Create an annual notification to the Finnish tax authorities

Introduction

FA supports the generation of six different annual notification reports, that are used to report for example charged fees and profits to the Finnish tax authorities. After providing some background information, you can conveniently generate the reports directly in the correct format that the tax authorities expect.

Annual notification - Purchases and sales (VSAPUUSE) is used to report details about security transactions. The report supports four different reporting roles (tax authority roles 1-4).

Annual notification - Asset management fees (VSOMHOIE) is used to report the asset management and custody fees collected from customers during the year.

Annual notification - Profits and shares (VSTVERIE) is used to report dividends and interests.

Annual notification - foreign dividends (VSULKOSE) is used to report transferred foreign dividends to persons resident in Finland.

Annual notification - Payments of interest, calling for withholding of tax at source (VSKTVYSL) is used to report interests that are subject to withholding tax.

Annual notification - Return on interest payments, made to nonresident beneficiaries (VSRKOERI) is used to report yearly profits to persons that are not resident in Finland. Only payment type C4 (Annual investment-fund profits) is supported in the current reporting implementation.

More details about the reports can be found from the tax authority.

Getting started

There is some data to enter on a report-by-report basis and something to put all in common for all reports. In this section, we first go through the common data, then the file-specific data.

General configuration

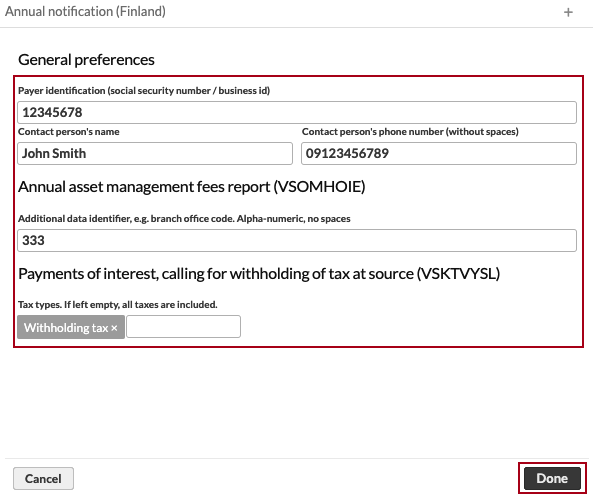

|

Define the general configurations for the reporting under Tools → Administer → Tax reporting → Finland

Define the Payer identification (the business ID or social security number of the entity paying any withholding taxes - usually your business ID)

Define the Contact person's name and phone number

Define additional data identifier, such as branch code, for asset management fee report (VSOMHOIE), if relevant.

Define tax types to include in the withholding of tax at source (VSKTVYSL) report.

