Calculate NAV with income distribution

Income distribution is calculated as a part of NAV processing.

The calculation

The formula sums values from bookkeeping accounts defined in the fund settings. The formula sums up postings with status Ready since the beginning of the year.

Prepare bookkeeping before running NAV

As income distribution calculation is based on bookkeeping postings, it is important that all bookkeeping is up to date when you calculate NAV. This means that you need to run Deferral processes that have impact on Income Distribution before you run NAV. Normally this is the following deferral processes, set up with FAFUNDS configuration name, and with process UI disabled:

Deferral of accrued interest

Deferral of other securities - needed for accounts (this to capture currency gain/loss on accounts)

Running NAV in the FA Fund management app

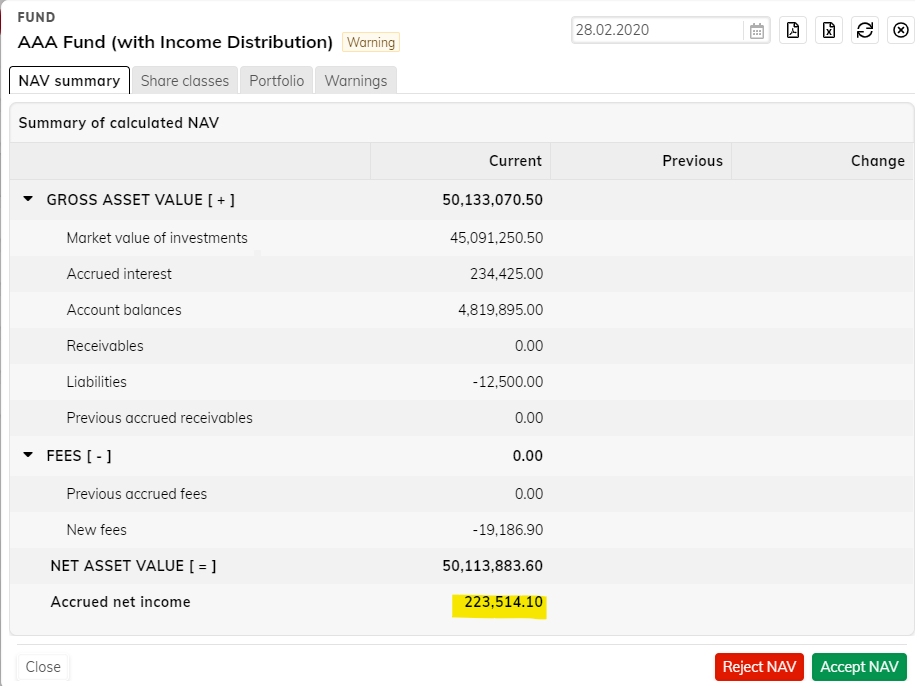

When previewing NAV you see the Income Distribution in bottom part of the NAV Summary tab as Accrued net income.

|

The number shown is ingoing Accrued net income from previous NAV date (Stored in Income Distribution Transactions per that date) + summed up Amounts in Ready Bookkeeping postings since beginning of year on mapped accounts + New fees in this NAV calculation.

