Set up a portfolio to be ready for analysis in Strategy analyzer

This tutorial is a step-by-step instruction on setting up a portfolio so that it can be analyzed Strategy analyzer.

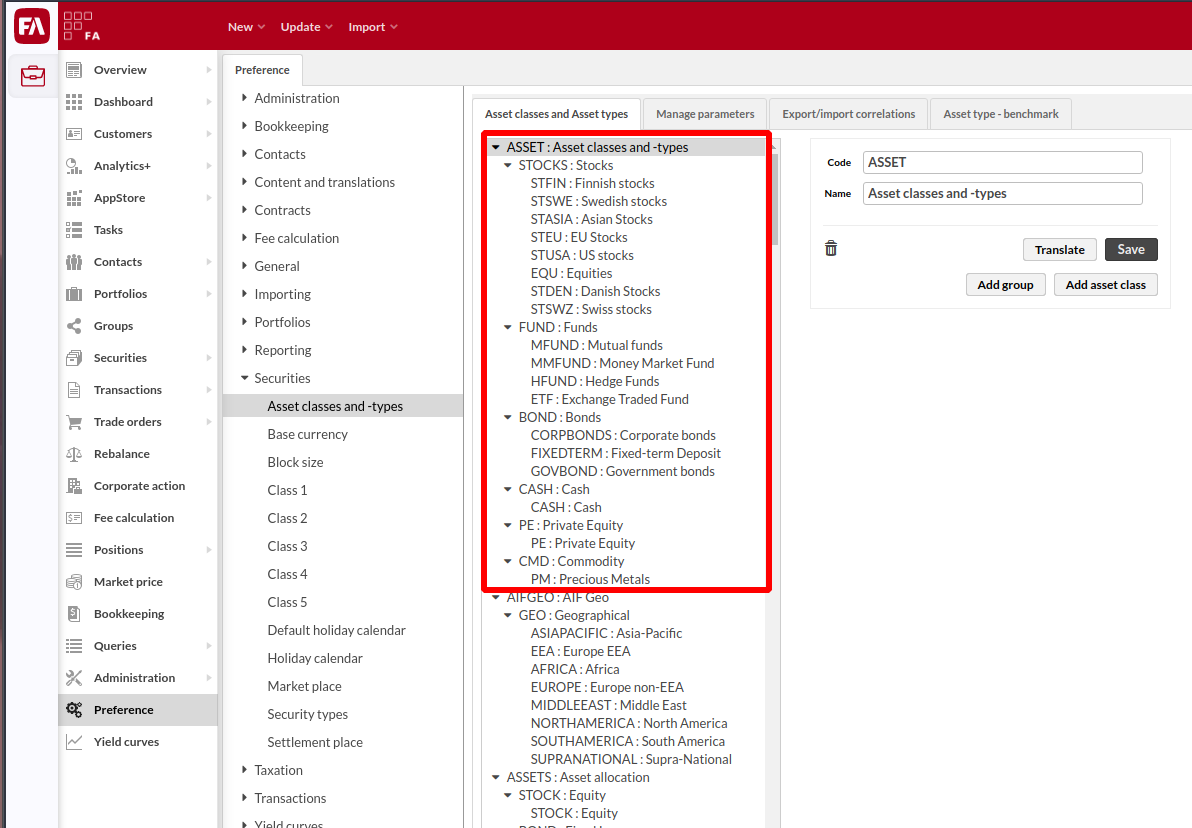

Setting up a group of Asset classes and types to be used in the strategy

Strategy defined for a portfolio is defined using a selected group of asset classes and types. That is defined in the preference section in FA.

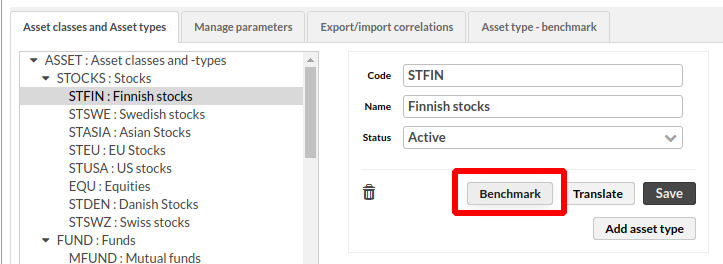

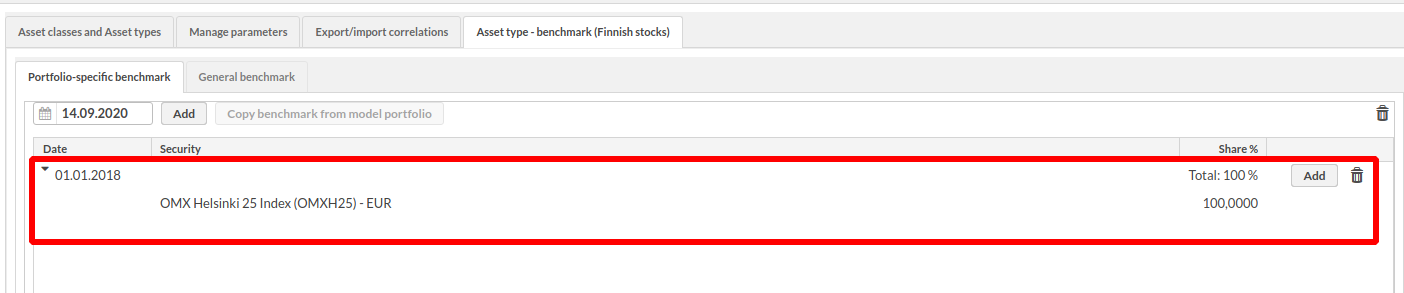

Each asset type within the group needs to be associated with a benchmark.