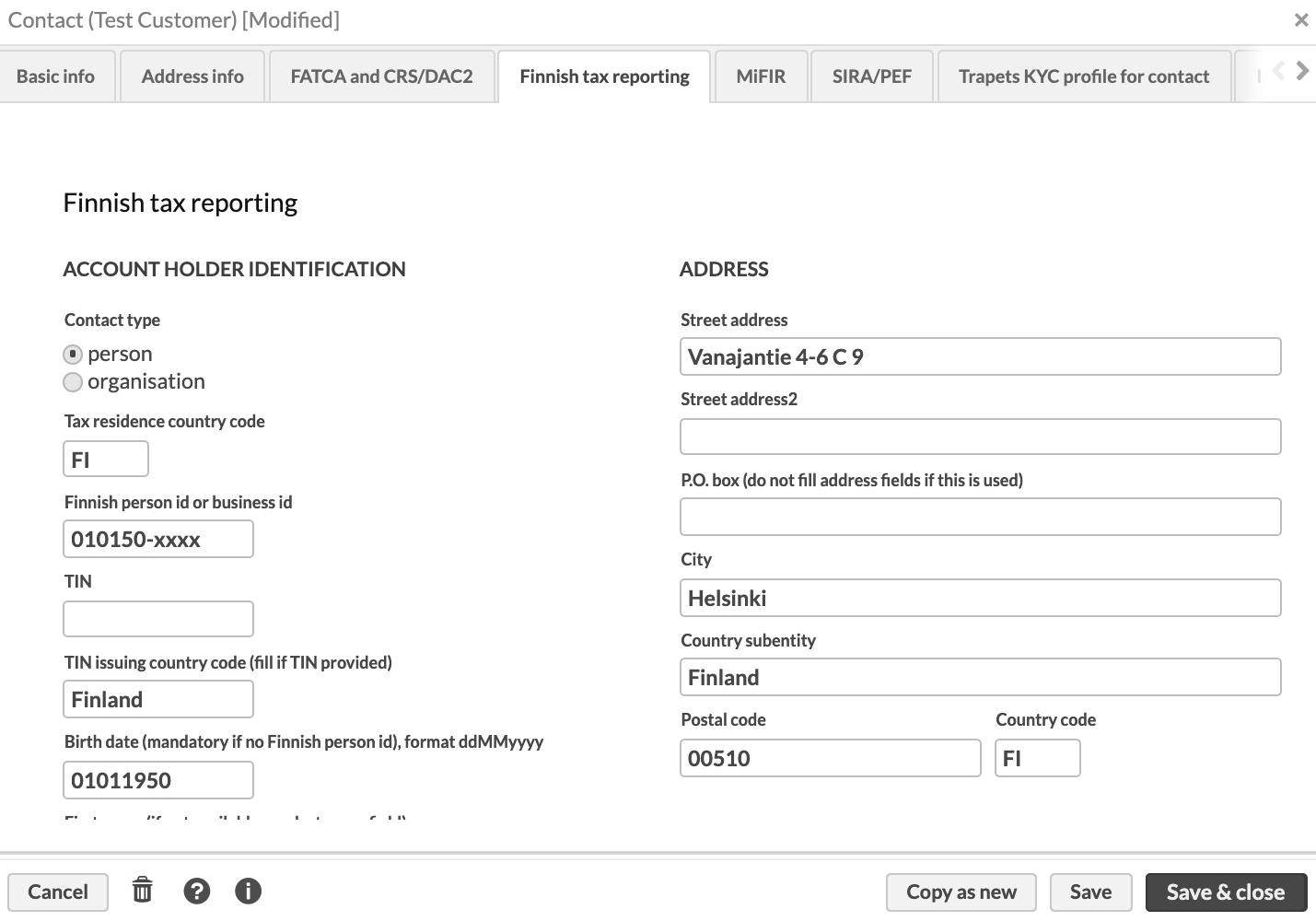

Define tax information in the Contact window (Finnish tax reporting tab) for all the contacts that are tax reportable.

If you don't want to take the notification report for all the portfolios, it is a good idea to create an Annual notification group for the portfolios. When you build the tax reporting group, you can use for example tax country, juridical form, portfolio type and so on for portfolio group criteria to collect the relevant portfolios.

Report-specific settings

Annual Asset management fees report (VSOMHOIE)

