FX Forward

Contract type FX Forward is an agreement between two parties to buy one currency against selling another currency at an agreed FX rate for settlement on a future date. Entering an FX Forward automatically generates forward cashflow positions until the end of your contract and relevant cashflow transactions for the end of your contract.

Note

After FA 3.10, if you are creating a contract that ends in the future, the logic uses the latest FX rates available as the “settlement FX rate” of your contract - you might want to re-save your contract once your FX rates are up-to-date to update the settlement FX rates as well. Up-to-date "settlement FX rate" allows you to calculate profit/loss you made on your contract due to FX changes.

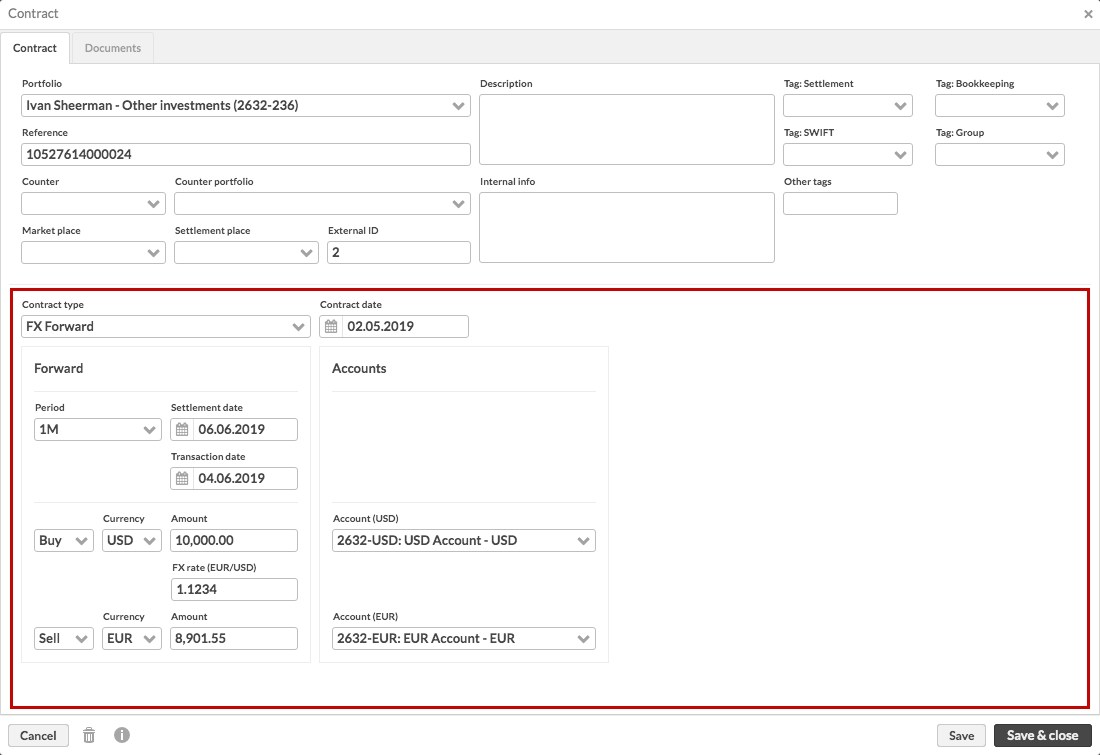

Contract-specific fields for FX Forwards

For FX Forward, the contract-specific fields allow you to fill in information that is relevant for entering an FX Forward contract into the system.

The fields available are:

- Contract date

Date when the contract beings. For FX Forward, the forward cashflow positions appear in your portfolio on the contract date.

Forward section allows you to define all relevant details of the forward itself. You can define your forward in terms of the two cashflows you would be getting in the future - information relevant to each cashflow is shown on the same row, with an FX rate in between the two rows.

- Period

Select the length of your forward contract. For example, you can select whether you are entering a 1 week or a 1 month contract. The period is used to calculate the settlement date of the forward cashflows.

- Settlement date

Date when the contract cashflows settle, calculated by adding the selected period into a spot date calculated from the contract date (settlement date = contract date + 2D + period). The settlement date is pre-filled after selecting the contract date and period, but you can also calculate the settlement date with a question mark (?), when the system calculates the settlement date again with the below logic. The settlement date is calculated based on the contract date and the period (when the period is something else than 2D) through:

First calculating a spot date from the contract date (by adding 2 business days to the contract date, by default considering weekends in Saturday/Sunday holiday calendar, or if the involves currency/currencies have already been filled in, the combined holiday calendars linked to the selected currencies), and

Then adding the chosen period (e.g. 1W, 1M, etc.) to the calculated spot date.

