Create KU reports to Swedish tax authorities

Introduction

FA supports the generation of nine different reports in XML format, that are used to report, for example, income statement for different portfolio types, such as ISK, to the Swedish tax authorities. After providing the background information, you can generate the reports directly in the correct format that the tax authorities expect.

Supported reports

KU20 Income statement for interest income

KU21 Income statement for bonds

KU30 Income statement for investment savings account - standard income

KU31 Income statement for dividends etc for shares and other securities

KU32 Income statement for transfer of shares, bonds and other securities

KU34 Income statement for the transfer/issuance/completion of options (current support is only for reporting option transfers to ISK account)

KU40 Income statement for transfer of shares in investment funds

KU41 Income statement - investment fund - standard income

KU50 Income statement for pension savings

KU53 Income statement regarding indirect insurance

More details about the reports can be found from the tax authority (see Skatteverket).

Getting started

To get started with the reports, you need to define common settings for all reports and also some report-specific data. In this section, we first go through the common data, then the report-specific data.

General configuration

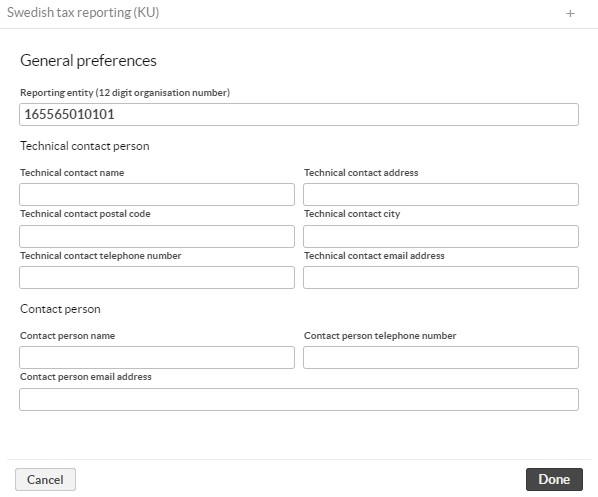

|

Define general configurations for the reporting under Tools → Administer → Tax reporting → Sweden.

Reporting entity (usually your organization number).

Technical contact person's name, address, postal code, city, telephone number and email address.

Contact person's name, telephone number and email address.

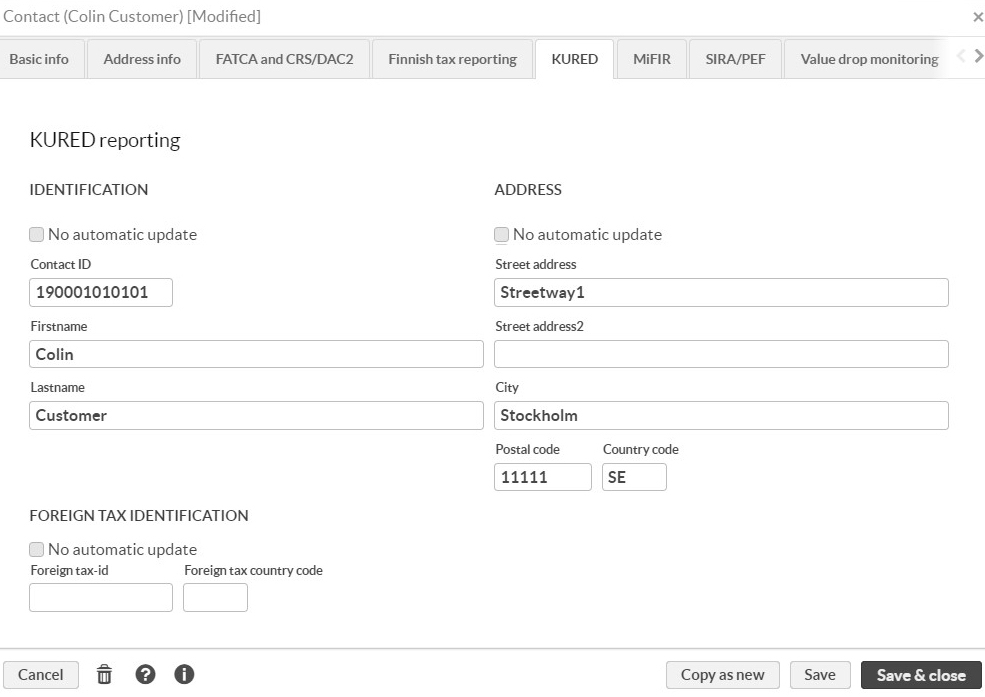

Fill in the tax information in the Contact window (KURED tab) for all contacts that are tax-reportable.