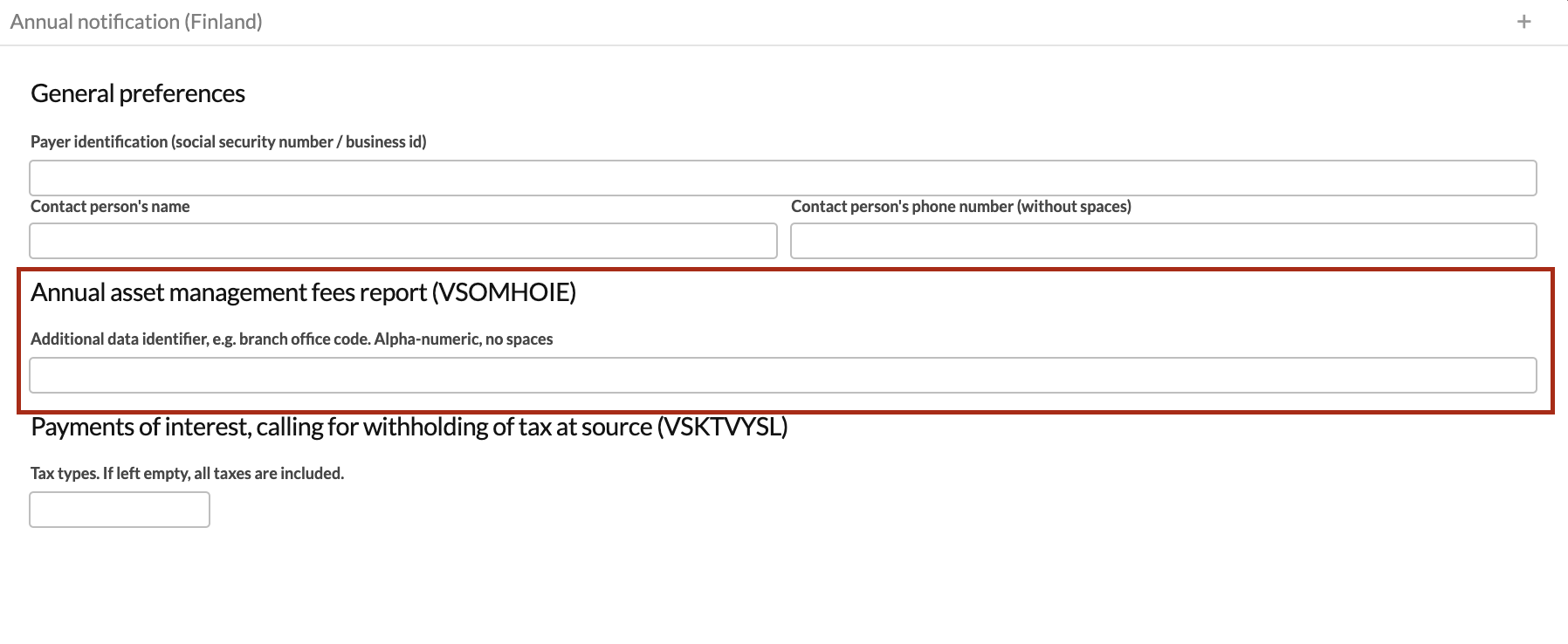

If you need to specify an additional attribute (for example, office) for payments, you can do this from the general preferences (Tools → Administer → Tax reporting → Finland). If you don't add this, the system uses default since this is mandatory for this report.

Make sure that your asset management transactions are added to the system (with types MFEE and PFEE).

|

Foreign dividends (VSULKOSE)

Make sure that a country is defined for all instruments that have paid dividends, no configurations needed.

Payments of interest, calling for withholding of tax at source (VSKTVYSL)

