Contract window

Contracts provides you with an easy and efficient way for entering contract-type investments into FA. Saving your contract saves it within your transactions, but also produces a contract security and position in your portfolio, and generates relevant cashflows for the end of the contract.

Contract window allows you to enter a new contract into the system or to view and modify the information of existing contracts. To create a new contract, you can open the Contract window from the New menu at the top or by right-clicking a portfolio on the Overview. To view and modify the information of existing contracts, you can open the Contract window by opening a contract from any of the transaction listings available in FA: in addition to searching for transactions in the Transactions view, transactions are also visible in the transaction listing on the Overview.

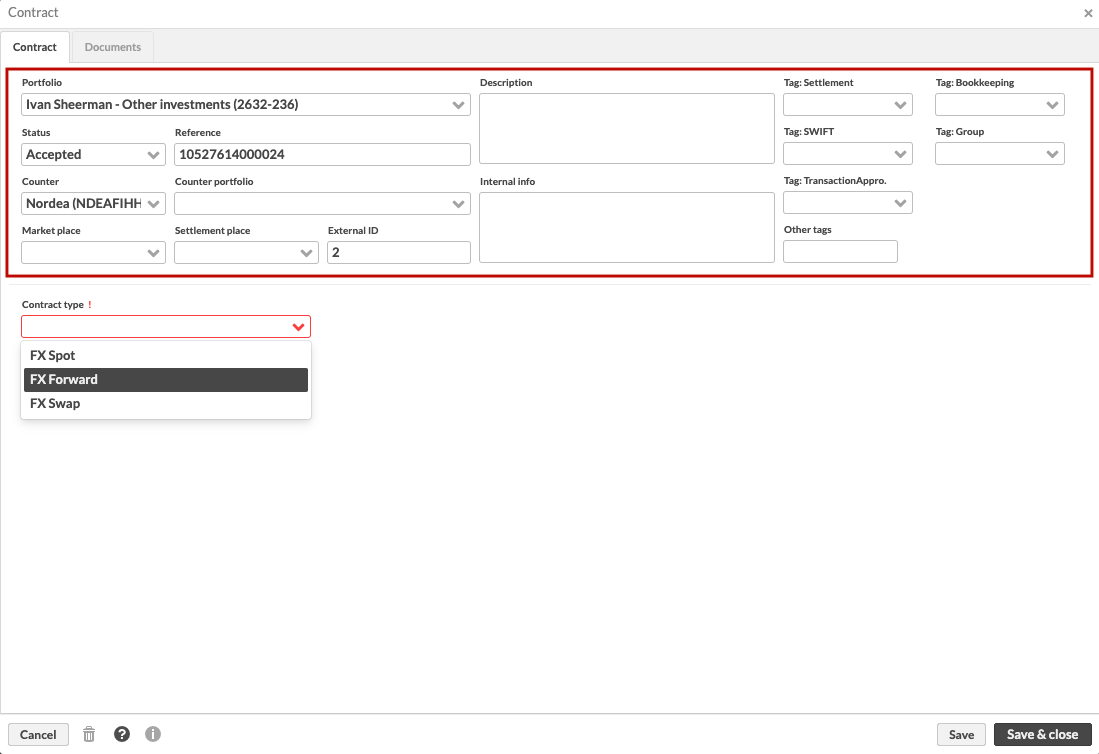

Contract window is divided into Basic contract fields and Contract-specific fields.

Basic contract fields

Basic contract fields at the top above the grey divider allow you to enter information common to all types of contracts - regardless of what kind of a contract you are entering, these fields are always available.

The following fields are available (fields marked with * are required):

- Portfolio*

The portfolio you want to enter the contract to.

- Status*

Status of your contract, either Accepted (default), Not finished or Deleted. The status of your contract determines the status of the forward cashflow and cashflow transactions created based on the contract - all transactions are created with the same status as your contract. Only "accepted" transactions have an effect on your portfolio's positions and market value. Status allows you to record contracts to the system even when you have not accepted them yet, or delete the contract's effect from your portfolio without loosing the track of what kind of transactions were created based on it.

- Reference

Reference of you contract. You can automatically generate the reference number with a question mark (?), when the system generates a reference with the formula portfolio ID * 100 000 + transaction external ID + control number. By default, the portfolio ID is used as a basis of the reference number, but if the portfolio ID is not a number, then portfolio external ID is used. If the portfolio external ID is not a number, then portfolio database ID is used. The control number is calculated based on the formula defined for forming reference numbers.

- Counter, Counter portfolio

The counter and a counter portfolio for your contract. The first dropdown for the counter contact first lists contacts of the type Counter party and Custody in an alphabetical order, and then the rest of the contacts within the system in alphabetical order. The second dropdown for the counter portfolio lists all portfolios within the system in alphabetical order.

- Market place

The marketplace (MIC) of the contract from the alternatives, which are defined in Marketplace preferences.

- Settlement place

The settlement place (BIC) of the contract from the alternatives, which are defined in Settlement place preferences.

- External ID

External ID / number of your contract. When creating a contract, the system automatically generates an external ID for it by determining the next available transaction number - the available number depends on whether you have selected transaction numbering to be handled on the portfolio or contact level within Transaction no. level field in the Contact window. For example, if the largest external ID in your portfolio at the moment is 123, the next transaction would get the external ID of 124. You can also modify the external ID manually or have the system re-generate it with the next available number by typing in a question mark (?). External ID can also include letters and other non-numeric characters - however, these can only be added manually and are not considered by the automatic external ID generation.

