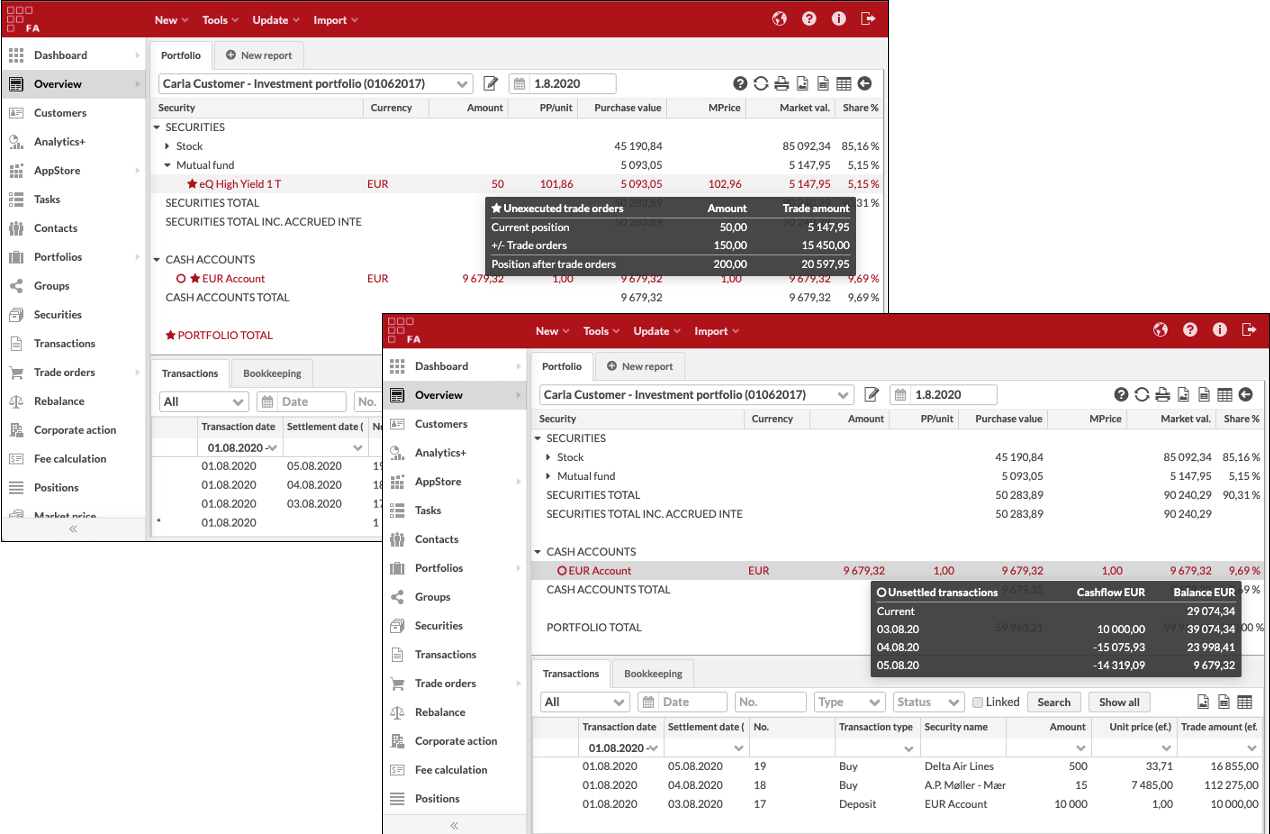

Extended position information in Overview

The extended position information in the Overview allows you to see the effect of unsettled transactions and unexecuted trade orders on security positions, accounts, and the portfolio total. Extended position information is enabled by default, but you can hide it by right-clicking the view and unticking Show extended position info. The system remembers your selection for the next session. When extended position information is enabled, positions, accounts, and the portfolio total are highlighted with red text. A symbol next to a row indicates how it is affected:

Unexecuted trade orders are indicated by a star

.

.Unsettled transactions are indicated by a circle

.

.

To see more information on the effects, hover your mouse over a row to see a grey information box. Note that you might need to scroll down to see all information in the box. The following sections describe the information shown for security positions, accounts, and the portfolio total in detail.

|

Extended information on security positions

When a security position is marked with the circle or star symbol, you can see the effect of unexecuted trade orders and/or unsettled transactions by hovering your mouse over the row.

Unexecuted trade orders predicts the effect of open and executable trade orders on your position if the trade orders were to be executed with their current values (amount, trade amount, and exchange rate).

Example: You have a position with an amount of 2000 and a market value of 9084,00. You have outstanding trade orders with an aggregated amount of 1000 (sum of trade order amounts) and an aggregated trade amount of 4510,00 (sum of trade amounts). After the trade orders, your position is predicted to have an amount of 3000 (2000 + 1000) and a trade amount of 13594,00 (9084,00 + 4510,00).

Unsettled transactions shows how the position looks based on the settlement date and only includes transactions that have an amount effect linked to the position.

Example: You have a position on October 20th with an amount of 2000 and a market value of 9084,00. You have unsettled transactions with a settlement date on October 21st, an aggregated amount of 1000 (sum of transaction amounts), and a trade amount of 4556,00 (sum of trade amounts). Based on the settlement date, your position is predicted to have an amount of 1000 (2000 - 1000) and a trade amount of 4528,00 (9084,00 - 4556,00). On the selected date, only 1000 units with a market value of 4528,00 have been settled.