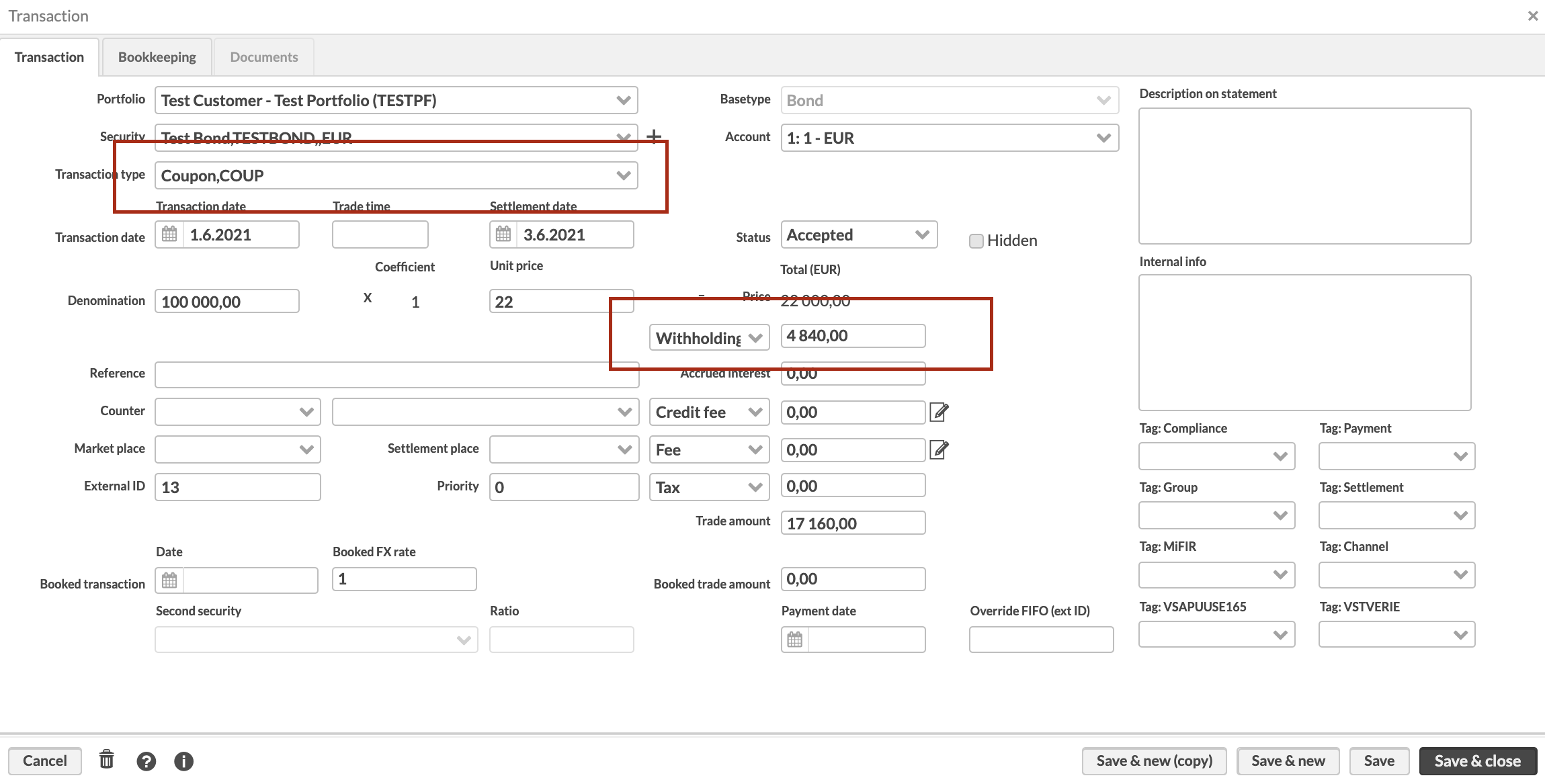

Make sure that all coupon payments are done with transaction type Coupon, COUP and withholding tax (WHT) is added to the coupon transactions. Also make sure that the required info is defined for all instruments that have paid coupons in tax reporting tab - no configurations needed.

|

|

Annual notification - Purchases and sales (VSAPUUSE)

FA supports reporting security transactions with roles 1, 2, 3 and 4.

Role 1 is used by brokers, role 2 by fund companies, role 3 to report the details required to calculate capital gains and role 4 for reporting details about bonds.

Reporting requirements of intermediaries in securities (role 1) reports all purchases and sales (excluding debt instruments with tax authority instrument code 07 and 57).

Reporting requirements of managements of funds (role 2) reports fund redemptions (tax authority instrument code 05).

Capital gains and capital losses (role 3) reports all the details related to sell transactions that are required to calculate capital gains (excluding bonds with tax authority instrument codes 07, 45, 46 and 57)

Role 4 is used instead of role 3 in situations where the filer has fully ensured, to avoid double reporting, that the sales transaction will not be reported by any intermediary with role 1. The role reports all sales (including bonds bonds with tax authority instrument codes 07, 45, 46 and 57)

When multiple roles are selected, the following rules apply:

If roles 3 and 4 are selected, role 3 is used for everything but bonds and role 4 only for bonds.

If roles 1 and 4 are selected, sells that are reported with role 4 are not reported at all with role 1.

If roles 1 and 3 are selected, the same sell transactions are reported with the same reference in both roles.