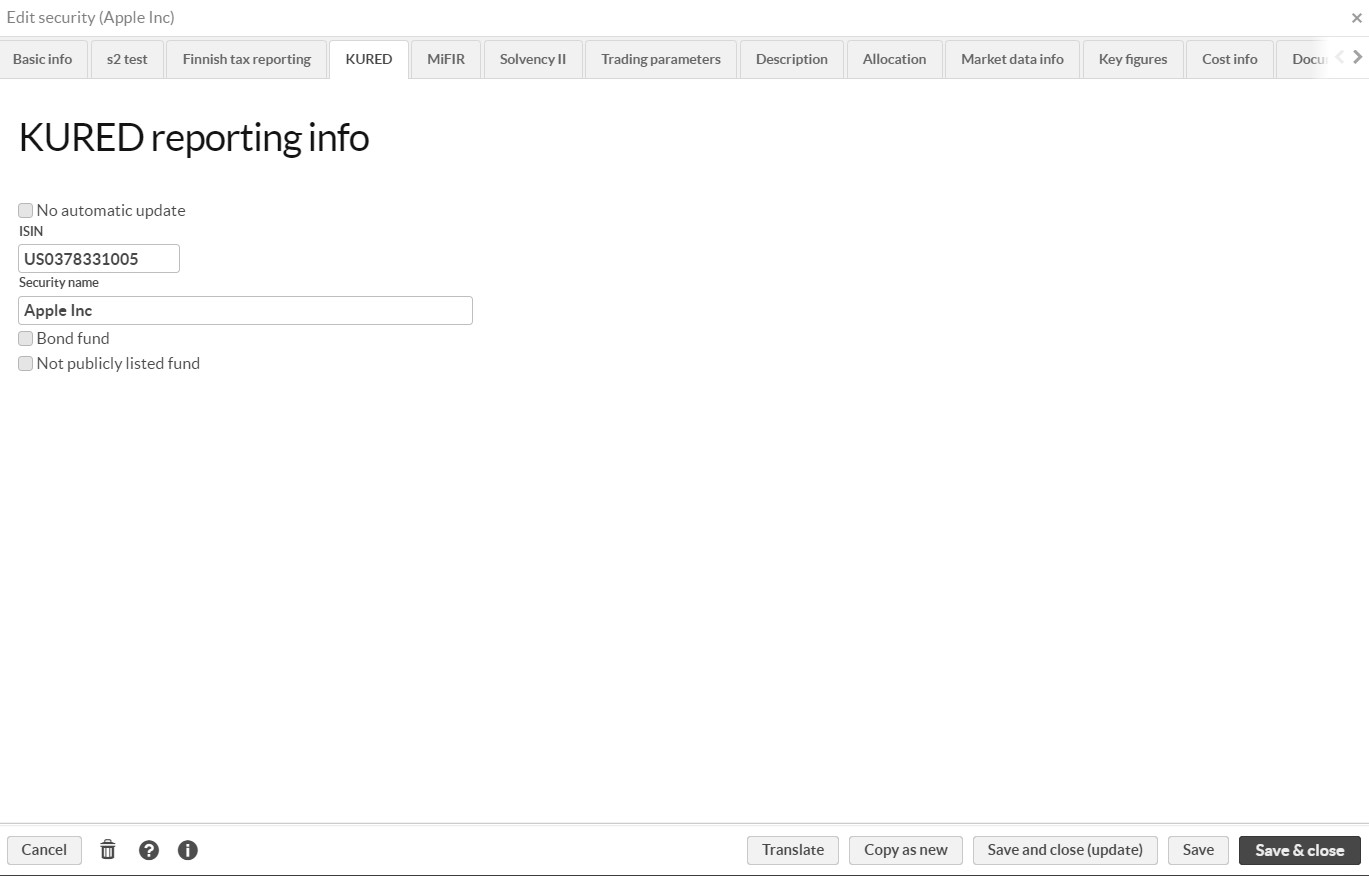

Fill in the tax information in the Security window (KURED tab) for all securities.

Transaction-level exceptions

In some situations, it is necessary to have separate handling for selected transactions. FA supports the following exceptions on the transaction level:

Move to ISK, transfer of assets from non-ISK account to ISK account. Supported in KU21, KU32, KU40.

Exclude, transfer of assets from ISK account to another ISK account. Supported only in KU30.

To mark transactions for this handling, tag them with corresponding tag: KU-Move to ISK or KU-Exclude.

Generating XML reports (for reporting everything except KU31)

Go to the Portfolios view and choose the portfolios to include in the report.

Click Tax reporting → Sweden →KU report. The Reporting parameters window appears.

Enter reporting parameters:

Reporting year. Used in reports as reporting period. Defaults to previous year.

State income rate. State income rate for the year selected above.

Run reporting in test mode (doesn't save results). This option generates files with a TEST prefix, and never updates records of what has been reported for the year into the database. This generation mode is useful for trying out configurations before actually performing the reporting.

Report types. Choose which report types you want to include. These options are saved from the latest run.

Click Continue or Continue (background). With Continue, you need to wait for the report to be generated. With Continue (background), you can continue working, and the report is generated in the background. Once it is ready, you can find it in the Tasks view with the task title "KURED files".

