Standard solution 1.37 - Release notes

Released: October 11th, 2023

Standard solution 1.37 provides you with functionality for Norwegian tax reporting, documentation about how to set up UCITS limits and automated corporate action runs of dividends and splits from Bloomberg.

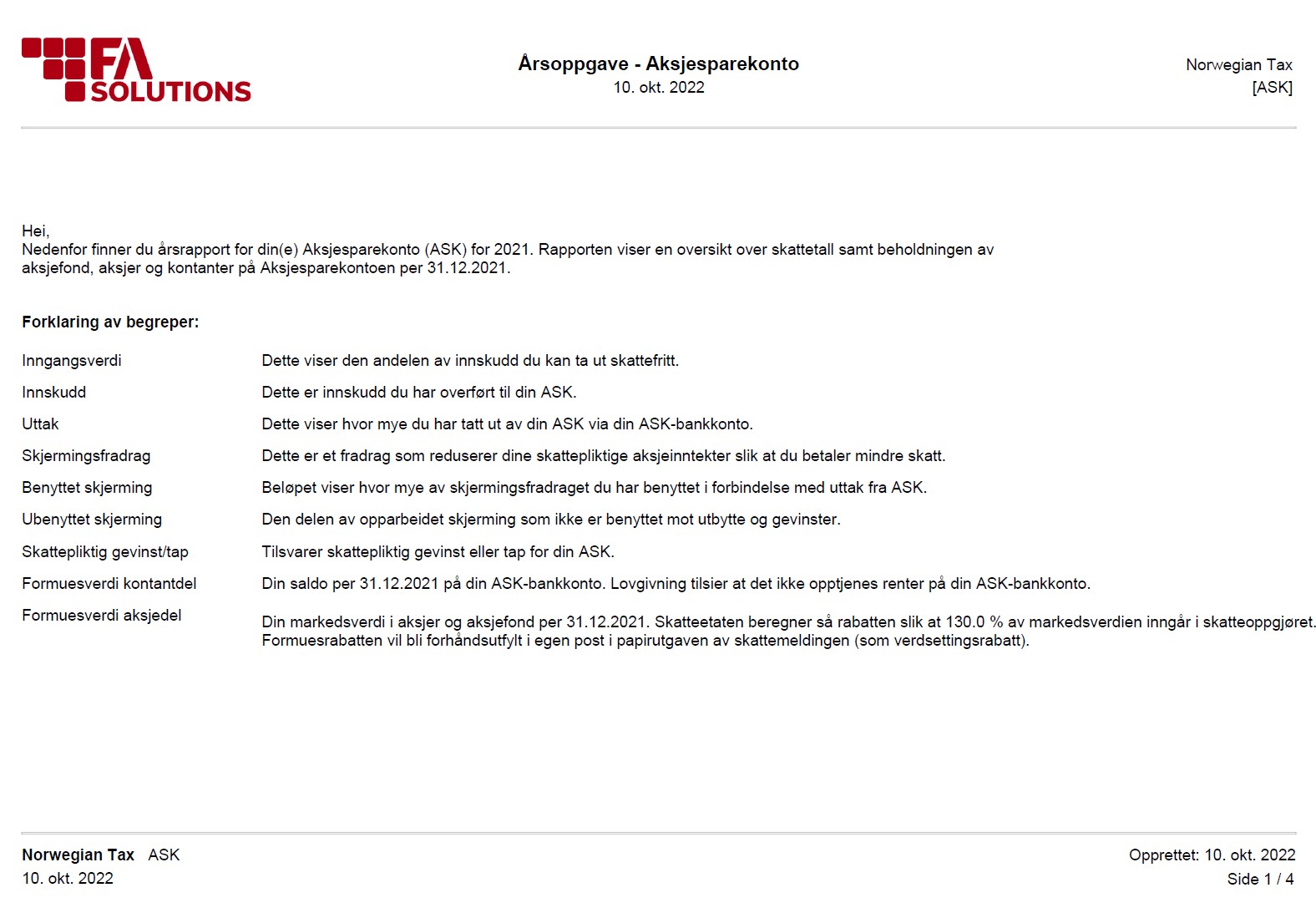

Norwegian tax reporting

This version provides support for generating Norwegian tax reports, both technical XML files for the tax authorities and PDF reports for your clients.

Standard Solution now supports the generation of five different reports.

Aksjesparekonto, ASK, used to report share saving accounts.

Finansprodukter, used to report holdings in foreign securities.

Individuellepensjonsordninger, IPS, used to report pension saving accounts.

Saldorente, used to report account balances and received interests.