Recording each period's income distribution calculation data as transactions

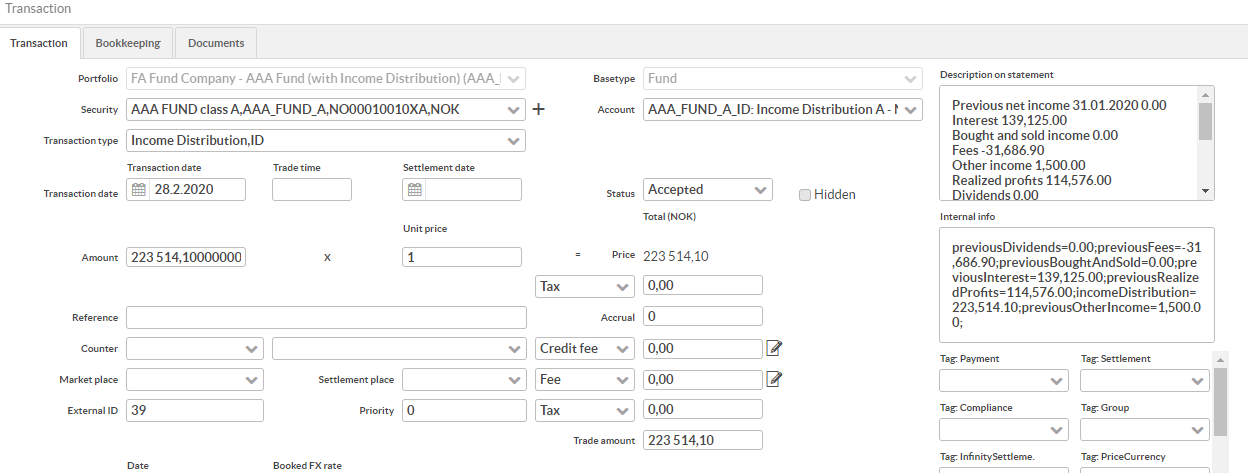

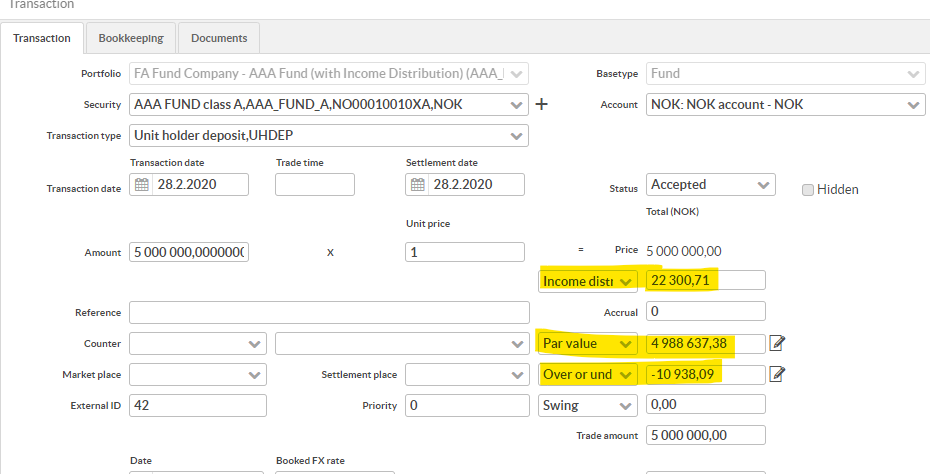

Each period's calculated income distribution is recorded in Income distribution transactions towards the “ID” accounts. Transactions like below are created in NAV run. Note that detailed breakdown from this NAV calculations Income is stored in Description on statement field. Internal info field also holds same information in format read by NAV process in next run.

|

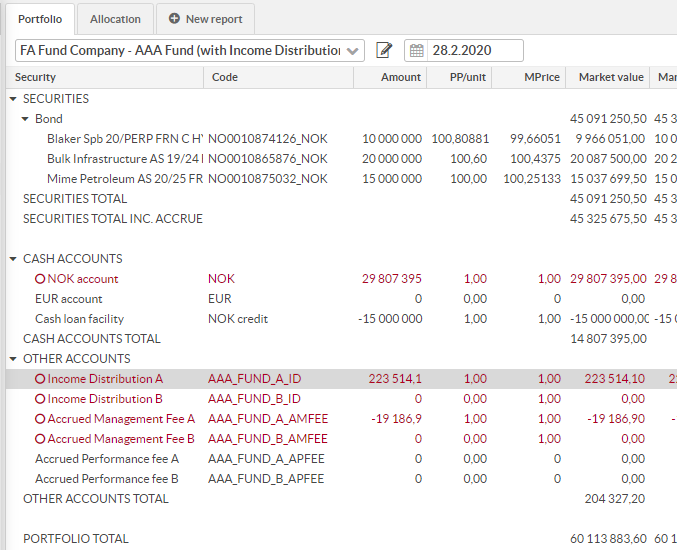

You can see balances in these accounts in Overview, it is excluded from Portfolio valuation.

