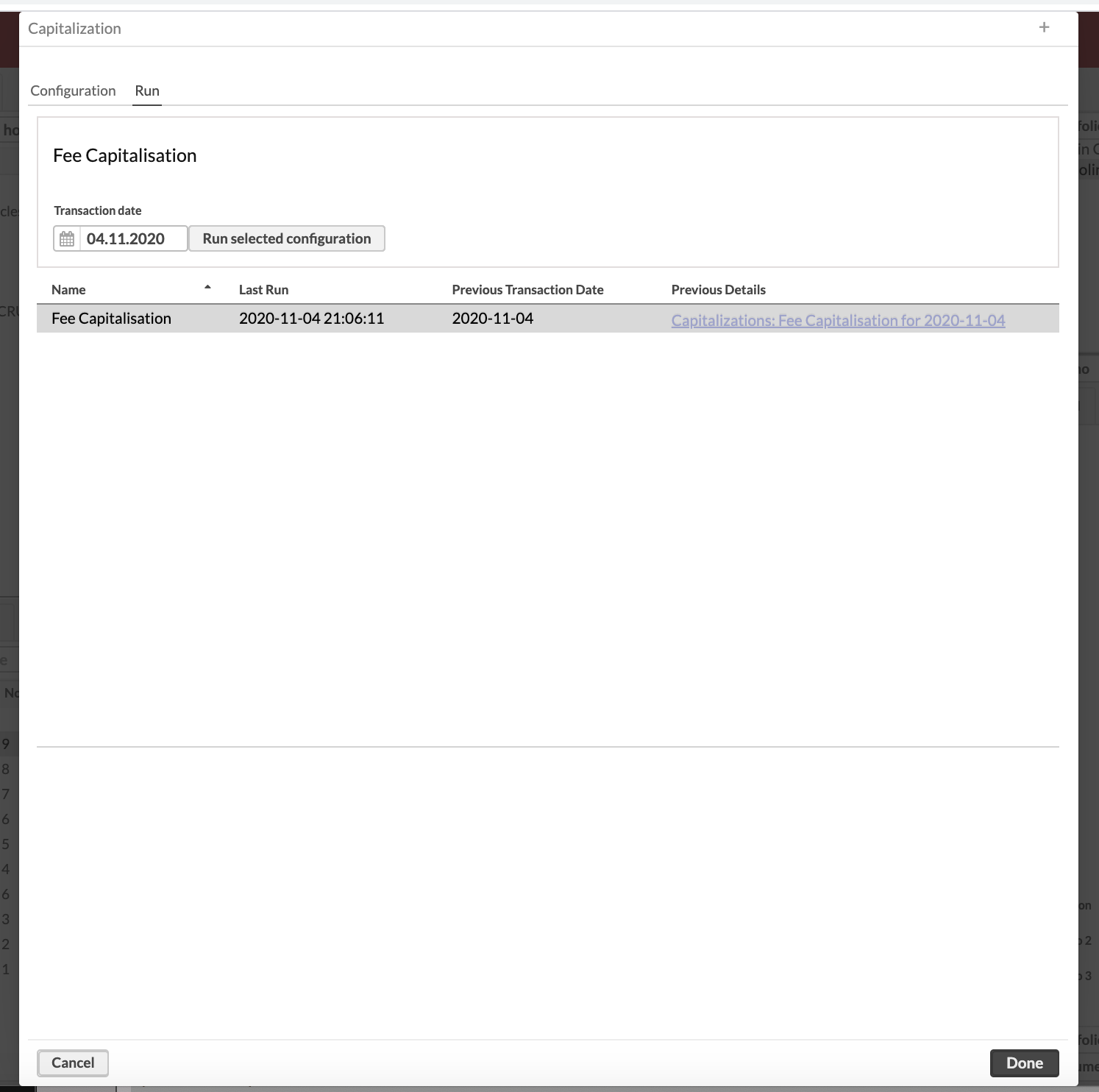

Capitalize fees

Open Tools → Fee calculations → Fee capitalization....

Define the fee capitalization date.

Select the fee capitalization configuration that you defined in Define capitalization parameters.

Click Run selected configurations.

How to schedule accrued fee calculation

You can schedule accrued fee calculation the same way as other processes. See Scheduling processes in FA Admin Guide for more details.

Follow these steps if you wish to change some of the default parameter values used in the scheduled calculation:

Go to Tools → Administer → Fee calculations.

You can define different settings for management fee and performance fee by making the following selections under the corresponding heading:

Account tag - see Account tag above in the Calculate fees section.

Save accrued management fee to portfolio key figures - see Do not save resulting fee transactions, but store the accrual in portfolio key figures instead above in the Calculate fees section.

Keep only the latest calculated value - used together with the previous selection. When selected, only the latest key figure value is kept. When unselected, the full history is kept.

Transaction status - see Status above in Calculate fees section.

Click Done.

