Standard Solution January 2023 - Release notes

Released: January 31st, 2023

Standard solution January 2023 provides you with the possibility to store accrued fees as a key figure, and send trade order updates and confirmation reports to fund distributors, along with other new features.

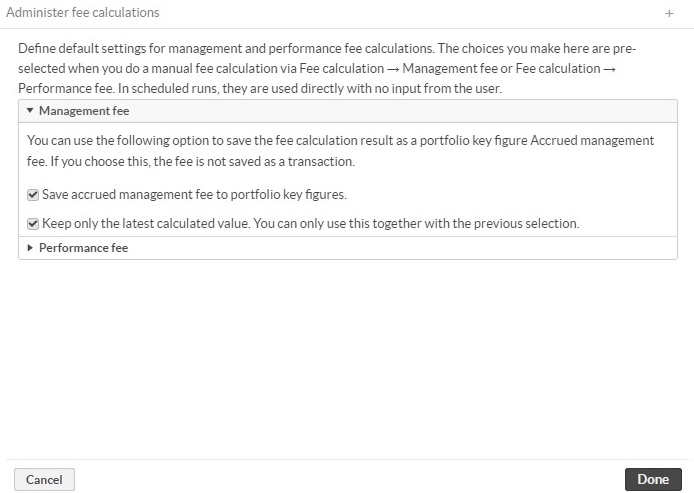

Accrued fees as key figure

Accrued fees have so far been calculated using accrued fee transactions linked to accrued fee accounts. If there is a need to know the accrual on a daily basis, it would result in lots of unnecessary transactions in the portfolio.

To provide a more practical overview of the accrued fees, accrued fees can now be stored in the portfolio key figures. The value can be seen in the Portfolio window, as a column on the Portfolios view, and used in customized reports. With this approach, the changes in already calculated time periods are also considered, because the accrual is always re-calculated daily from the previous capitalized fee.

The standard fee calculation process now has the option to store calculated fees as key figures. If selected, the trade amount(s) of the fee transaction(s) returned is stored as a portfolio key figure with the Accrued_fee transaction type code code, and the transaction is not saved.

|

Learn more: Handle accrued fees and capitalization in FA User Guide.

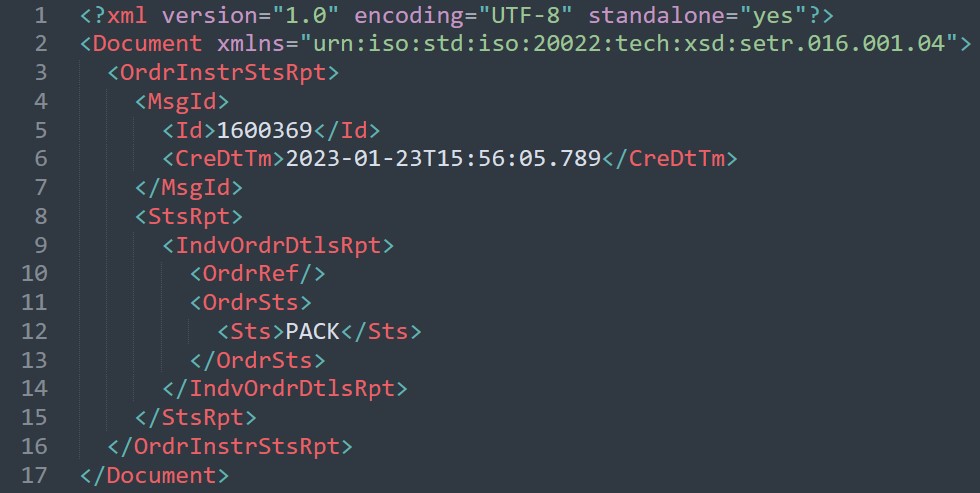

Trade order updates and confirmation reports to fund distributors

In sending trade orders to a trading platform, FA can also process and execute fund trade orders initiated outside of FA. For example, a common use case of the integration would be a fund company that receives new subscriptions and redemptions into their funds, executes orders and sends back confirmations.