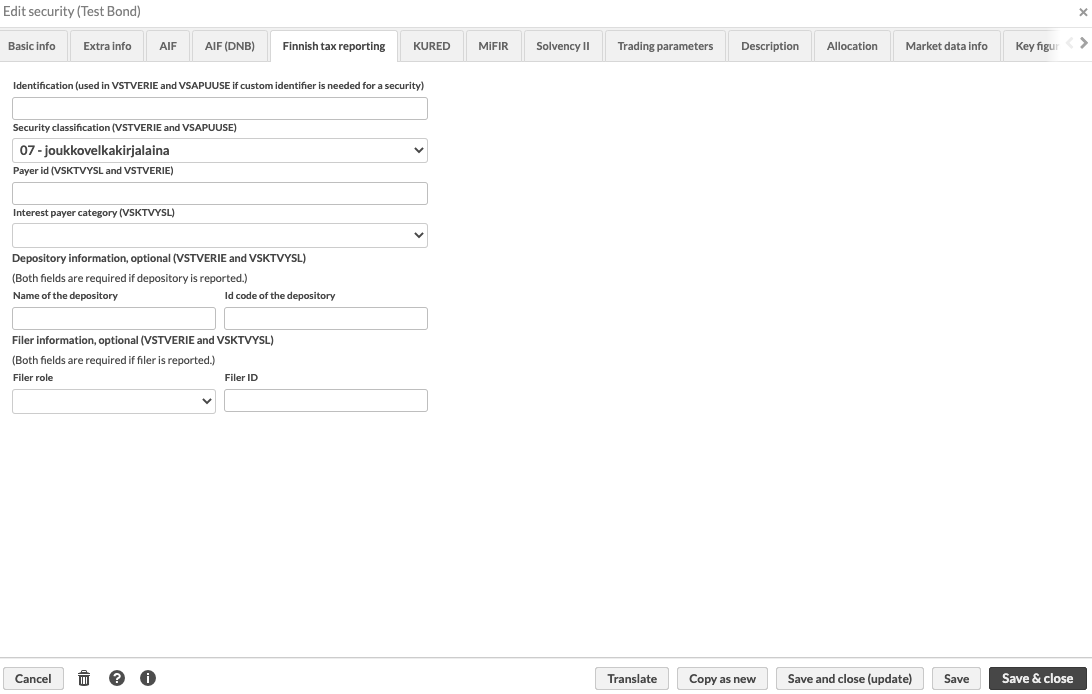

In order to report the transactions correctly, you need to classify your securities according to the classification used by the tax authorities. This can be done either using the Class 3 field or by selecting the class in the Finnish tax reporting tab on the security:

|

If you wish to use the Class 3 field, follow these steps:

Define the tax authorities instrument type to the Class 3 selection in preferences. Note, that it is usable if you only add the classifications relevant for you.

Finnish securities:

01 = shares

02 = subscription rights for a new issue

03 = subscription rights for a bonus issue

04 = other derivative contracts

05 = fund units of an investment fund

06 = special subscription rights, listed options

(including stock options related to an employment contract)

07 = bonds

08 = covered warrants

09 = index shares (ETF)

11 = domestic sales rights

41 = call options

42 = put options

43 = term contracts

44 = future contracts

45 = peer-to-peer loan

46 = crowdfunded loan

Foreign securities:

51 = shares

52 = subscription rights for a new issue

53 = subscription rights for a bonus issue

54 = other derivative contracts

55 = shares of a UCITS

56 = special subscription rights, listed option

(including stock options related to an employment contract)

57 = bonds

58 = covered warrants

59 = shares of a UCITS (e.g. index share)

61 = foreign sales rights

81 = call options

82 = put options

83 = term contracts

84 = future contracts

99 = foreign securities, no exact description or details available.

Define this classification to the instruments by selecting the relevant Class 3 field value

To exclude transactions from VSAPUUSE reporting, use the tag "VSAPUUSE_exclude". This will exclude the transactions when reporting in role 1, and with roles 2, 3 and 4 portfolio position information linked and tagged sell transaction are excluded.

NOTE: Roles 3 and 4. As sometimes the real purchase values are not known, or are given by the end client, this can be indicated in the report in field 165. Field value defaults to 2, and can be overwritten with purchase transaction tag: VSAPUUSE165-Client supplied information (1),VSAPUUSE165-Not known (3)

Return on interest payments made to nonresident beneficiaries (VSRKOERI)

Make sure that all securities that the dividends are paid for have security classification. Only classes 05 and 55 are reported with this report. There are two ways to set the classification.

Set the classification in Finnish tax reporting tab in the Security window. This is the preferred way and will overwrite the Class 3 -method below if both are set.

Set the Class 3 field value in the Security window.

Create the reports

Annual Asset Management Fees report (VSOMHOIE)

Go to the Portfolios view.