- Description on statement

Contract description.

- Internal info

Internal description of the contract visible only internally in the Contract window.

- Tags

Choose tags from the alternatives defined in Tags Preferences under Transaction tags. You can define tags in three different ways:

Grouped tags (select one): you can select one tag from each tag group, grouped in separate dropdowns. Only one tag in each tag group can be chosen. To group tags in a dropdown, defined them with a hyphen as "group - tag".

Grouped tags (select multiple): you can select multiple tags from each tag group, grouped as separate sets of checkboxes. You can check multiple tags within each tag group. To group tags as a set of checkboxes, defined them with a colon as "group : tag".

Individual tags: search for individual tags by typing the tag in the field and choosing the correct tag from the list below the field - all available tags are shown from the downward arrow on the keyboard. You can select multiple individual tags.

Contract-specific fields

Contract-specific fields at the bottom below the grey divider allow you to enter your contract information. The contract-specific fields vary depending on the contract type you select - thus, you need to first select the contract type you want to enter.

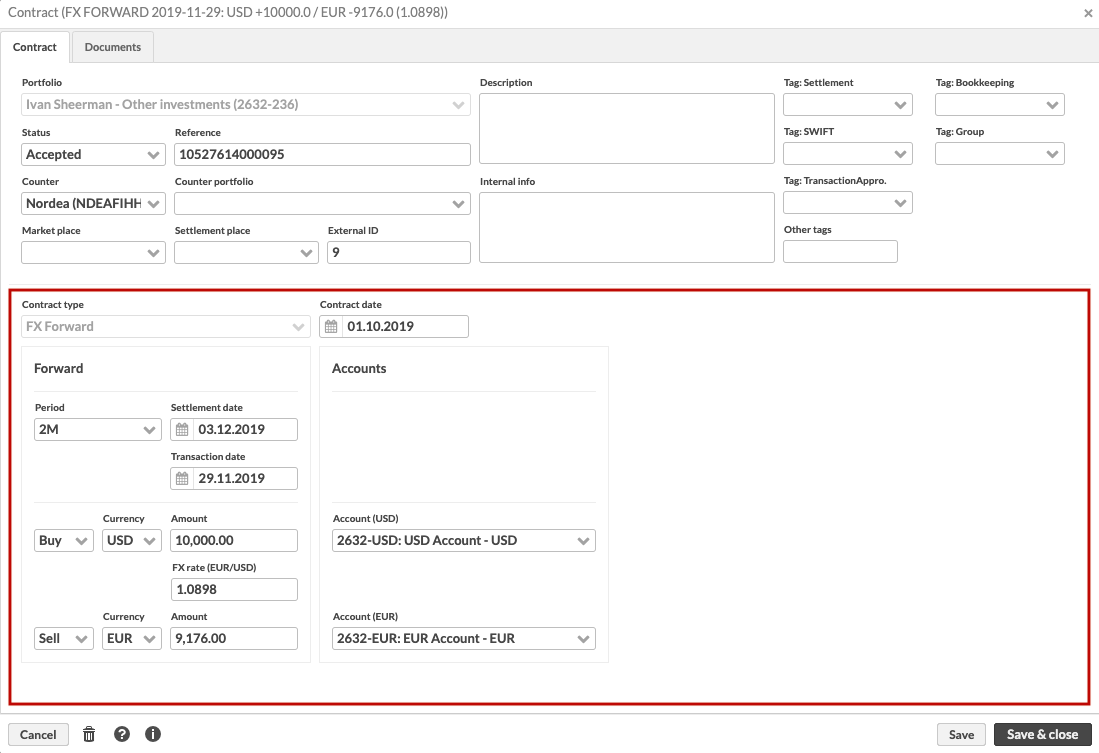

When opening an existing contract, the title of the Contract window shows the summary of your contract with the name of the created contract security.

The following fields are available (fields marked with * are required):

- Contract type*

The contract type that determines what kind of fields you have available, and what kind of information you can enter for you contract. The contract type field shows the available contract types you have configured in Contract type Preferences - if the field is empty, you have not yet configured any contract types for use.

- Forward cashflow and cashflow transactions are created as “Hidden”

If you have configured your forward cashflow and cashflow transactions to be created as "Hidden" in contract preferences, the Contract window will indicate this with a piece of text (available from FA 3.7 onward).

The other contract-specific fields vary depending on the contract type you select. To make entering different types of contracts easier, the window only shows the fields relevant for each contract type - whatever fields are visible are relevant for you to fill in.

Available contract types are:

Follow the links above for more information on the fields available for each type of a contract.

Saving a contract

Contract window allows you to enter all relevant contract information in one screen – the system takes care of the rest when you save your contract. Saving your contract:

Saves it within your transactions and creates a contract security for you to be able to access you contract information later on (see Contract and contract security).

Produces forward cashflows in your portfolio for you to be able to see the discounted present value of the forward cashflows terminating at the end of the contract (see Forward cashflows).

Generates relevant cashflows for the end of the contract to transfer money between the affected currency accounts (see Contract cashflows).

All of the above are handled in the background when you save your contract.