When the distributor sends subscription or redemption orders to FA, they expect to receive Status and Confirmation reports back from FA. You can now send sending trade order updates and confirmation reports in ISO 2020022 V4 format back to the distributor.

Orders imported from the distributor are tagged, and you can search for them and generate Status and Confirmation reports to send them back to the distributor. It is also possible to schedule the report sending against different saved trade order views to automate the flow.

|

Learn more: Receive trade orders from fund distributor in FA User Guide.

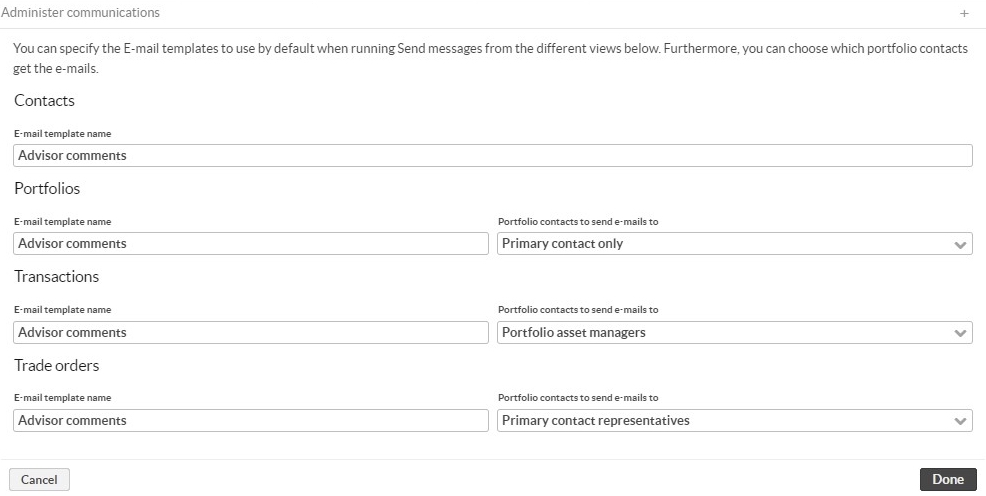

Improved Send message process

The Send message process is used to send email or SMS messages. You can send emails to contacts based on a contact, portfolio, transaction, or trade order search.

The process is now improved, with more options for defining the addressee to send the emails to. You can now select primary contact only, all contacts, portfolio asset managers or primary contact representatives. In addition to that, the process can now also be scheduled to run automatically.

These improvements open up for many different use cases, but for example, it is now possible to automatically send emails to clients' advisers when orders are created. It can be a back office team creating an order, and the advisors should get an email when the order is created to perform 4-eyes check or similar.

|

Learn more: Send and receive emails and SMS messages in FA User Guide.

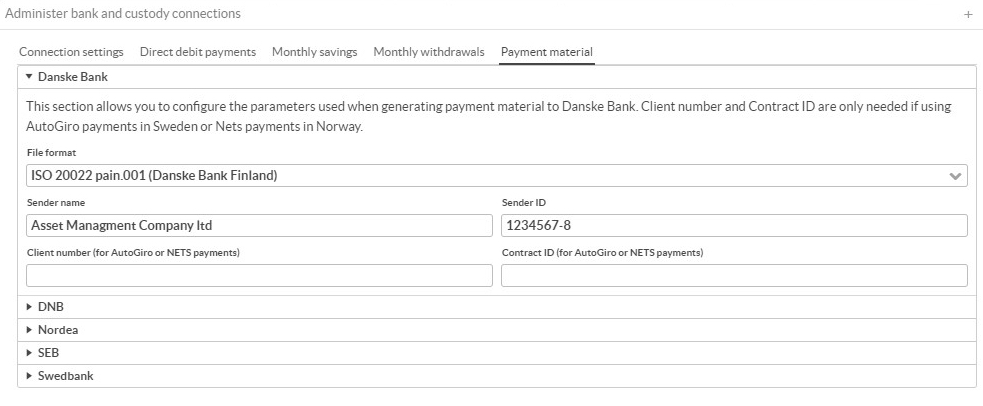

Payment files to multiple banks

In earlier versions of Standard Solution, there was a limitation that made it impossible to create payment files (i.e. pain.001 files) for multiple banks in one environment.