Verdipapirfond and Verdipapirfondshistorikk, used to report holdings in Norwegian funds.

All you need to do is to fill in general configurations for the reporting organization and some contact, security and portfolio-specific details to be able to generate the reports.

You can generate the reports directly in the format that the tax authorities expect.

According to Norwegian regulations, investors need to be informed of the data that has been reported to the tax authorities on their behalf. Therefore, after authority reporting is done (in XML-format), clients must be provided with the same information. Standard Solution lets you generate PDF reports with the data that has been reported to the tax authorities. PDF reports can be sent out to clients via email, or, for example, uploaded to FA Client Portal for easy access for the client.

|

Learn more: Create authority reports in FA User Guide.

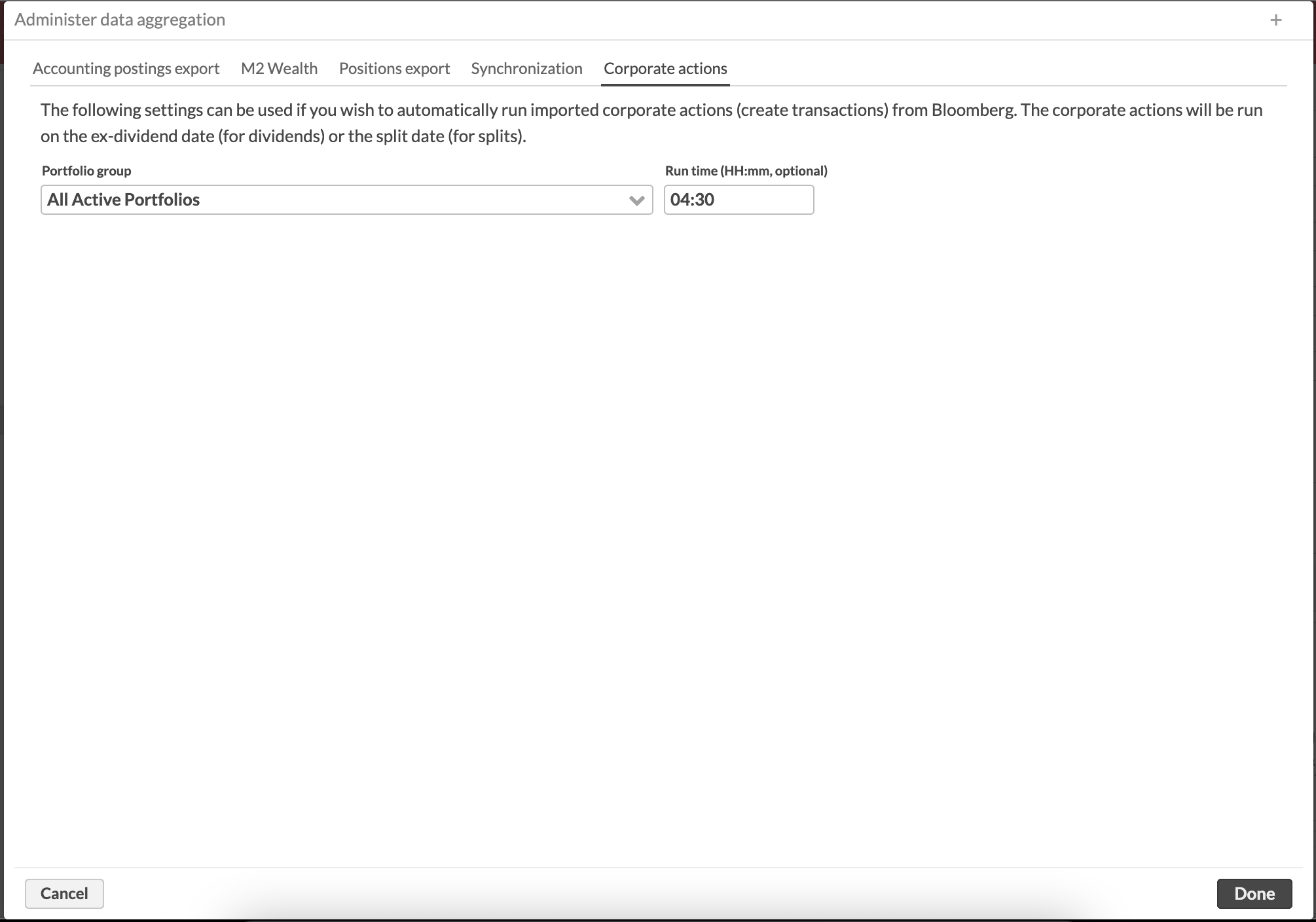

Automated corporate action runs of dividends and splits from Bloomberg

In an earlier version of Standard solution, we introduced the feature that imports dividends and splits for equity securities if you have the connectivity to Bloomberg for security reference data. This feature imports the corporate action event with the relevant corporate action details.

