Run deferrals

Deferrals in the FA system are used to valuate portfolios based on the market value, accrued interest or bond maturity value and record this value to the bookkeeping system.

Deferral processes create transactions for bookkeeping purposes. You can map these transactions to appropriate bookkeeping accounts using posting rules. When deferral transactions are generated, appropriate postings are generated for accounting purposes.

Preconditions

Before you start editing position valuations, make sure that the market prices of the securities are updated and that the maturity dates and values are correct for the bonds.

Deferral of positions

Deferral of positions calculates deferrals for any security types for closing the portfolio at the end of the accounting year for bookkeeping purposes. The generated transactions can be used in bookkeeping, allowing you to revaluate the booked purchase value of other types of securities based on the market value at year-end.

The deferral transactions created by this process re-valuate your open positions' booked purchase value based on the market value of the position at year-end. This allows you close the books on your portfolios at year-end. You can also calculate separate adjustments for changes in currency and security prices, and configure how the re-valuation affects your portfolio's booked purchase value.

You can create a single adjustment or separate adjustments due to currency and security changes. In the single adjustment mode, the logic compares the current booked purchase value against the market value and updates the booked purchase value:

To be the market value, if market value was less than the booked value.

To be the market value, if the market value was greater than the booked value but less than the original purchase value

To be the original purchase value, if the market value was greater than the original purchase value

If you choose to create separate adjustments due to currency and security changes, the logic is more complicated:

Security adjustment: if market value (sec) is larger than the original purchase value (sec), then original purchase value (sec) - purchase value (sec). Otherwise market value (sec) - purchase value (sec). Used FX rate is the purchase FX rate, if market value (sec) is larger then the original purchase value (sec), otherwise market FX rate.

FX adjustment: (purchase value (sec) + Security adjustment (sec))/market FX - (purchase value + Security adjustment). The FX adjustment is always done with the market FX rate.

Run deferral to market value

To carry out the deferrals:

Open the Deferrals window:

To generate deferrals for one portfolio, open it in the Overview. Right-click the portfolio in the portfolio hierarchy on the right and choose Bookkeeping.

To generate deferrals for several portfolios, open the Portfolios view. Click Bookkeeping at the bottom.

Choose one of the options:

Deferral of positions creates deferrals for the difference between the purchase value and market value, but not allowing the purchase value to go above the original purchase value.

Deferral of positions (market value) creates deferrals for the difference between the purchase value and market value.

Deferral of positions (market value, use original purchase value) creates deferrals for the difference between the original purchase value and market value. Use this option if you have transactions with booked values and want to use the original values for deferrals. You need to cancel the deferrals the next day because the already deferred amounts are not considered in subsequent deferrals.

Fill in the fields:

- End date

Deferral end date.

- Cancelled on the following day

An option to cancel bookkeeping posting on the next day.

Select the security types and click Done.

Review the valuation changes in the table (+/- column) and click Done.

