Distribute fund income

Funds income distributions represent the allocation of capital gains and dividend or interest income generated by the fund for the investors periodically during a calendar year. In some countries, like Norway, Tax legislation has an impact on how this is performed.

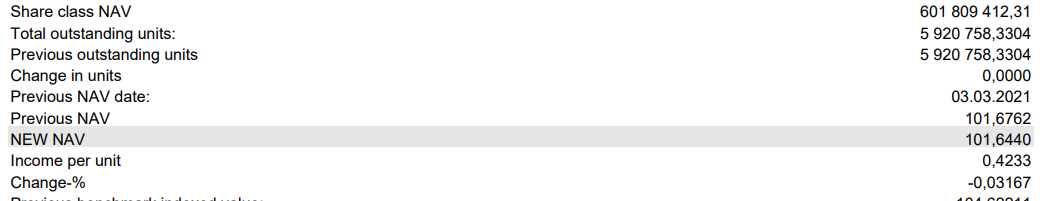

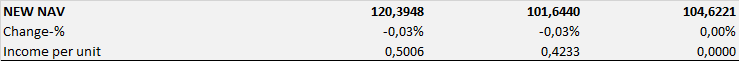

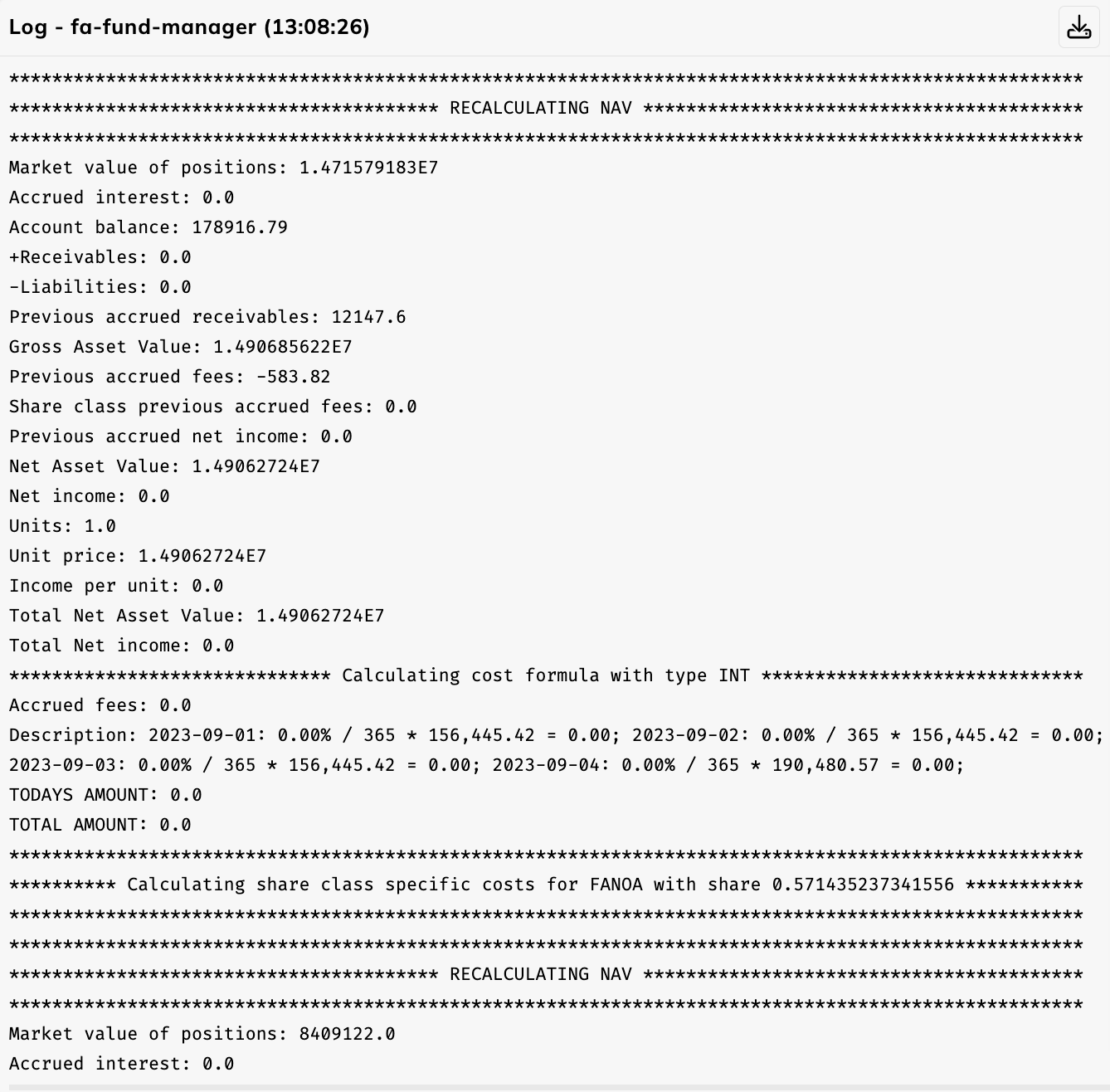

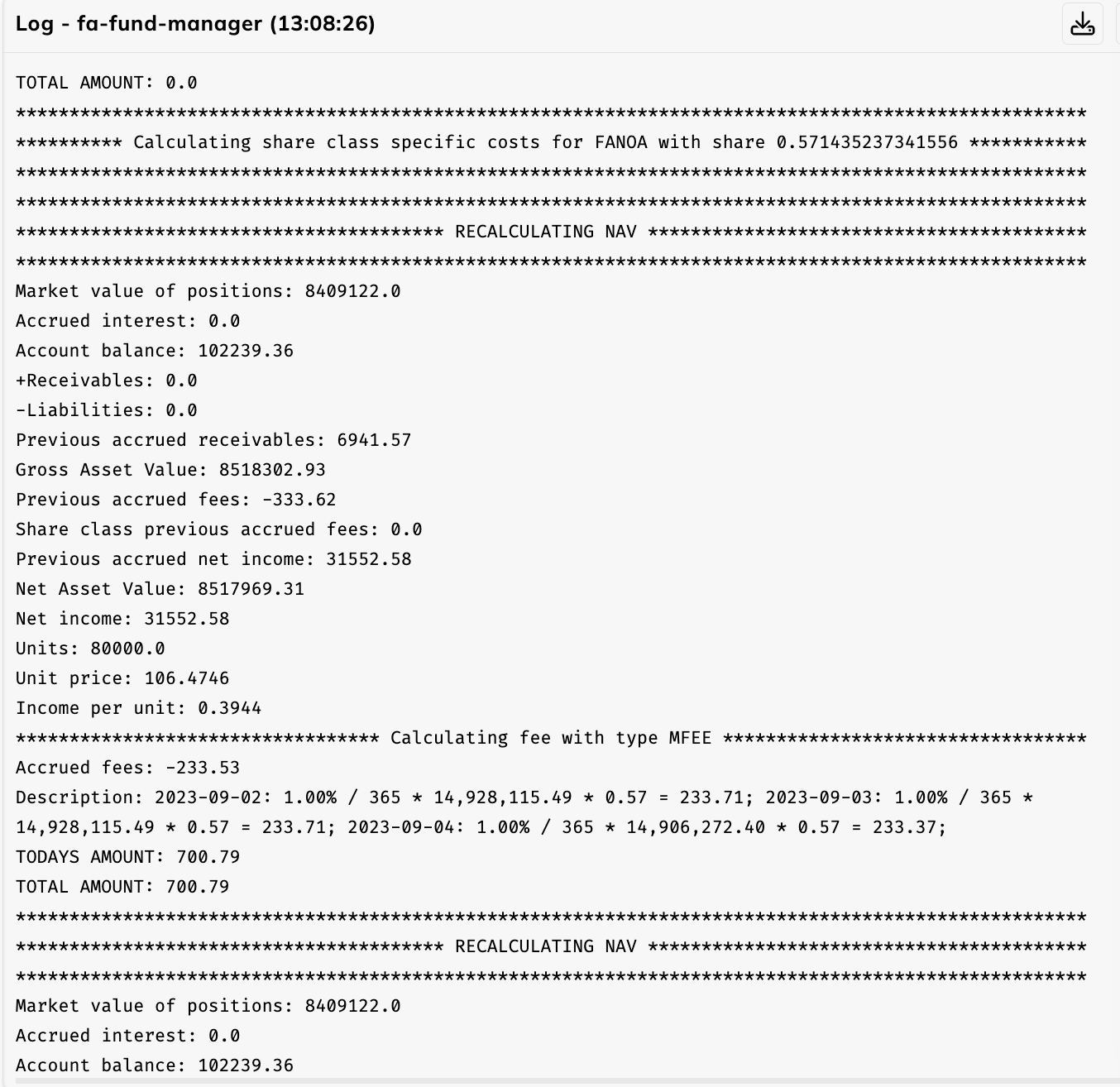

In FA, calculation of income distribution is part of the NAV processing and can be calculated from the total with a bookkeeping posting -based fee formula. The formula sums values from bookkeeping accounts defined on the fund settings. The formula sums up postings with status “Ready” since the beginning of the year - thus all the existing postings should be marked “Reported” after NAV calculation - and generates a transaction with a sum of these postings on an accrual account, the balance of which is excluded from the portfolio total and accrued throughout a year. The total accrued income distributions as well as the value per unit is shown in the NAV calculation and NAV reports (XLS and PDF). The calculation log contains a detailed division into the different income distribution components per share class being at the moment the only report providing this information. The accrued income distribution components per share class can be also found in the internal info field of each fee transaction.

Income distribution formula

NAV periods accrued income distribution per share-class = (Accrued interest + Realized gains and losses + Expenses + Other income + Received dividends) x share-class share of total in latest NAV + The calculated fees per share-class in this NAV run + Bought and sold accrual for share-class

Explanation:

(Accrued interest + Realized gains and losses + Expenses + Other income + Received dividends)

This is just summing up bookkeeping postings in respective sections mapped accounts in Fund settings tab - Income distributions tab. Any percent multiplier in mapping applied.

share-class share of total in latest NAV

The fraction of this share-class value of total value in latest NAV run.

The calculated fees per share-class in this NAV run

The only part that is not based on Bookkeeping, taken from calculation in current NAV run.

Bought and sold accrual for share-class

Summing up accrual amounts in Client transactions since latest NAV run