Contract and contract security

When you save a contract, the system automatically saves the contract and creates a contract security in the background. The contract and contract security are used to store the contract information you filled in. In addition, all other items created when saving a contract are linked to the contract itself, allowing the system to keep track of the security, forward cashflow positions and cashflows created based on the contract.

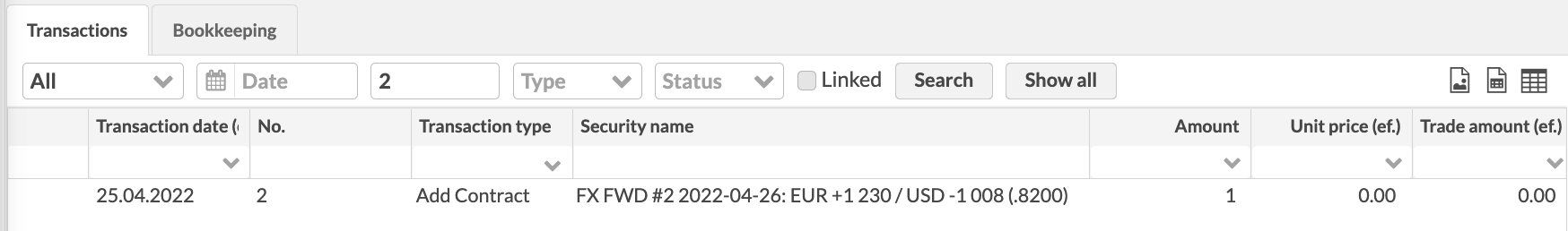

Contract

When you save a contract, the contract itself is saved within your transactions - the contract stores all the contract information you have filled in.

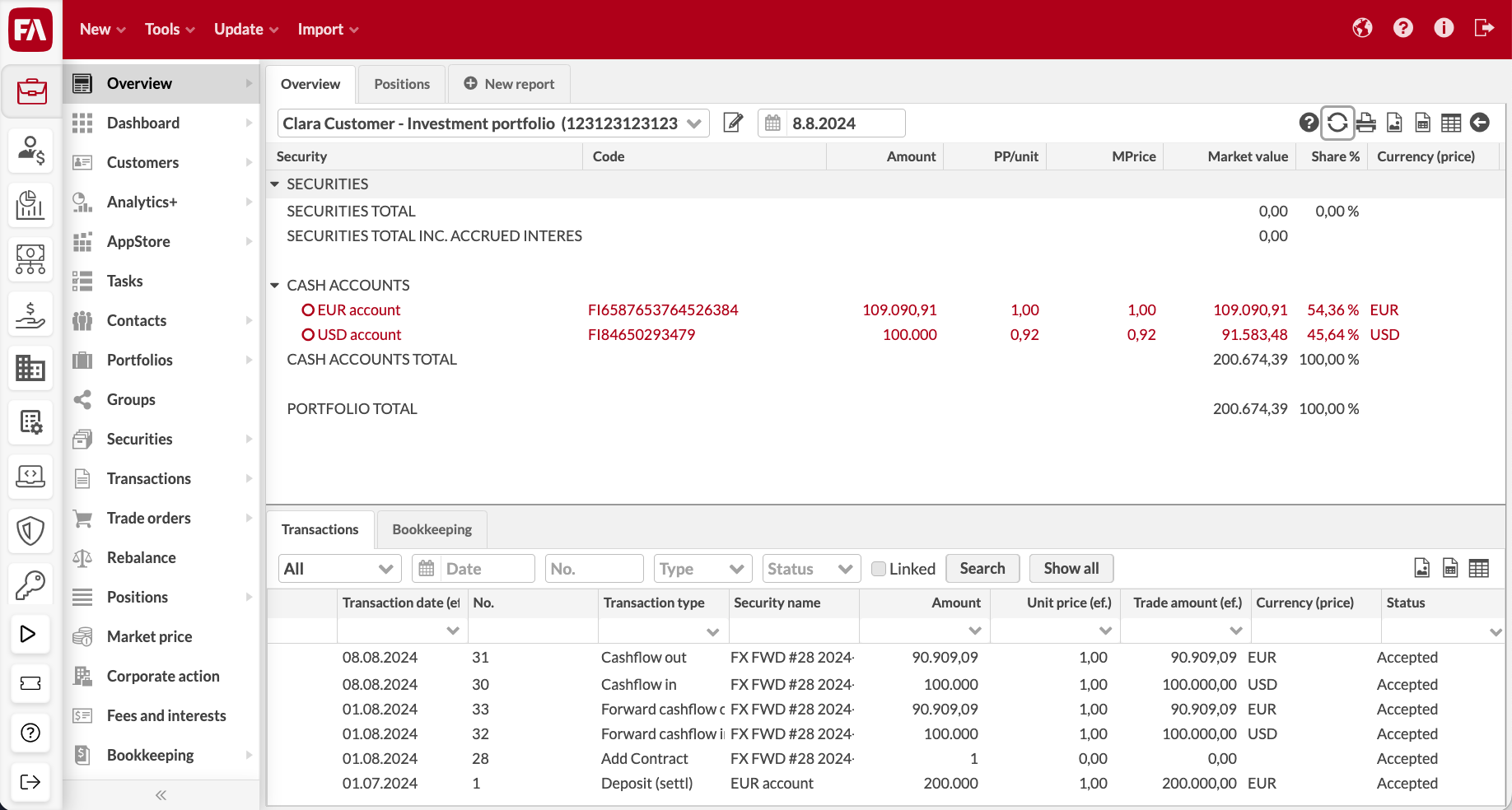

Existing contracts are available within any transaction listing, and you can open existing contracts from the transaction listing on the Overview or Transactions view to view and modify the contract information. The contract information shown in the transaction listing is picked up from the contract preferences and the contract information you filled in the Contract window:

- Transaction date, Settlement date

Transaction date and Settlement date are picked up from the Contract date you defined in the contract details.