In case the resulting date is a holiday (based on weekends in Saturday/Sunday holiday calendar, or if the involves currency/currencies have already been filled in, the combined holiday calendars linked to the selected currencies), then the next available business day is used as the settlement date.

Example: The contract date is Thursday 2019-03-07 with 1W period. The system first calculates the spot date, which is two business days after 2019-03-07. There is a weekend in between, so the spot date is Monday 2019-03-11. To get the settlement date the system then adds 1 week to the spot date, resulting in Monday 2019-03-18.

- Transaction date

Date when the cashflow transactions occur. This field behaves differently (from FA 3.10 onward) depending on whether you have configured your contracts to create "Forward cashflow" securities based on the transaction date or settlement date of the leg in Preference - Contracts:

With Create "Forward cashflow" securities based on the transaction date of the leg. The transaction date is pre-filled after setting the settlement date, and calculated by subtracting 2 business days from the settlement date (transaction date = settlement date - 2D). By default, the calculation considers weekends in Saturday/Sunday holiday calendar, or if the involved currency/currencies have already been filled in, the combined holiday calendars linked to the selected currencies (i.e. if EUR and USD are using a different holiday calendar, a day is considered a holiday if it is a holiday in either of the involve currencies' holiday calendar). You can also calculate the transaction date with a question mark (?), when the system calculates the transaction date again with the above logic (especially useful if you change the involved currencies and want to make sure afterwards the transaction date is still correct with their linked holiday calendars).

With Create "Forward cashflow" securities based on the settlement date of the leg. The transaction date is filled after setting the settlement date, and the transaction date always equals to the settlement date. This ensures your forward cashflow positions stay open in your portfolio up until the settlement date (which is also the date the forward cashflow positions are discounted to). Transaction date is greyed out, and you cannot modify it. (Available from FA 3.10 onward - prior to this, the logic described first is used regardless of the selection in preferences)

- Buy / Sell

Allows you to select the direction of the first cashflow, i.e. whether the currency and amount you enter on the same row next to the field are "buy" or "sell".

- Currency

Select the currency of the first cashflow, i.e. the currency you are buying / selling.

- Amount

Define how much of the selected currency you are buying / selling.

- FX rate (currency cross)

Define the forward FX rate, i.e. the price you agreed to do the exchange between the two currencies you selected. The FX rate is used to convert the amount you have entered on the upper row to the amount on the lower row. The caption of the field indicates the currency cross you should fill in, and you can also fetch the FX rate with a question mark (?), when the system fetches the latest available price for the contract date from the currency cross.

- Sell / Buy

Pre-filled to be opposite to the buy / sell selection you made above. Determines the direction of the second cashflow, i.e. whether the currency and amount you enter on the same row next to the field are "buy" or "sell". If you change this selection, the above buy / sell selection is changed accordingly.

- Currency

Select the currency of the second cashflow, i.e. the currency you are buying / selling.

- Amount

Define how much of the selected currency you are buying / selling. This amount is pre-filled based on the amount you entered on the upper row and the FX rate you defined. If you update this amount, the system automatically calculates the FX rate to ensure all calculations match.

Accounts section allows you to define the accounts affected on the forward date, i.e. which accounts the buy and sell cashflows are directed to.

- Account (Currency)

Select the account you want to direct the cashflow in the selected currency to. The account selections always correspond to the cashflow you have defined on the same row on the left, and the caption of the account field indicates which currency cashflow you should select the account for. The dropdown lists accounts in the selected currency within your selected portfolio, and the account filed is pre-filled if your selected portfolio only has one account in the selected currency.