Version 1.37 now provides the next step for automating the full flow. This version lets you run the imported corporate actions automatically, creating the actual corporate action transactions (based on the corporate actions event) into portfolios on the ex-dividend/spit date. You only need to define the portfolio group it should be run against and an optional run time.

|

Learn more: Import dividends and splits from Bloomberg in FA User Guide.

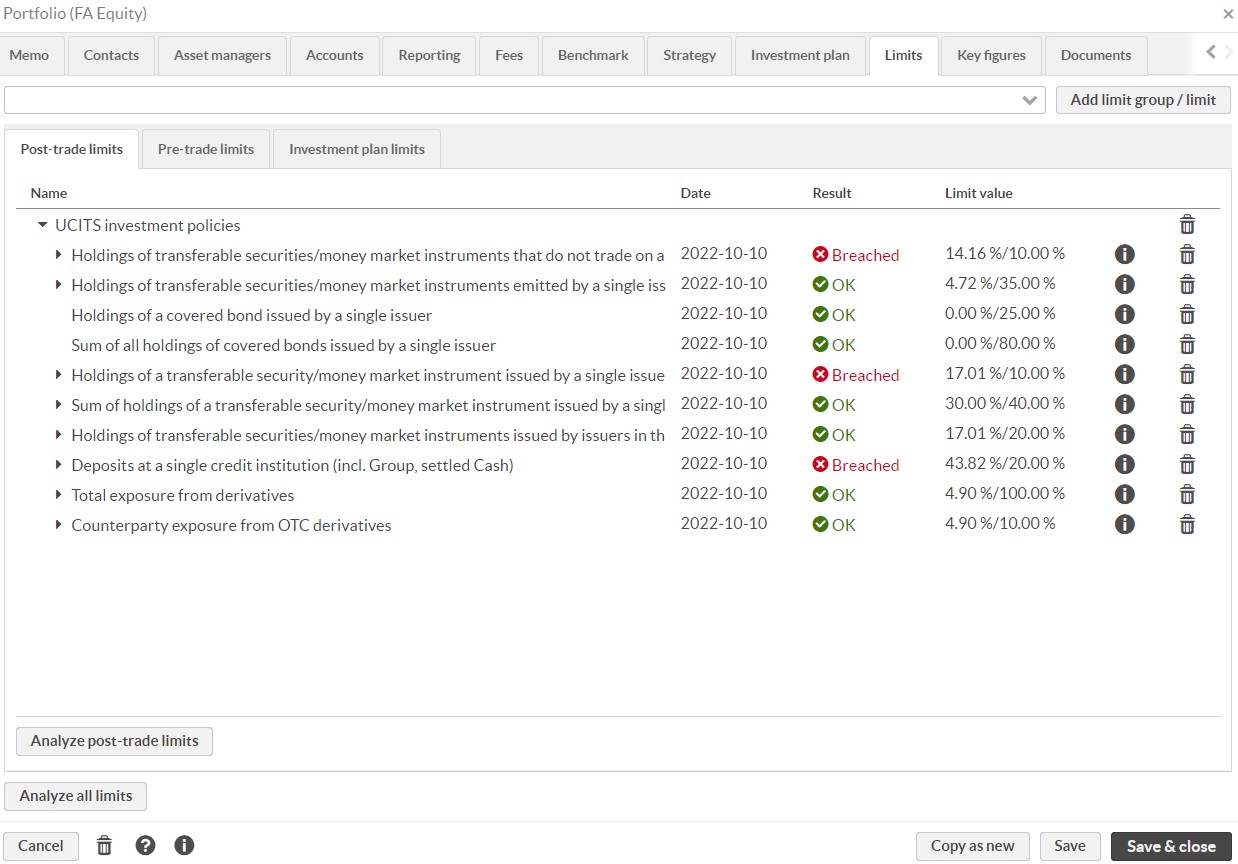

UCITS limits documentation

Mutual fund portfolios often have very specific investment policies defined in their rules and in the governing law. For example, in the European Union, UCITS funds are governed by the investment policies defined in Chapter 7 of the UCITS directive, local laws, and fund rules. In FA, you can define the limits and use them to make sure that your mutual fund follows the investment policies.

Version 1.37 provides extensive documentation on how UCITS limits can be set up in FA using FA's limits functionality. The documentation can act as a base for setting it up, and you might need to adjust them to suit your local laws or fund rules.

|

Learn more: Set up investment limits for mutual fund portfolios in FA User Guide.