- Transaction type

Transaction type is set according to the transaction type you defined in Contract preferences.

- Security

Security is set to be the contract security created while saving the contract.

- Amount

Amount is set to 1, and other numeric values available as columns are shown as 0 - open the contract window to see the details and values related to your contract.

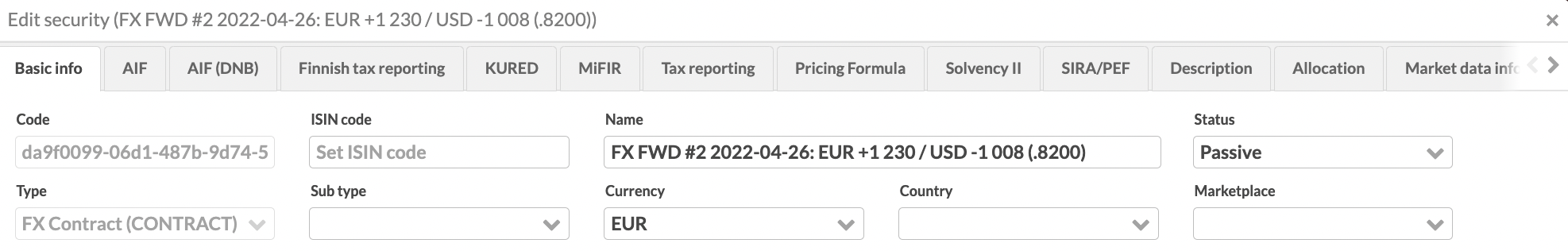

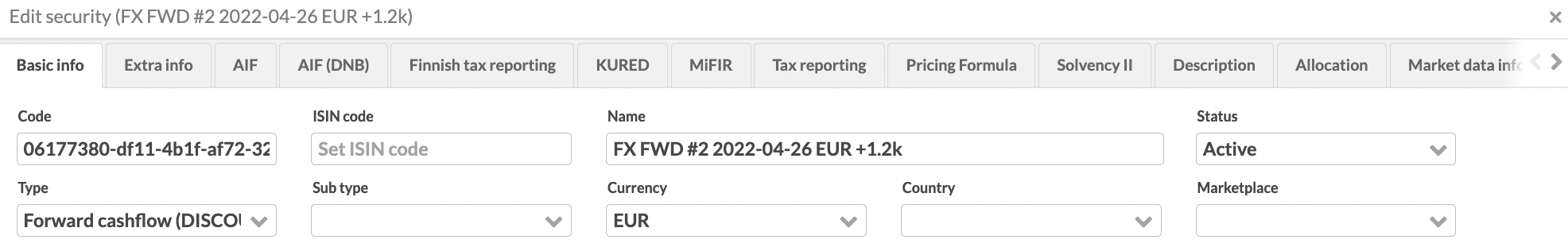

Contract security

When you save a contract, a contract security is created and saved automatically in the background by the system. The contract security is created in order to store certain contract information within the system.

The contract security is saved within your other securities, and you can open existing contract securities from the Securities view. The security information is generated based on the contract preferences and the contract information you filled in the Contract window:

- Code

Code is automatically generated by the system as UUID (universally unique identifier), and you cannot edit the code afterwards.

- Name

Name is automatically generated by the system based on the contract information you filled in. The naming convention varies per each contract type, but the contract name usually indicates the contract type, date, cashflows of your contract, and FX rate (e.g. FX FWD #36 2019-05-02: USD +10000.00 / EUR -8901.55 (1.123)). The "date" used in the contract name depends on your selection in contract preferences - date is set either based on the transaction date or settlement date of your contract (available from FA 3.7 onward). See the documentation for different contract types for more details on the naming convention for each type of a contract.

- Status

Status is set to Passive to ensure that the contract doesn't appear in your security listings unintentionally. You cannot manually create transactions on contract securities, thus the contract securities don't need to appear as active.

- Type

Type is set according to the Security type you defined in contract preferences, and should use the base type CONTRACT. You cannot change the security type afterwards to ensure your don't accidentally change your contract securities to something else than "contracts".

- Currency

Currency is set based on the currency of the portfolio you created your contract into.