Unexecuted trade orders | ||

Amount | Trade amount | |

Current position | Position amount based on transactions (same as Amount column in Overview). | Current position market value in portfolio currency based on transactions (same as Market val. column in Overview). |

+/- Trade orders | Aggregated amount of open and executable trade orders (sum of trade order amounts). | Aggregated trade amount of open and executable trade orders in portfolio currency (sum of trade amounts). |

Position after trade orders | Predicted amount after trade orders if they were to be executed with their current information (current position amount + trade orders). | Predicted trade amount in portfolio currency after trade orders if they were to be executed with their current information (current position trade amount + trade orders). |

Unsettled transactions | ||

Amount | Trade amount | |

Position based on transaction date | Position amount based on transaction date (same as Amount column in Overview). | Current position market value in portfolio currency based on transaction date (same as Market val. in Overview). |

+/- Unsettled transactions | Aggregated amount of transactions with a settlement date later than the selected date (sum of transaction amounts). Also includes transactions without a settlement date if they have a cash effect. | Aggregated trade amount of transactions with a settlement date later than the selected date in portfolio currency (sum of trade amounts). Also includes transactions without a settlement date if they have a cash effect. |

Position based on settlement date | Position amount based on the settlement date instead of the transaction date (position amount on transaction date - unsettled transactions). Deducts effect of unsettled transactions from position in the Overview. | Position trade amount in portfolio currency based on the settlement date instead of the transaction date (position trade amount - unsettled transactions). Deducts the effect of unsettled transactions from position in Overview. |

Extended information on accounts

When an account is marked with the circle or star symbol, you can see the effect of unexecuted trade orders and/or unsettled transactions by hovering your mouse over the row.

Unexecuted trade orders predicts the effect of open and executable trade orders linked to the account would have on the account balance if the trade orders were to be executed with their current information (amount, trade amount, and exchange rate). This allows you to predict if your account has enough available cash to execute all trade orders linked to it.

Example: Your account has a balance of 5321,88. You have outstanding trade orders with an aggregated cashflow of -4510,00 (sum of trade order amounts, taking into account positive or negative cash effect). After the trade orders, your account balance is 811,88 (5321,88 - 4510,00).

Unsettled transactions shows how your account balance looks like on the selected date based on the settlement dates of unsettled transactions (similar to bank statement reports). You can also predict how the account balance will develop in the future.

Example: On October 19th, your account balance is 15128,00 based on the settlement date. You have transactions that are settled on October 20th with an aggregated cashflow of -5250,12. The resulting account balance on October 20th is 9877,88 (15128,00 - 5250,12). You also have transactions that are settled on October 21st with an aggregated cashflow of -4556,00. The resulting account balance on October 21st is 5321,88 (9877,88 - 4556,00).

Note

To view the projected account balance for a shared account, you need to analyze all portfolios with transactions against the account. For example, if portfolio A has a shared account X and you only analyze portfolio A, the projected balance for X does not reflect transactions from other portfolios. To view the projected balance for a shared account, you can select the contact that own all of the portfolio in the Overview.

Unexecuted trade orders | |||

Balance EUR (account currency) | |||

Available cash before trade orders | Account balance in account currency based on transactions (same as Amount column in Overview). | ||

+/- Cashflow from trade orders | Aggregated total cashflow in account currency from open and executable trade orders linked to the account (sum of trade order amounts, taking into account positive or negative cash effect). | ||

Available cash after trade orders | Predicted account balance in account currency after trade orders linked to the account if they were to be executed with their current information (balance as available cash before trade orders + cashflow from trade orders). | ||

Unsettled transactions | |||

Cashflow EUR (account currency) | Balance EUR (account currency) | ||

Current |

| Current account balance in account currency based on the settlement date. | |

Future settlement dates | Aggregated total cashflow from unsettled transactions linked to the account on the listed date (sum of transaction trade amounts, taking into account positive or negative cash effect). | Account balance in account currency based on the settlement date on the listed date. The last listed settlement date shows your account balance after settling all transactions (same as Amount column in Overview). | |

Extended information on portfolio total

When the portfolio total is marked with star symbol, you can see the effect of unexecuted trade orders by hovering your mouse over the row.

Unexecuted trade orders predicts the effect of open and executable trade orders on the total of your securities and available cash if the trade orders were to be executed with their current information (amount, trade amount, and exchange rate).

Example 1: Your "SECURITIES TOTAL" is 19262,51. You have outstanding trade orders with an aggregated trade amount of 4510,00 (sum of trade order amounts). After the trade orders, your securities total is 23722,51 (19262,51 + 4510,00).

Example 2: Your available cash in "ACCOUNTS TOTAL" is 19570,08. You have outstanding trade orders with an aggregated cashflow of -4510,00 (sum of trade order amounts, taking into account positive or negative cash effect). After the trade orders, your available cash total is 15060,08 (19570,08 - 4510,00).

Unexecuted trade orders | |

|---|---|

Securities total before trade orders | Total market value of your securities in portfolio currency based on transactions (same as Market val. column for "SECURITIES TOTAL" row in Overview). |

+/- Market value effect from trade orders | Aggregated trade amount of open and executable trade orders in portfolio currency (sum of trade order amounts). |

Securities total after trade orders | Predicted total market value of securities in portfolio currency after trade orders if they were to be executed with their current information (securities total before trade orders + market value effect from trade orders). |

Available cash before trade orders | Total available cash in portfolio currency based on transactions (same as Market val. column for "ACCOUNTS TOTAL" row in Overview). |

+/- Cashflow from trade orders | Aggregated total cashflow in portfolio currency from open and executable trade orders (sum of trade order amounts, taking into account positive or negative cash effect). |

Available cash after trade orders | Predicted total available cash in portfolio currency after trade orders if they were to be executed with their current information (available cash before trade orders + cashflow from trade orders). |