Analyze and monitor portfolios' drift

Overview

In FA, you can analyze and monitor portfolios' drift against its:

Investment plan,

Model portfolio or

Strategy.

There are two tools available for the purpose. Drift tracker can be used to visually analyze the drift on an ad-hoc basis. Drift monitor can be used to tag drifted portfolios and send emails about the drifts, either manually or automatically via scheduling. For more inofrmation, see the Scheduling processessection in the FA Admin guide.

Use Drift tracker to analyze drift

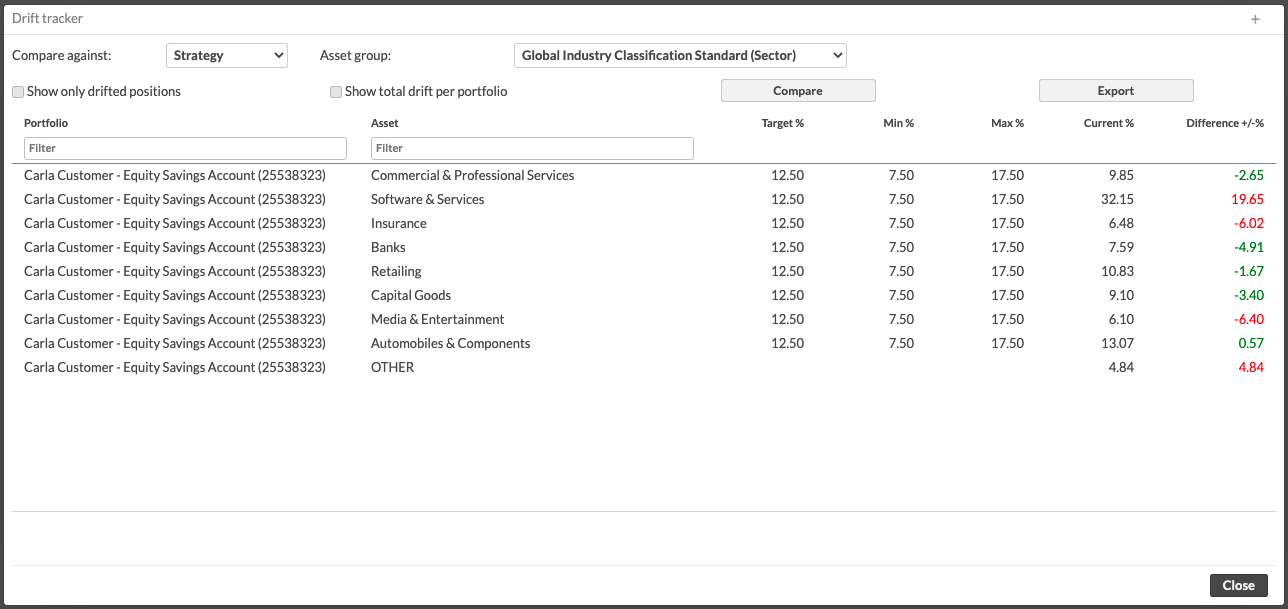

Drift Tracker shows the difference between contents of a portfolio and its investment plan, model portfolio or strategy.

Set an investment plan, model portfolio and/or strategy to the portfolios you want to analyze.

Go to Portfolios view and select the portfolio(s) you want to analyze. Open the Drift tracker vai Compliance → Drift tracker.

Select which you want to compare against (investment plan, model portfolio or strategy).

If you selected Strategy, select also the asset group to compare against. Otherwise, specify the limit (in percentage points) after which a position is considered drifted

|

Using Drift Monitoring to tag drifted portfolios and send emails

In addition to analyzing portfolio drift with Drift Tracker, you can also tag drifted portfolios using Drift Monitor. Drift Monitor can also be used to send emails about drifts.

First, configure the drift monitoring by going to Tools → Administer → Compliance settings. In the configuration window, on the tab Drift Monitoring, input the appropriate configurations:

Email address where notifications about drifts are sent (leave empty to not send email). The email contains the drifted positions in a CSV file.

Error threshold for individual positions / for the portfolio. This is specifiable separately for investment plans, model portfolios, and strategy monitoring. The threshold is the minimum amount of percentage points above or under the target level after which an error for the given position is indicated.

Warning threshold for individual positions / for the portfolio. Same as above, but instead of an error, a warning is indicated when the threshold is exceeded.

Asset group used when analyzing drift against strategy. Only applicable when drift is analyzed against strategy, this configuration determines the asset group which the analysis is based on.

Note

When comparing a portfolio with its strategy, a position is only considered as "drifted" if it is outside both the defined minimum and maximum in the strategy, and the target threshold configured here.

I.e. if your strategies contain the minimum and maximum values for all asset types, and those are the only criteria which should be used, then the error threshold values for Drift against strategy should be set to 0!

Note

The portfolio level drift is calculated as the sum of individual positions' / asset types' drift, divided by two.

The division by two is done because an excess in one position is always reflected as an insufficient position is something else. If we didn't divide by two, a portfolio which contains absolutely nothing would have 200% drift.

After the monitoring has been configured, it can be launched by going to the Portfolios view, selecting appropriate portfolios and clicking Compliance → Monitoring → Drift monitoring → Investment plan / Model portfolio / Strategy.

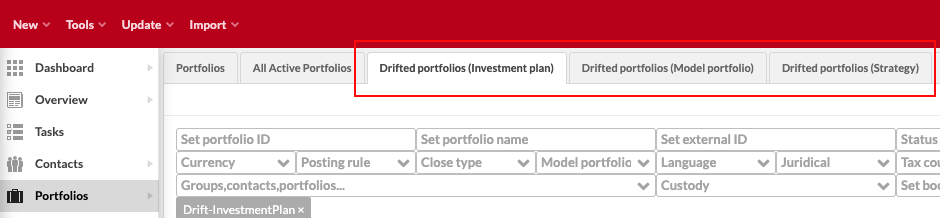

The drifted portfolios are tagged accordingly. You can utilize the pre-saved Portfolio views Drifted portfolios (Investment plan, Model portfolio or Strategy) to search for the drifted portfolios:

|

Note

You can also schedule the drift monitoring to be run automatically. For more inofrmation, see the Scheduling processessection in the FA Admin guide.Refer to the for details.