Forward cashflows

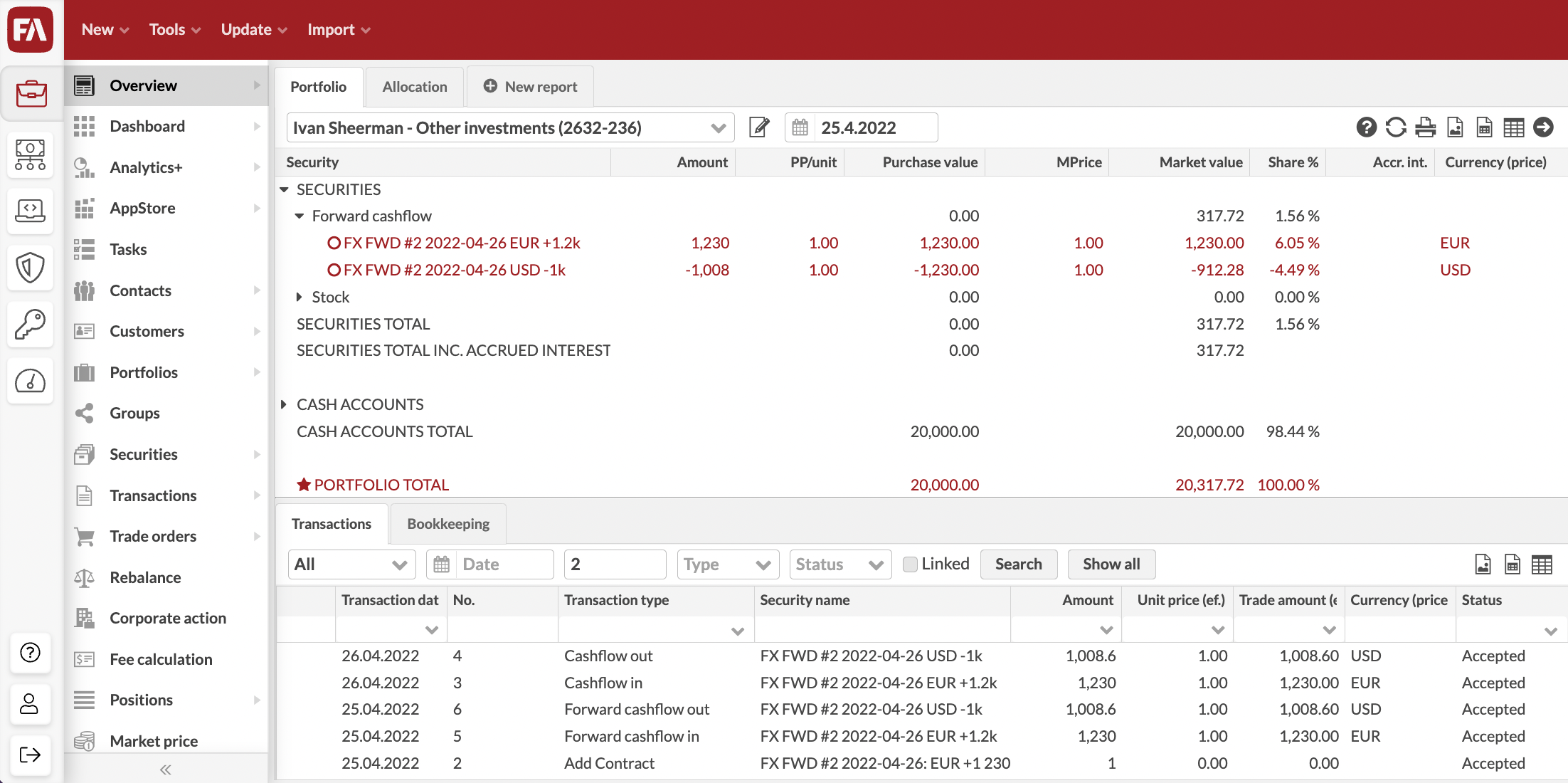

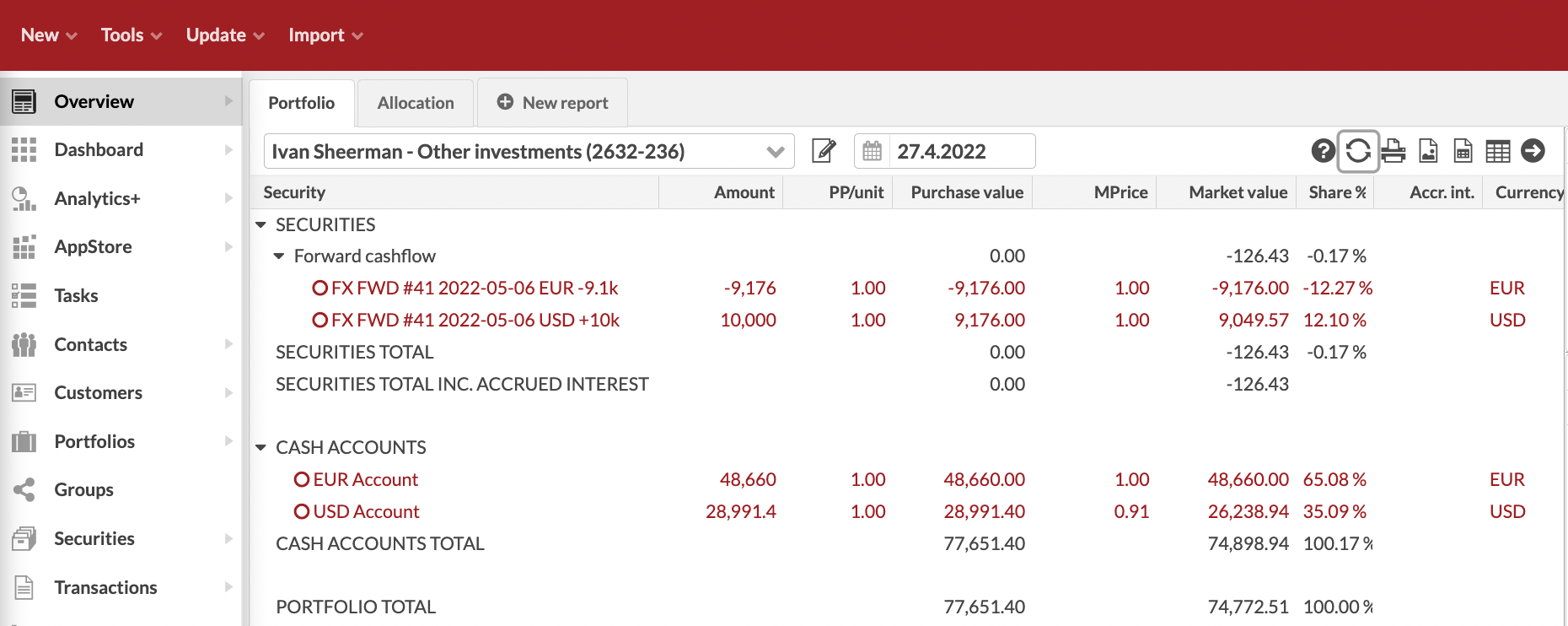

When you save a contract which induces cashflows in the future, forward cashflows are automatically generated in the background for the contract for each involved currency. The idea of contracts is to exchange one cashflow to another at a specified date in the future. Thus, the forward cashflow positions allow you to see the discounted present value of both of the contract cashflows that will happen in the future: you will easily see both the buy and sell cashflows (i.e. both legs of the contract) within your portfolio's positions, their maturity dates, and their current market value (i.e. the discounted present value).

The forward cashflow positions are shown within your portfolio from the time your contract starts (i.e. the contract date) until your contract ends and Forward cashflow transactions are generated for the end of the contract. Forward cashflows are shown for example on the Overview and in different reports. In addition, you can thoroughly analyze your contract investments in Analytics Plus and for example to see your investments' currency exposure when grouping your analysis By currency.

Whether forward cashflow positions are generated varies per contract type:

FX Spot can generate forward cashflows, depending on your system's settings (see Preference - Contracts). Forward cashflow positions are based on the forward cashflow securities that are created at the background when you save the contract.

FX Forward always generates forward cashflows. Forward cashflow positions are based on the forward cashflow securities and transactions that are created at the background when you save the contract.

FX Swap contract is a combination of two contracts (FX Spot + FX Forward), so the forward cashflows are generated based on the logic for FX Spots and FX Forwards accordingly.

Forward cashflow securities

When you save a contract, forward cashflow securities are automatically created in the background by the system. Each forward cashflow security is a combination of a cashflow, currency and a maturity date - forward cashflow securities are contract-specific and created for each leg of a contract (available from FA 3.7 onward).

Prior to FA 3.7, forward cashflow securities are automatically created in the background by the system if corresponding forward cashflow securities cannot already be found. Each forward cashflow security is a combination of a currency and a maturity date - if you have contracts in different portfolios that end on the same date and involve the same currencies (i.e. the maturity date and the currency of the forward cashflow is the same), then the same forward cashflow securities are used.