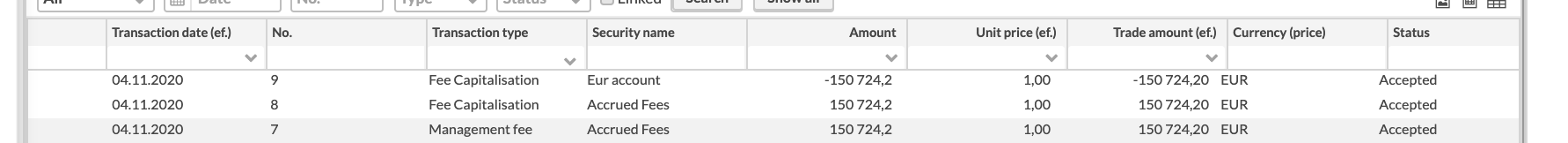

Example transactions

In this example there is only one management fee after the previous capitalization. Then accrued account cleared with Fee Capitalisation transaction (Deposit type) and bank account has a withdrawal type of transaction (negative Fee Capitalisation).

|

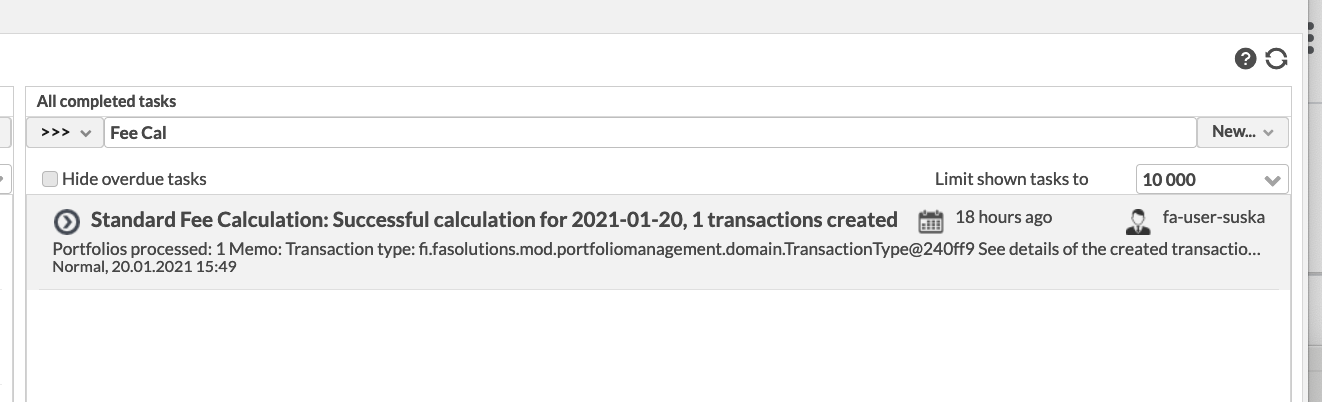

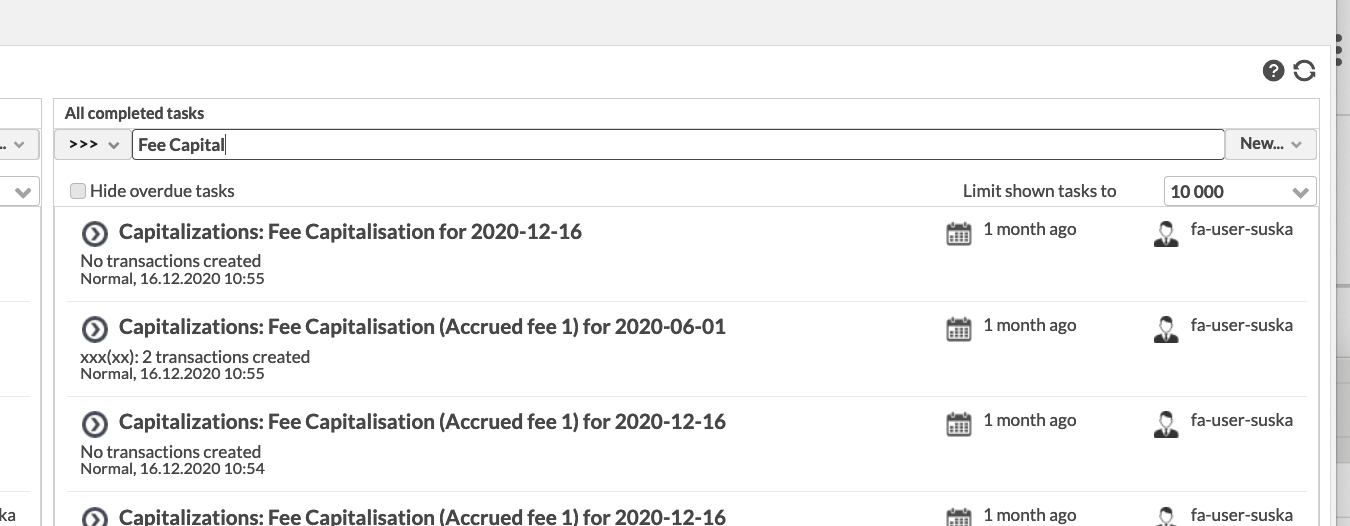

How to monitor, if there has been calculations / capitalization

All successful calculations and capitalizations create done tasks in FA.

|

|