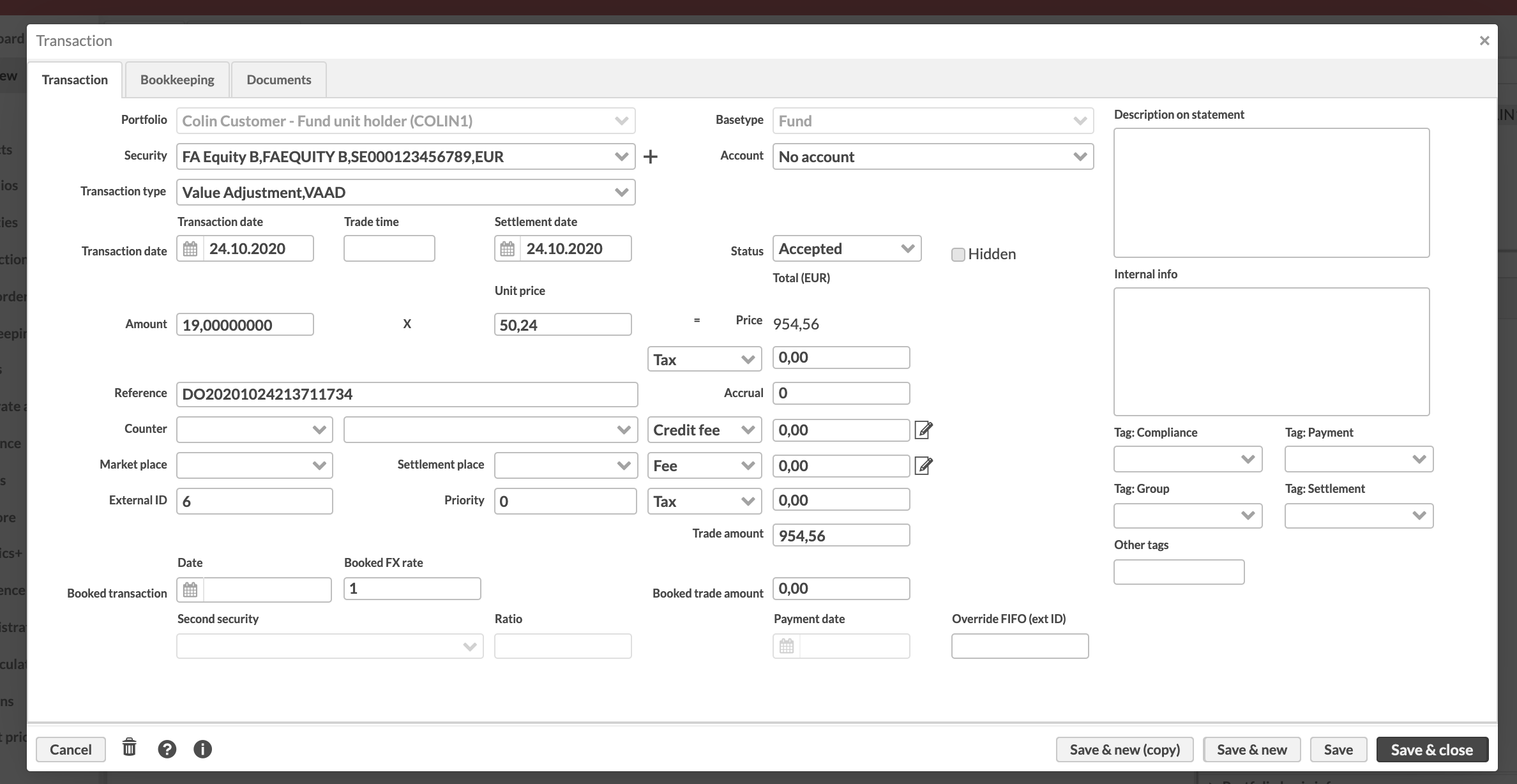

The system creates Value adjustment transactions. These transactions modify the purchase price for open purchase lots (position purchase price = accounting price).

|

Deferral of accrued interest

Deferral of accrued interest allows you to book accrued interest on bonds and portfolio accounts before the actual interest payment. The system generates deferral transactions for a selected portfolio. You can choose to create transactions per security or account, or create a single sum transaction for the interest accrued in the portfolio. In addition, reverse transactions are created for the next day. The generated transactions can then be used in accounting to handle accrued interest.

Run deferral of accrued interest

To carry out the deferrals:

Open the Deferrals window:

To generate deferrals for one portfolio, open it in the Overview. Right-click the portfolio in the portfolio hierarchy on the right and choose Bookkeeping → Deferral of accrued interest.

To generate deferrals for several portfolios, open the Portfolios view. Click Bookkeeping → Deferral of accrued interest at the bottom.

Fill in the fields:

- Deferral date

The date to create the deferral transactions for.

- Method

The option to to create one transaction for the total accrued interest or separate transactions per bond position or account.

Click Done.

The system creates Deferral of accrued interest transactions in the portfolios if there is any accrued interest to defer. Also, it creates reverse transactions of the same type with the same amount for the next day.

Deferral of accounts

Deferral of accounts helps you handle profits and losses for the currency accounts. It creates Cashflow in (Internal) and Cashflow out (Internal) transactions with the value equal to the entire account balance. The transactions use the latest FX rate. The Cash out transaction realizes all profits on the cash account, and the Cash in adds back the account balance with the latest FX rate.

Run deferral of accounts

To carry out the deferrals:

Open the Deferrals window:

To generate deferrals for one portfolio, open it in the Overview. Right-click the portfolio in the portfolio hierarchy on the right and choose Bookkeeping → Deferral of accounts.

To generate deferrals for several portfolios, open the Portfolios view. Click Bookkeeping → Deferral of accounts at the bottom.

Choose the date to realize the currency profits and losses for.

Review the transactions and click Done.

Deferral of bond purchase price

Deferral of the bond purchase price supports two methods for calculating the deferral transactions.