|

Recording Income Distribution per Unit

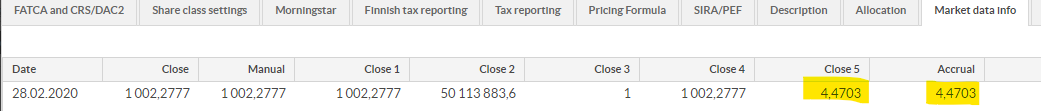

NAV calculation records the income per unit in the accrual and close 5 market data fields of each of the fund securities.

|

Income distribution in cash flow to fund portfolio

NAV process creates cash transactions to fund portfolios based on aggregated flows from subscriptions and redemptions. They are aggregated per transaction type and settlement date in client orders. Transaction types used are defined in the Fund wizard, Order execution tab. We recommend using Deposit - Fund (FMDEP) and Withdrawal - Fund (FMWD).

The trade amount is broken down in the following parts:

Par value. Par value = Sum of amounts in client transactions x Par value (defined in the Fund wizard, Order execution tab).

Income distribution. Income distribution = The sum of accrual in client transactions.

Over or under value. Over or under value = Trade amount - Par value - Income distribution (- Swing if swing pricing is applied).

Swing (if swing pricing is applied).

|

Implication in Bookkeeping export from income distribution processing

When NAV is run with income distribution, all bookkeeping postings up to the NAV run are set to status "Reported". This is normally not in sync with what actually is reported to bookkeeping system.

The reason for this is that income distribution calculation requires that already included transactions are flagged Reported. This way, next time only bookkeeping postings with status "Ready" will be included in income distribution calculation.

To manage the not in sync Reported mark from NAV processing extension Bookkeeping reporting (from version 3.4) supports to only include postings with ext_id larger than latest reported.

Income distribution in client transactions

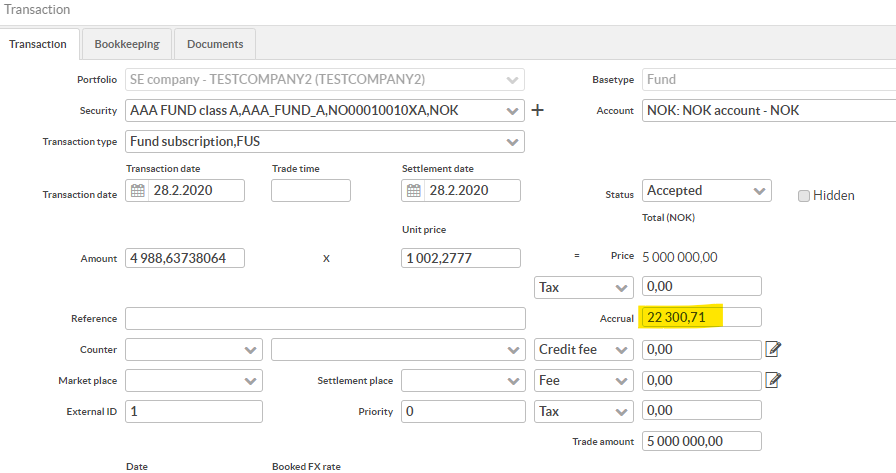

Transactions in fund unit securities

Transactions in Fund unit Securities with accrued Income Distribution (Accrual) in is treated similar to bond transactions with Accrued Interest. The difference is that the Price here is a dirty price including the Accrued Income Distribution (Accrual).

|

Purchase value in reporting is the Trade Amount minus the Accrued Income Distribution (Accrual) in the transaction. So for example above Purchase value is 10 000 000 - 41 579,87 = 9 958 420,13.

Year end processing

For Norwegian funds the accrued Income Distribution on December 31st is paid out to share-holders as a Yearly dividend (term Dividend is used even if it is more like a Coupon).

A special situation can occur from tax reporting perspective as Income Distribution not just goes up during year, as an Accrued Interest, but can also go down. That mean that a client may buy Fund unit Securities with a higher Accrued Income Distribution (Accrual) then what is actually paid out in Yearly dividend. This deficit is deductible from any future profits according to Norwegian tax legislation. This situation is handled in FA Norwegian tax reporting.