Set up and capitalize accrued interest on account

You can use track and capitalize accrued interest for debit, credit, and other accounts. The system calculates accrued interest every day using the following formula:

In this formula, the account balance is the settled balance on the current or previous day (depending on the settings), the base interest rate is determined by an index or a fixed or floating rate, and spread is the interest on top of the base rate that you can specify depending on the account balance.

The following sections describe how to set up and capitalize account interest.

Set up interest accrual for account

To set up the accrual logic for the account:

Open the "Interest details" section in the Portfolio window, Accounts tab and click Edit.

Fill in the fields (for field descriptions, see Portfolio window in FA Back reference).

Settings related to interest accrual and capitalization (Additional settings block) come from preferences (see Preference - Portfolios). You can re-define them on the account level if needed.

Click Ok and then Save & close.

Now you can track the accrued interest: select the portfolio in the Overview and see the Accr. int. column.

Capitalize accrued interest

Define the interest run

To book accrued interest payouts, you need to run it as a corporate action that creates interest transactions:

In the Fees and interests view, click New fee/interest calculation.

Select "Account interest" as the action type and fill in the fields in the upper section of the window:

Calculation date* – Account interest payment date (same as the previous account interest run date or later). The system runs the interest payment for interest accrued since the previous interest payment date (if available), the portfolio start-up date, or the date of the earliest transaction in the portfolio.

Capitalize earned and charged interest with* – A setting to track and capitalize earned and charged interest in one transaction or separately, using different transaction types. The choice in this field must be in line with the account settings (see Set up interest accrual for account), otherwise transactions aren't created.

Same transaction type – Capitalize earned and charged accrued interest with one transaction. Specify the transaction type that is set for your accounts (see Set up interest accrual for account).

Different transaction types – Capitalize earned and charged accrued interest separately, using different transaction types. This option is useful if you need to capitalize interest on an overdraft monthly or shortly after it accrues, and pay out interest on positive balance yearly. Different transaction types let you separate earned and charged interest in reports and accounting.

If the account settings (see Set up interest accrual for account) are also set to capitalizing accrued interest with different transaction types, you can choose to:

Capitalize only earned or only charged interest. To to this, specify the transaction type that is set for earned or charged interest (see Set up interest accrual for account). Leave the other field empty.

Capitalize both earned and charged interest using different transaction types. To do this, specify both transaction types as they are defined in the account settings (see Set up interest accrual for account).

Memo – Notes related to your account interest run. You can use them, for example, to store additional information or to help with searching for previous interest runs.

Click Save & close.

The interest run is now saved but not yet executed.

Execute or schedule the run

To execute the account interest run defined in the previous step:

Double-click the account interest run you saved to open the Corporate action run window.

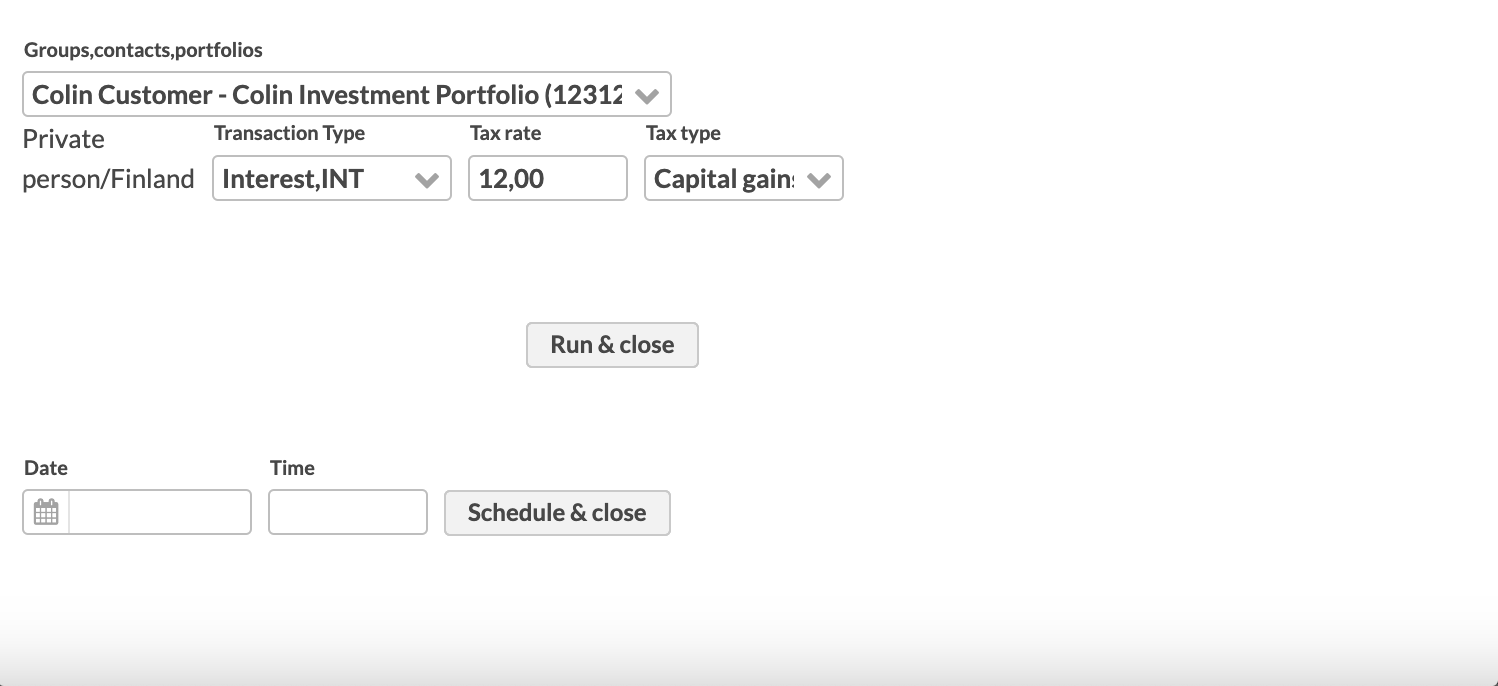

In the middle section of the window, select the portfolios to run the interest.

Fill in the tax rate and tax type (default tax rates are set in Preferences - Taxation - Default tax rates). Note that taxes are added only for the earned interest (in case you capitalize earned and charged interest separately).

To execute the run, click Run & close, preview the transactions, and click Accept and run. You can also schedule the run for later by entering a date and time and clicking Schedule & close.

You can view the transactions in the Overview or Transactions view. The interest transactions are created with the status "Accepted". The interest calculation details are specified in the transaction's Description on statement field, for example: "11.08.2024 - 11.04.2025 = 1,000.000*4.0000%*0.6694444444". This includes:

Account interest period – The date range used for the calculation.

Weighted average balance – The average balance of the account over that period, weighted by time.

Weighted average interest rate – The average interest rate applied during the period.

Day count convention – The factor used to annualize interest based on the selected convention (for example, 0.6694444444 for a partial year under Act/360).

Re-run account interest for a specific date

You can re-run account interest for a specific date by selecting that date as the Calculation date when defining the interest run. When you execute the run, the system re-runs account interest for this date and creates a new interest transaction that replaces the existing one.