Total return swaps (TRS)

Total Return Swaps can be managed in FA as two opposite transactions. FA does not handle market valuation of the Financing leg of Total Return Swaps.

Financing leg

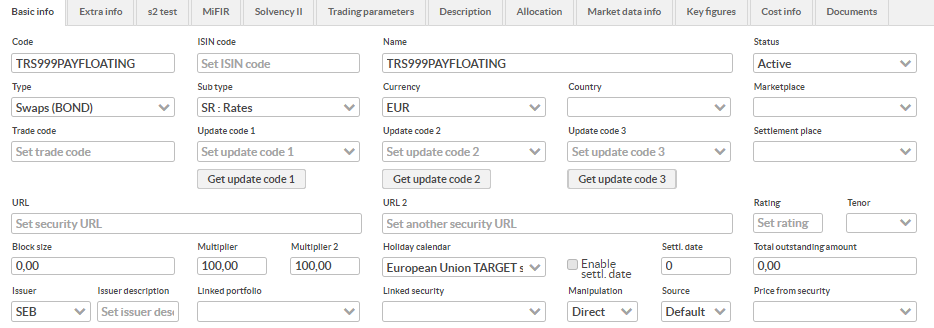

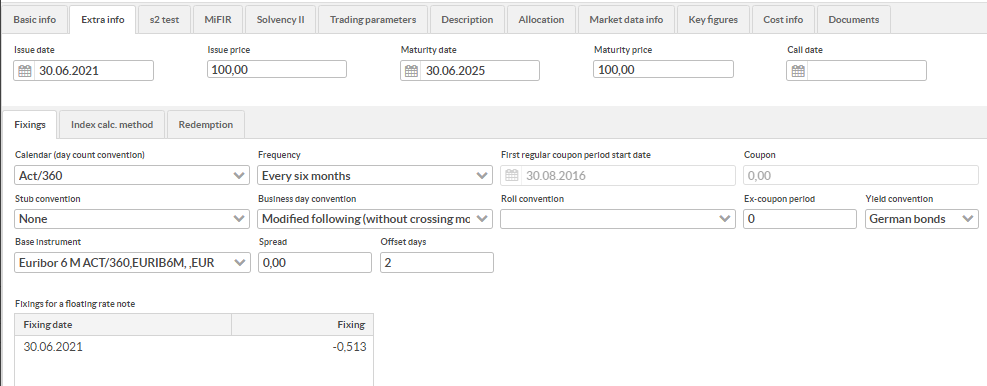

The financing leg of a Total return Swap you set up exactly like a floating leg of an Interest Rate Swap. Security type, security and transactions are done in same way.

|

|

Fixings

Given that you have Market data updated on the Base instrument you can set the fixings for the Financing leg in Security view: Update security data - Generate fixings.

Market data info for Financing security

You need to maintain prices on Financing leg manually or by importing. If you have prices from an external source these can be imported to FA just by saving a csv file and use Import - Import security prices.

Coupon and maturity processing

Coupon and maturity processing is made with same routines as for Bonds.

Note

An important note is that for these Securities it will exist short positions in maturity processing. If a short position transaction type EXPSH - Expire short position must be used instead of EXP - Expire.

Asset leg

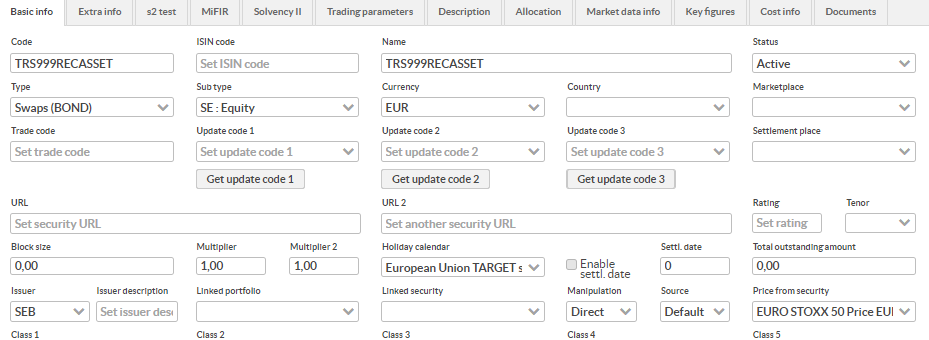

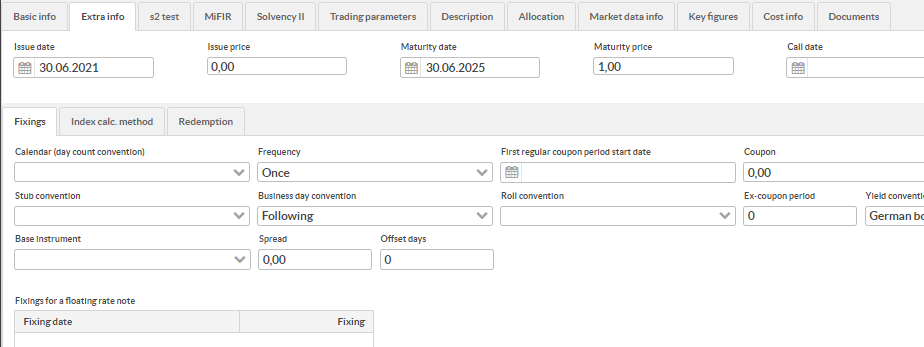

The asset leg however is often an equity or equity index.