The forward cashflow security is saved within your other securities, and you can open existing forward cashflow securities from the Securities view. The security information is generated based on the contract preferences and the contract information you filled in the Contract window:

- Code

Code is automatically generated by the system as UUID (universally unique identifier) (available from FA 3.7 onward). Prior to FA 3.7, the code was generated with the currency code of the forward cashflow's currency and the maturity date of the forward cashflow with the syntax CODE-yyyyMMdd (e.g. EUR-20190502).

- Name

Name is automatically generated by the system with contract type, maturity date of the forward cashflow, currency code of the forward cashflow's currency and value of the cashflow with the syntax TYPE #EXTERNAL_ID yyyy-MM-dd CURRENCY +/- cashflow (e.g. FX FWD #34 2019-11-29 EUR -9.1k).

The maturity date used in the forward cashflow name depends on your selection in contract preferences . The date is set either based on the transaction date or settlement date of your contract. (Available from FA 3.7 onward) Prior to FA 3.7, the name was generated with the currency code of the forward cashflow's currency and the maturity date of the forward cashflow with the syntax CODE yyyy-MM-dd (e.g. EUR 2019-05-02).

The cashflow amount is shortened to the number of thousands (K), millions (M), billions (B) or trillions (T). No rounding is applied.

- Status

Status is set to Active.

- Type

Type is set according to the Security type you defined in contract preferences, and should use the base type DISCOUNT for the system to know to valuate the forward cashflow securities automatically.

- Currency

Currency is set based on the currency of the forward cashflow.

- Linked security

Linked security is set as the corresponding contract security. This allows the system to track which forward cashflows are generated based on which contract, and for example to show the contract in the transaction listing on the Overview when clicking a forward cashflow position. You cannot edit your forward cashflows' linked security afterwards. (Available from FA 3.7 onward).

- Maturity date

Maturity date within Extra info is set as the the maturity date of the forward cashflow. The maturity date of the forward cashflow depends on your selection in contract preferences - maturity date is set either as the transaction date or settlement date of your contract (available from FA 3.7 onward). By default, maturity date is set based on the transaction date, or the date when your cashflows occur at the end of the contract. Maturity date is used when calculating the discount factors on the forward cashflows - discount factors are calculated only up until the maturity date, and at the maturity date, the discount factor corresponds with the maturity price.