There could be cases where an asset management company uses two or more different banks (i.e. Nordea & SEB) for payments, and this version solves that problem by providing separate configuration fields per bank. This means that the bank details can be defined per bank, and payment material is generated with the needed bank-specific details.

Learn more: Set up payment instructions in FA User Guide.

Improved configurability and usability of settlements

In this version of Standard Solution, we switched to using a new implementation of settlements, which allows greater configurability and usability. In addition, the new implementation enables new features such as batch SWIFT messages, which some custodians require. The new settlement implementation also helps us to support more banks in the future.

The transaction-related information that is needed to generate the settlement messages can be filled manually in transactions, but in many cases, it is easier to use decision tables to fill it in automatically. This version of Standard Solution also provides a sample decision table for that purpose, and our User guide documentation has been improved and clarified.

Learn more: Settlements in FA User Guide.

Other improvements

SEB custody report presents a breakdown of how each NAV was calculated in FA Fund Management, and FA supports generation of custody reports to SEB in a format that SEB has defined. Latest version now also supports to report Bloomberg Identifier. If a security has the key figure Bloomberg Identifier, the identifier is included in the report with the tag BloombergId. This key figure is added to your securities and included in the report automatically, if you create the securities from Bloomberg. Learn more: Custody report for SEB in FA User Guide.

Rebate contracts process now has the option to export the preview of the calculated rebates to xlsx file. Clicking "Export table to Excel" outputs an Excel file containing the contents of the table. Any filters used in the table are taken into account in the export. Learn more: Rebate contracts (kickbacks) in FA User Guide.

Rebate contracts process now saves additional information in the transactions that rebate contracts process generates. Total costs associated during the time period (rebate calculation basis), Final rebate percentage (Calculated rebate / total costs) and Average position value during the time period is saved into the transactions internal info field. This information is helpful when cross-checking the calculations. Learn more: Rebate contracts (kickbacks) in FA User Guide.

Trapets integration used for PEP and sanction list checks has been updated to use Trapets REST API instead of their SOAP API which will be discontinued 2023-06-01.

Nordea has been added as a payment channel so that it is now possible to generate payment material (pain001 files) to Nordea. Automatic transfer of payment file is currently not available for Nordea as they do not offer SFTP connections for sending in payment material.

You can configure how bookkeeping postings and deferral transactions are generated. Changing these settings might be useful in certain cases, but generally, there shouldn't be a need to change them. Learn more: Configure deferrals in FA User Guide.

Signicat signing configuration now supports using client-specific credentials which is needed in some specific cases. For example when Finnish Trust Network (FTN) is used.

Norwegian tax reports (pdf) now show which taxation year the values are for.

Norwegian tax fee report (pdf) is updated to match the new themes set by the Norwegian tax authoritites.

AIFMD reporting to FIVA no longer produces a header file as that is no longer required. The header file requirement was the reason why the report previously had to be run from contact level. When header file requirement is now removed, report is run per fund portfolio or a fund portfolio group instead which is more logical.

Fixes

Tax reporting

Swedish tax reporting (KU40) now uses the correct transaction type for Fund redemptions (RED).

Finnish tax reporting VSAPUUSE role 2, 3 and 4 is now including Value Added Tax if such is recorded to the transactions.

Finnish tax reporting VSAPUUSE now picks up the ISIN-code correctly from security Basic info tab if not defined in tax reporting profile.

Finnish tax reporting VSAPUUSE now only picks up securities that have class 3 or classification defined in Finnish tax reporting profile.

External reporting

Fixed an issue in FATCA nil reporting where FilerCategory was not always picked up correctly.

Version update of FATCA and CRS/DAC2 process no longer erase reporter details for reporter contacts.

FATCA and CRS/DAC2 now use GIIN if given, and if GIIN is not given then TIN is reported.

Fixed an issue in Futur Pension reporting where security price (<rate>) was not expressed in the right way for bond-like securities.

Trade Order Management

Bulk trade order execution is now restricted to bulk portfolio to avoid accidentally executing non-bulk portfolio orders.