Linear method

The linear method generates deferral transactions based on the bond purchase price vs its price at maturity. Calculation logic:

Maturity price = nominal value in portfolio currency corrected with the maturity price if it is different from 100%.

Over/underprice = maturity price - purchase price.

Total days = days between purchase date and maturity date.

Deferral days = difference between start date (or purchase date if it is after the start date) and end date (or maturity date if it is before the end date).

Constant yield method

The constant yield method (also known as "amortized costs") generates deferral transactions based on the bond's yield at the time of purchase vs its yield on the day of the deferral. This means that the process calculates the initial yield to maturity for each purchase lot, and uses that to calculate the bond position's expected price for the given date. The resulting deferral transaction captures the difference between this calculated price and the position's purchase price.

Note

Use a portfolio valuation type that keeps separate items, for example, FIFO or "Average price with separate items" for the purchase dates of all purchase lots to be considered.

Calculation logic:

YTM = Yield at purchase

Calculated unit price = Based on YTM on the day of the deferral.

Run deferral of bond purchase price

To carry out the deferrals:

Open the Deferrals window:

To generate deferrals for one portfolio, open it in the Overview. Right-click the portfolio in the portfolio hierarchy on the right and choose Bookkeeping → Deferral of bond purchase price.

To generate deferrals for several portfolios, open the Portfolios view. Click Bookkeeping → Deferral of bond purchase price at the bottom.

Fill in the fields:

- Start date

Deferral start date.

- End date

Deferral end date.

- Method

Deferral method. The linear method calculates the difference between the bond's purchase value and maturity value and divides this difference equally over the days remaining before maturity. The constant yield method keeps the yield-to-maturity at the same level as it was on the day of the purchase.

Review the deferrals (you can deselect some rows if needed) and accept them by clicking Done.

Deleting a deferral

To delete a deferral, remove the generated transactions.

If you configured deferral runs as a part of NAV calculation in the FA Fund management app, reset the Latest deferral date in the Accounting tab of the Fund wizard to the date when the latest correct deferral was carried out.

Transaction types for deferrals

Transactions created by deferrals can be mapped to appropriate bookkeeping accounts using posting rules (see Preference - Bookkeeping). Follow the configurations below to set up the transaction types used by the processes:

Name (Code) | Description and effects |

|---|---|

Deferral of accrued interest (DAI) | Transaction type for deferral of accrued interest. Allows you to book accrued interest of bonds for a period, prior to the actual interest payment. Effects // FIFO: Add |

Deferral of bond purchase price (DEFPR) | Transaction type for deferral of bond purchase price. Allows you to book purchase prices of bonds periodically between purchase and maturity. Effects // Purchase price: Reduce, record orig values |

Value adjustment (VAAD) | Transaction type for deferral of other securities. Allows you to revaluate the booked purchase value of securities based on the market value at year-end for closing the books. This transaction type should be used for single adjustments. Effects // Purchase price: Reduce, record orig values |

Value adjustment (sec) (VAADSEC) | Transaction type for deferral of other securities. Allows you to revaluate the booked purchase value of securities based on the market value at year-end for closing the books. This transaction type should be used if separate adjustments are created due to currency and security changes. Effects // Purchase price: Reduce in security currency, record orig values |

Value adjustment (fx) (VAADSEC) | Transaction type for deferral of other securities. Allows you to revaluate the booked purchase value of securities based on the market value at year-end for closing the books. This transaction type should be used if separate adjustments are created due to currency and security changes. Effects // Purchase price: Reduce and set fx, record orig values |

Questions about deferrals

I ran a deferral in my portfolio. The system didn't create value changes for all positions. In these cases, the market value of the position was higher than the original purchase price.

FA system has two predefined deferrals:

Deferrals of position amortize the purchase price (= accounting price) so it raises the maximum to the level of the original purchase price.

Deferrals of positions (market value) convert the purchase price into the market price and thus don't compare it with the original purchase price.

I run a deferral. Value adjustment transactions were created correctly. Why doesn't the system create bookkeeping postings?

You should create bookkeeping rules for this transaction type (VAAD).

I run deferral for my portfolio. The market value for one position changes. Why?

If you don't have a market unit price for the security, FA system uses the purchase price as market price. If the position isn't in portfolio currency, the deferral function changes the purchase price. Then the value adjustment modifies indirectly the market price as well.

You can use deferrals to currency positions only if you have a market price observation for the security.