- Maturity price

Maturity price within Extra info is set to 1. Maturity price is used when calculating the discount factors on the forward cashflows - on the maturity date, the discount factor corresponds with the maturity price.

- Market data info

Market data info contains the daily discount factors in the Close 5 field, calculated for the forward cashflow security from the beginning of the contract (i.e. the contract date) up until the maturity date of the forward cashflow security. The system calculates the discount factors through relevant yield curves defined in the system, and the discount factors are used to valuate the forward cashflow positions in your portfolios.

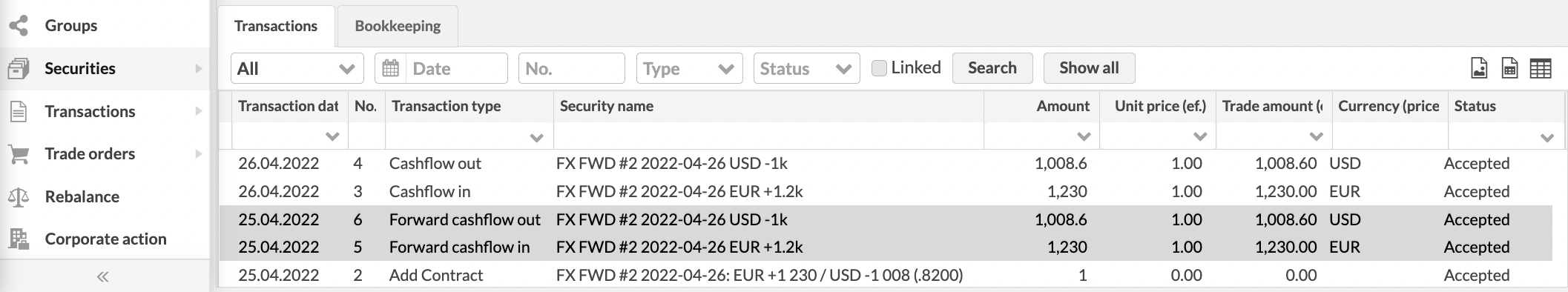

Forward cashflow transactions

When you save a contract, forward cashflow transactions are created for the beginning of the contract, if the contract induces forward cashflows.

The forward cashflows are saved within your transactions, and you can open existing forward cashflows from the transaction listing on the Overview or Transactions view. The number of forward cashflows generated varies per each contract type - for example, spots don't induce forward cashflows at all while forwards induce two forward cashflows.

The forward cashflow transactions are generated based on the contract preferences and the contract information you filled in the Contract window. You always get two forward cashflows at the same time: the forward cashflows are always opposite, i.e. one "buy" and one "sell", and forward cashflows are in different currency involved in the contract.

- Portfolio

Portfolio is set as the portfolio you created your contract into.

- Basetype

Basetype is set as DISCOUNT.

- Security

Security is set as the corresponding forward cashflow security.

- Transaction type

Transaction type is set according to the Transaction type for "Forward cashflow in" / Transaction type for "Forward cashflow out" you defined in contract preferences. A different transaction type is used if the cashflow is "buy" or "sell" - the type of the cashflow is determined based on the contract information you filled in.

- Transaction date

Transaction date is set as the Contract date you defined in contract details. Forward cashflows are visible in your portfolio from the contract date onwards.

- Settlement date

Settlement date is set as the Settlement date you defined in contract details. Forward cashflows are visible in your portfolio from the contract date onwards.

- Status

Status is set to Accepted.

- Total, Trade amount

Total and Trade amount is picked up from the contract information you filled in, often based on the Amount or other value you defined in the contract details.

- Unit price

Unit price is set as 1.

- Account

Account is set as No account - forward cashflows don't have a cash effect when they are created, so they are not linked to an account.

- Report FX date

Report FX rate is picked up from the contract information you filled in. The Report FX rate is set only if a forward cashflow is in another currency than the portfolio currency, and thus requires an FX rate to convert the cashflow into portfolio currency for reporting. Report FX rate is often based on the FX rate you defined in the contract details.

- Hidden

Hidden is checked if you have configured your forward cashflow and cashflow transactions to be created as "Hidden" in contract preferences (available from FA 3.7 onward).

- Counter, Counter portfolio, Market place, Settlement place, Description, Internal info,Tags

Counter, Counter portfolio, Market place, Settlement place, Description, Internal info and Tags are filled in based on the information you filled in on your contract in the basic contract fields. This ensures the transactions generated based on your contracts are categorized consistently, allowing you for example to search and report them. (Available from FA 3.9 onward)

Forward cashflow positions

When you save a contract, the system will recalculate your portfolio's reports to show the forward cashflow positions for both legs of your contract, opened with the forward cashflow transactions.

The forward cashflow positions are open within your portfolio from the start of your contract until the cashflows take effect at the end of your contract. You'll get one positive and one negative forward cashflow position, i.e. one position for you "buy" forward cashflow and one for your "sell" forward cashflow. The Market value of your forward cashflow position tells you the discounted present value of your forward cashflow on the selected date. The system calculates the discounted present value of each forward cashflow through relevant yield curves defined in the system, and uses these discount factors to calculate each day’s market value of your forward cashflow positions.