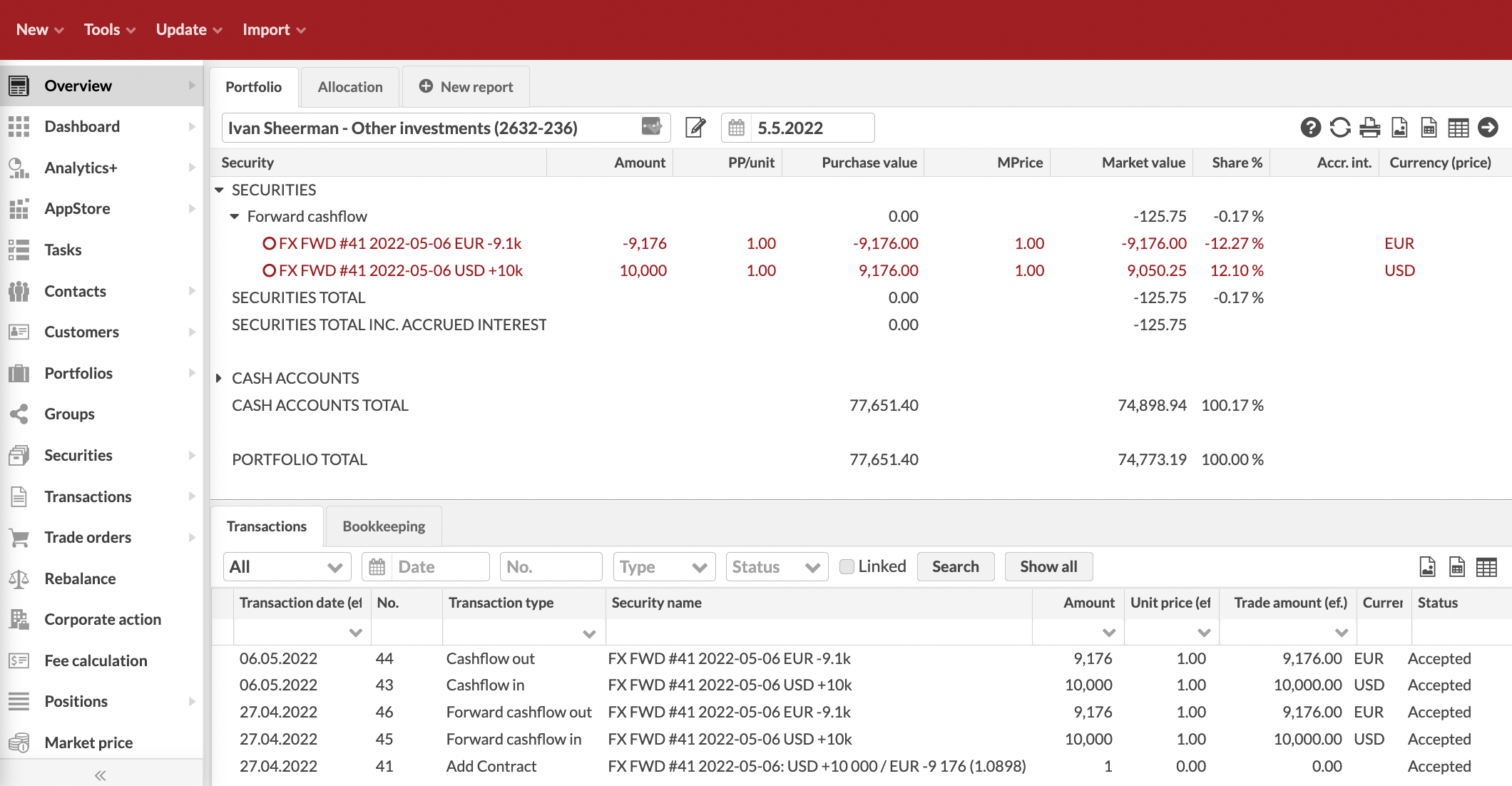

Security, forward cashflows and cashflows for FX Forwards

When saving an FX Forward, the system creates a contract security, produces forward cashflow positions into your portfolio between the contract date and the end of the contract, and generates relevant cashflow transaction for the end of the contract.

Component | FX Forward specific details |

|---|---|

Contract security | Naming of the FX Forward security: Syntax: FX FWD #[security external ID] [date yyyy-MM-dd]: [first cashflow's Currency] [+ for Buy / - for Sell] [first cashflow's Amount] / [second cashflow's Currency] [+ for Buy / - for Sell] [second cashflow's Amount] ([FX rate]) The date used in the contract name depends on your selection in contract preferences - date is set either based on the contract date (=transaction date) or settlement date of your FX Forward (available from FA 3.7 onward). Example: FX FWD #36 2019-06-04: USD +10000.00 / EUR -8901.55 (1.1234) |

FX Forward induces two forward cashflows, one for "buy" and one for "sell". The forward cashflow positions are open within your portfolio from the contract date until the transaction date, when the cashflows take effect at the end of the contract. Forward cashflows are opened with forward cashflow transactions. Each forward cashflow transaction is created based on the information you defined on the same row in within the FX Forward fields. Forward cashflow transactions are created with the following information (see Forward cashflows for more information):

| |

FX Forward induces two cashflow transactions at the end of the contract, one for "buy" and one for "sell". Each cashflow transaction is created based on the information you defined on the same row within the FX Forward fields. Cashflow transactions are created with the following information (see cashflows for more information):

|