Report generation results

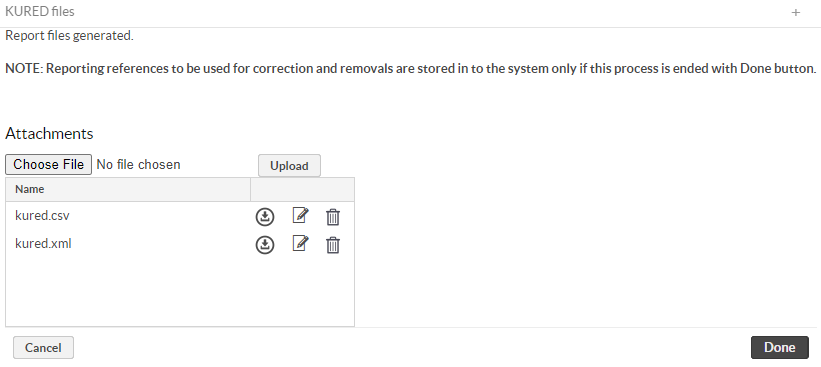

|

The KURED files window shows generated KU files (.xml), and more human-readable versions (.csv). If running in the test mode, the files have a "TEST" prefix.

To complete the process, click one of the buttons:

Done . If running in test mode, the process ends here. Otherwise, the process updates the records of reported items for the selected year and exits. Note that the files aren't automatically sent or saved anywhere apart from audit system logs.

Cancel. Exit without updating the records of reported items regardless of the mode.

Generating XML report for KU31

KU31 is used for reporting dividends that occur throughout the year. Unlike other KU reports, KU31 reports are normally sent to Tax authorities throughout the year. Other reports are generated after the end of the year.

To generate a report:

Navigate to the Transactions view and choose the transactions to include in the report. KU31 reports transactions in non-ISK portfolios, so your transaction search should use a portfolio group that excludes ISK portfolios.

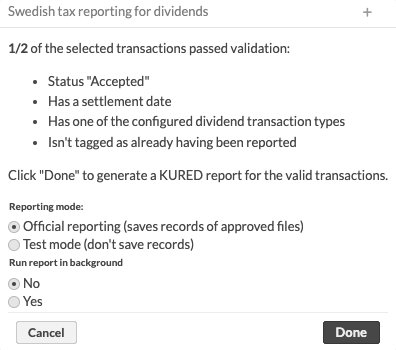

Click Tax reporting → Sweden → KU31 report.

Enter the reporting options. If you choose No under Run report in background, you need to wait for the report to be generated, after which you are automatically presented with the generated reports. If you choose Yes, you can continue working normally and the report is generated in the background. Once it's done, you can find it from the Tasks view with the task title KURED files.

Click Done.

Clicking Done takes you to the next step (see Report generation resultsbelow), from which it is still possible to exit without saving any changes.

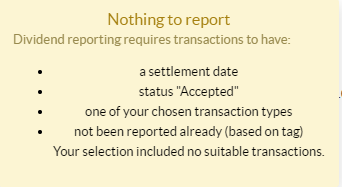

If none of the transactions is suitable, the following notification shows up, and the process terminates:

|

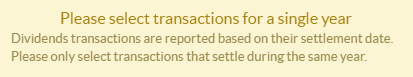

If you select valid dividend transactions that settle on different years, you will get the following notification, after which the process terminates:

|

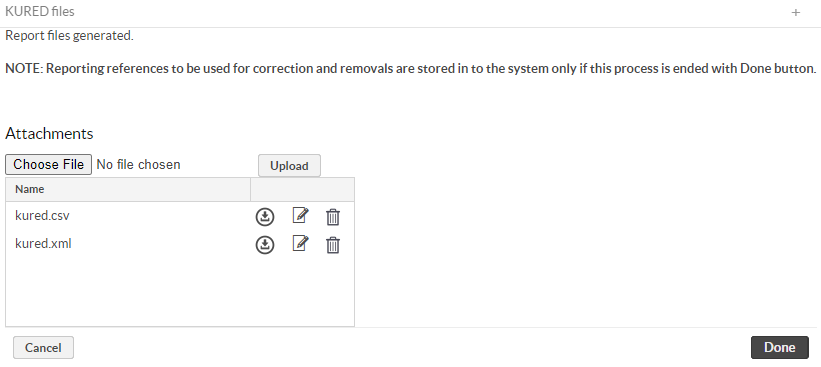

Report generation results

|

This window shows generated KU files (.xml), and more human-readable versions (.csv). If running in test mode, the files have a "TEST" prefix.

To complete the process, click one of the buttons:

Done. If running in test mode, the process ends here. Otherwise, the process updates the records of reported items for the selected year and exits. The valid transactions will be tagged with "KU31 reported dividend".

Note that the files aren't automatically sent or saved anywhere apart from audit system logs.

Cancel. Exit without updating the records of reported items regardless of the mode.