To keep your forward cashflows up-to-date, the automatic nightly report update valuates all your forward cashflows with new discount factors based on latest yield curve prices. In addition, you can manually revaluate your forward cashflow securities through the Market prices tab in the Security window or Update. For more details, see Valuation of forward cashflows.

Contract cashflows

When you save a contract, contract cashflows for the end of the contract are created and saved automatically in the background by the system. The idea of contracts is to exchange one cashflow to another at a specified date in the future at a price that is fixed on the contract start date. Thus, when the contract is saved, the cashflows for the future are already created and saved into your portfolio. When the future date occurs, the cashflows take place and transfer money between affected accounts, and the forward cashflow positions are closed from the portfolio.

The contract cashflows are saved within your transactions, and you can open existing contract cashflows from the transaction listing on the Overview or Transactions view. The number of cashflow transactions generated varies per each contract type - for example, for spots and forwards, you get two cashflows at the end of the contract, whereas for swaps you get two cashflows in the beginning and two cashflows at the end of the contract.

The cashflow transactions are generated based on the contract preferences and the contract information you filled in the Contract window. You always get two cashflows at the same time: the cashflows are always opposite, i.e. one "buy" and one "sell", and cashflows are in different currency involved in the contract.

- Portfolio

Portfolio is set as the portfolio you created your contract into.

- Basetype

Basetype is set as CASH (for spots) or DISCOUNT (for forwards and swaps). If the contract induces forward cashflows, the cashflows are created with the same basetype as the forward cashflow transactions, otherwise if the contract doesn't induce forward cashflows, the cashflows are generated as cash transactions.

- Security

Security is set as the corresponding forward cashflow security if the contract induces forward cashflows - otherwise no security is set. In addition to transferring money between the affected accounts, the cashflow transactions also close the forward cashflow positions.

- Transaction type

Transaction type is set according to the Transaction type for "Cashflow in" / Transaction type for "Cashflow out" you defined in contract preferences. A different transaction type is used if the cashflow is "buy" or "sell" - the type of the cashflow is determined based on the contract information you filled in.

- Transaction date, Settlement date

Transaction date and Settlement date are picked up from the contract information you filled in, often based on the Transaction date and Settlement date you defined in the contract details.

- Status

Status is set to Accepted.

- Total, Trade amount

Total and Trade amount is picked up from the contract information you filled in, often based on the Amount or other value you defined in the contract details.

- Unit price

Unit price is set as 1.

- Account

Account is picked up from the contract information you filled in, often based on the Account you defined in the contract details for the cashflow.

- Report FX rate

Report FX rate is picked up from the contract information you filled in. The Report FX rate is set only if a cashflow is in another currency than the portfolio currency, and thus requires an FX rate to convert the cashflow into portfolio currency for reporting. Report FX rate is often based on the FX rate you defined in the contract details.

- Hidden

Hidden is checked if you have configured your forward cashflow and cashflow transactions to be created as "Hidden" in contract preferences (available from FA 3.7 onward).

- Counter, Counter portfolio, Market place, Settlement place, Description, Internal info, Tags

Counter, Counter portfolio, Market place, Settlement place, Description, Internal info and Tags are filled in based on the information you filled in on your contract in the basic contract fields. This ensures the transactions generated based on your contracts are categorized consistently, allowing you for example to search and report them. (Available from FA 3.9 onward)

Modifying a contract

In order to modify your contract, open the contract from a transaction listing - similar to entering a contract in one screen, also modifying a contract is possible through the Contract window. When you modify your contract information in the Contract window, the system takes care of updating all your changes in the background once you save your modifications.

When you modify an existing contract through the Contract window, once you save, the system:

Saves your modifications within the contract itself.

Updates your contract security with the changes, including the security name - all additional categorizations or allocations you have added will remain untouched.

Updates your forward cashflow securities according to the changes you made. If the previously used forward cashflow securities are in use in another portfolio, they are left untouched, or if not used, deleted from the system.

Updates your forward cashflow securities Counter, Counter portfolio, Market place, Settlement place, Description on statement and Internal info fields related to transactions.

Updates your forward cashflow transactions according to the changes in the contract. The Counter, Counter portfolio, Market place, Settlement place, Description on statement and Internal info fields are lost.

Recalculates your portfolio's report data to update your forward cashflow positions.

Updates your contract cashflows according to the changes in the contract.

Note

To make changes to the securities or transactions, modify the contract - securities and transactions are updated accordingly.

Deleting a contract

To delete your contract, open the contract from a transaction listing - similar to entering a contract in one screen, also deleting a contract is possible through the Contract window. When you delete your contract from the Contract window, the system takes care of deleting all linked items in the background.

When you delete an existing contract through the Contract window, the system will:

Delete your contract itself.

Delete your contract security.

Delete your forward cashflow securities, if they are not in use in another portfolio. If the forward cashflow securities are in use in another portfolio, they are left untouched.

Delete your forward cashflow transactions.

Delete your contract cashflows transaction.

Recalculate your portfolio's report data to remove your forward cashflow positions and the effect of your contract cashflows.

Note

You can't delete the contract security or forward cashflow securities (since they are linked to transactions) and should not have to delete the forward cashflow or cashflow transactions (since deleting them is not reflected into the contract) - delete the contract instead to ensure everything gets deleted correctly!