You define the Asset leg as Security Type Swaps (S) and sub-type Asset leg.

Define Price from security to be the Asset, in example below EURO STOXX 50 index.

Use multipliers 1 and define the Counterparty as Issuer.

|

|

Corporate action in the Asset security

Any corporate actions in the Asset is processed as a normal corporate action on the Asset security itself. That can be dividends or splits.

Market data info for Asset security

Asset security is priced from another security, so if that security has Market price feed it will also be reflected in Asset security.

Transactions

Like Interest Rate Swaps you need to enter transactions in both legs.

It is recommended to have a Reference common for the two legs of the contract and to add Counterparty.

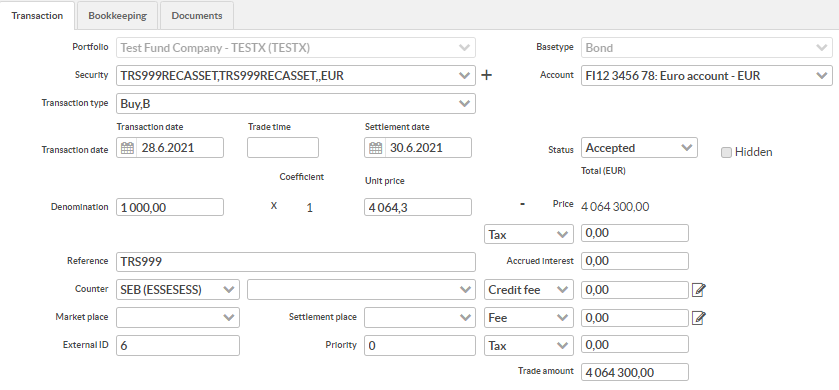

Asset leg transaction

You enter Asset leg normally with denomination in Units terms.

|

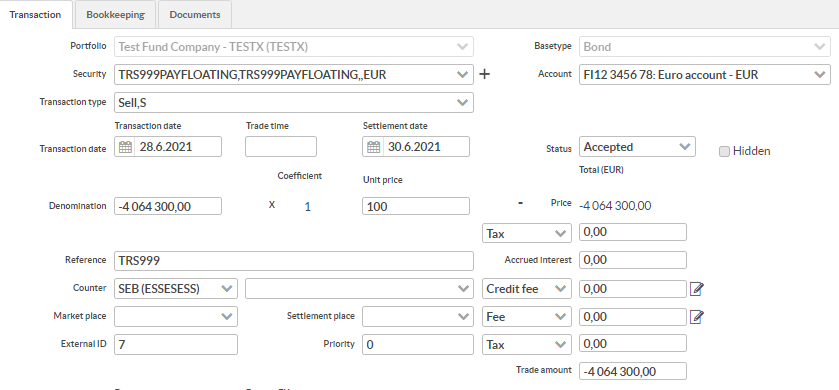

Financing leg

You enter Financing leg transaction in monetary denomination.

|

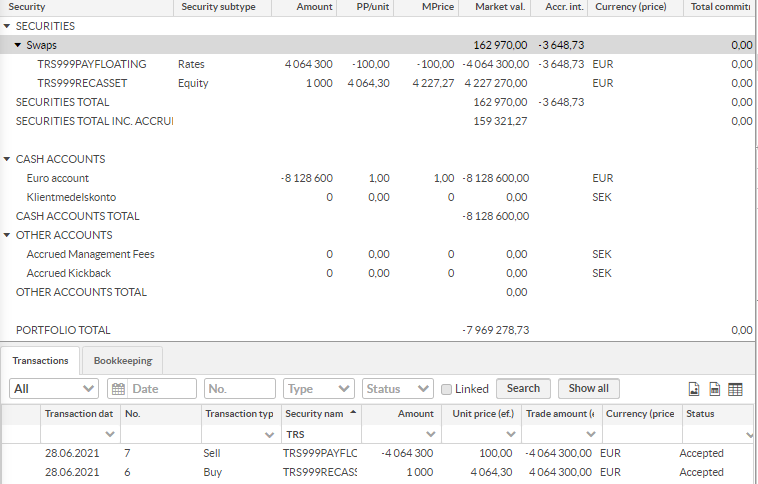

Positions in Total return swaps

In position views, like Overview and Analytics+ ,Total Return Swaps are shown per leg, as two security positions. See example below from Overview. In this case they are in different security types.

|