To limit the report to a specific portfolio group, select the group.

Open the report from Tax reporting → Finland → Asset management fees (VSOMHOIE).

Specify the reporting time.

Download reports. The process generates two files, .txt (for the tax office) and .csv for easy viewing of the data.

In this report, all Management fee (MFEE) and Performance fee (PFEE) transactions are summed up on the client level.

Foreign dividends (VSULKOSE)

Go to the Portfolios view.

To limit the report to a specific portfolio group, select the group.

Open the report window (Tax reporting → Finland → Foreign dividends (VSULKOSE)).

Define the reporting time.

Download the report.

The report lists all the foreign dividends (=country for the instrument is not Finland). In the report, there are two transaction types pre-defined: Dividend (DIV) and Dividend as shares (DIVAS).

Payments of interest, calling for withholding of tax at source (VSKTVYSL)

Go to the Portfolios view.

To limit the report to a specific portfolio group, select the group.

Open the report window (Tax reporting → Finland → Payments of interest, calling for withholding of tax at source (VSKTVYSL)).

Define the reporting time.

Download the report.

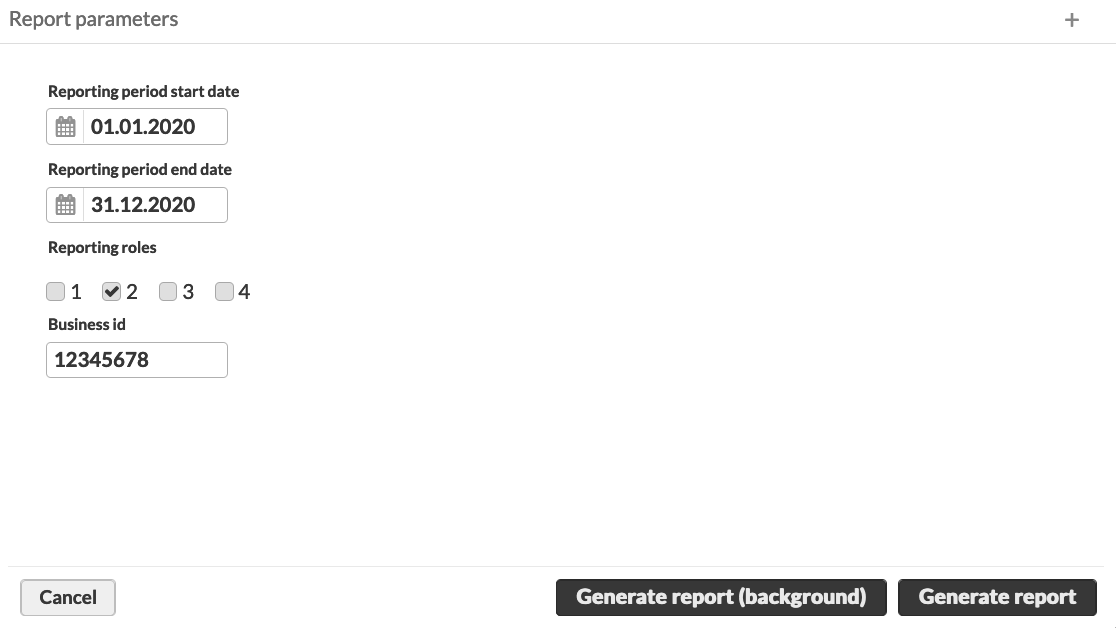

Purchases and sales (VSAPUUSE)

Go to the Portfolios view.

To limit the report to a specific portfolio group, select the group.

Open the report window (Tax reporting → Finland → Purchases and sales (VSAPUUSE)...)

Define the reporting time, role and business ID.

Download the report.

Return on interest payments made to nonresident beneficiaries (VSRKOERI)

Go to the Portfolios view

To limit the report to a specific portfolio group, select the group.

Open the report window (Tax reporting → Finland → Return on interest payments, made to nonresident beneficiaries (VSRKOERI)).

Define the reporting time.

Download the report.

This report will report all Dividend (DIV) transactions for securities with classification 05 - sijoitusrahaston rahasto-osuus or 55 - yhteissijoitusyrityksen osuus in the given portfolios.