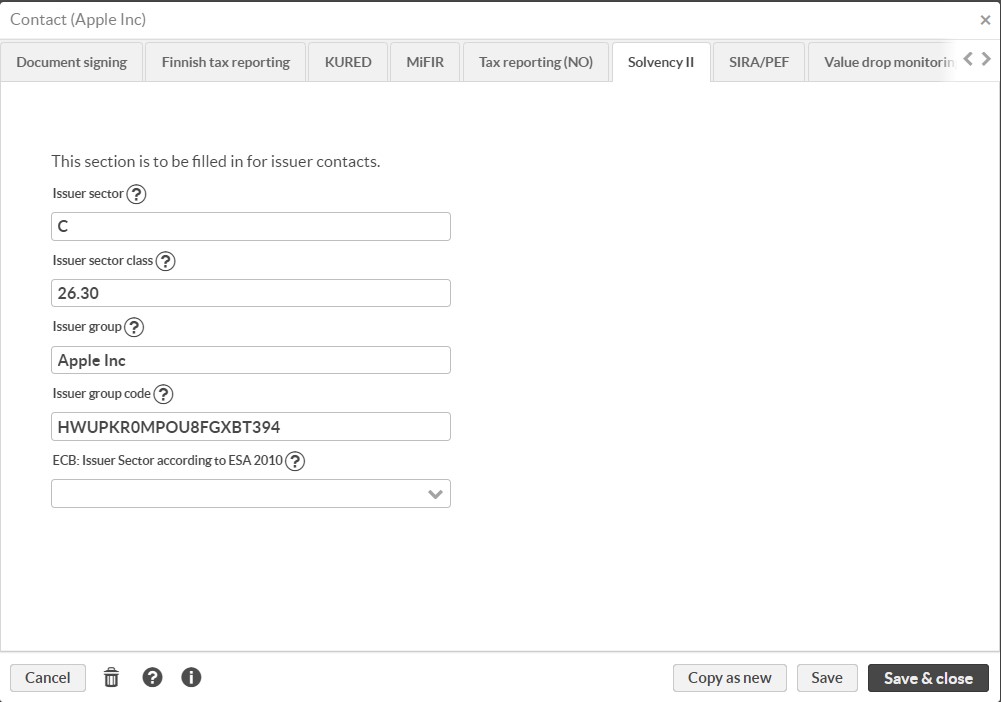

Solvency II issuer sector class

For Solvency II reporting, issuer sector code (e.g. “K”) is not enough in certain cases, and would need to be accompanied by a 4-digit class code (e.g. “6411”).

We had already before a contact field for the Issuer sector code, and fetched it from Bloomberg (NACE_SECTOR_CODE), but we were not fetching the class code (NACE_CLASS_CODE) which would be needed in some situations.

Version 1.37 provides a new field on the issuer contact for entering the issuer sector class code, and Bloomberg issuer mapping has been updated so that the sector class code field can be populated automatically if Bloomberg reference data connection is in use.

|

Learn more: Classify data according to Solvency II directive in FA User Guide.

Other improvements

Bloomberg reference data as market data

You can now import security reference data as market data in FA. For example, Bloomberg provides index market capitalizations only as reference data, but in certain cases you might want to use market caps as index security's price.

Learn more: Use Bloomberg reference data as market data in FA User Guide.

Automated file delivery to Bloomberg PORT

In an earlier version of Standard Solution, we made a standard report to export positions to Bloomberg PORT available as an optional package. Version 1.37 provides an automated way to deliver the file to Bloomberg via sFTP. There is now a configuration screen available where you configure if you want to use the automated delivery or not and the needed username and password for the connection.

Learn more: Set up Bloomberg PORT export in FA User Guide.

Merge transaction type

Mainly for tax reporting reasons, there is a need to be able to distinguish between exchanges and mergers. For that reason, version 1.37 introduces a new transaction type (MRG) to be used for mergers. Exchange transaction type already existed before in Standard Solution.

Fixes

Portfolio Management

Security type Futures are traded with 0 decimals but were before configured to use 2 decimals. Now the decimal count for Futures is set to 0 in Standard Solution.

Signicat

The configuration used in Send documents to Signicat process for requiring authentication with BankID to view a document before signing it now works again.

Swedish tax reporting

Swedish tax reporting now picks up the general preferences (such as reporting entity, or technical contact) properly in the XML files.

Trade Order Management

Bulk trade orders and Bulk trade order execution now use the correct rounding tax type "RND" (affects certain trade-amount-based orders).