The benchmark can be be an aggregate and it can also change over a period of time.

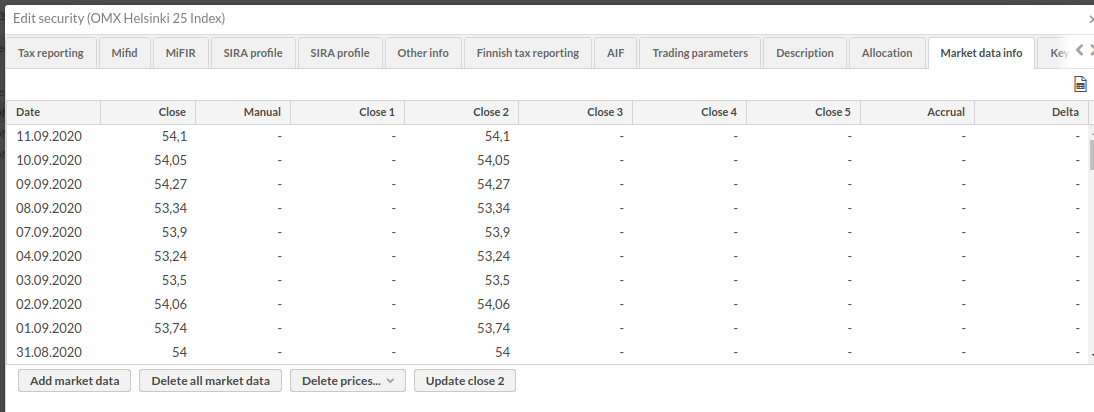

The selected benchmark instrument needs to have a market prices over the analysis period.

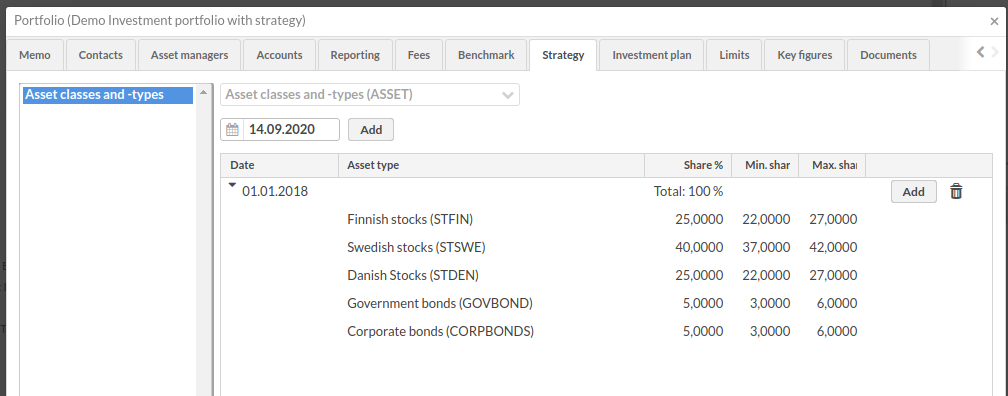

Define strategy for the portfolio

The portfolio to be analyzed needs to have a strategy defined on the group of asset classes and types defined in the previous step.

Define target shares along with minimum and maximum variation range against the asset types in such way, that the total is 100%.

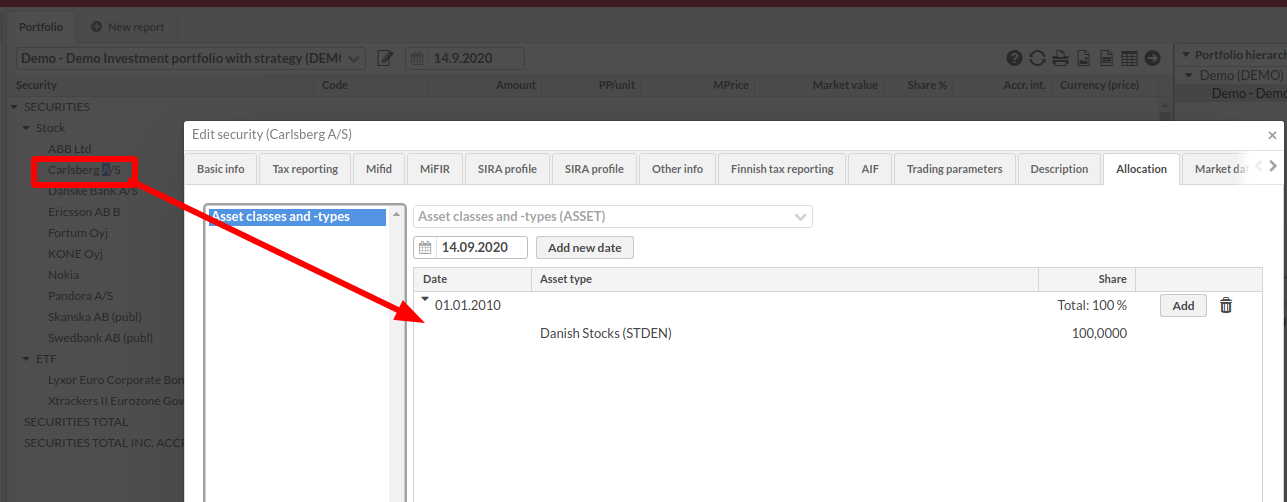

Define allocation against the group in the strategy for each securities in the portfolio

In order for the Strategy Analyzer to be able to analyze the portfolio and compare it against its strategy, each investment in the portfolio (security) needs to be associate with minimum one asset type within the group used in the strategy.