Provide credit to your clients

Portfolio credit is a feature that allows you to give credit to your clients using their portfolio holdings as collateral. The credit amount is determined by the collateral value of the portfolio holdings which is in turn summed up from the individual collateral values of securities in the portfolio. The following sections describe the logic behind portfolio credit calculations and guide you through giving portfolio credit to a client.

Portfolio holdings as collateral for credit

The FA Platform calculates the collateral value of the portfolio, but the total amount of credit available to use is decided by you. The collateral value is based on all of the positions in the portfolio and can serve as guidance for your decision on the total amount of credit available to the client.

Portfolio collateral calculation logic

The collateral value of a portfolio position is determined by multiplying the following values:

Market value of the security.

Collateral ratio of the security. Each security in the portfolio must have a defined collateral ratio for portfolio credit to be calculated.

For example, if the collateral ratio of security A is 40% and its market value is 100,000 euros, and the collateral ratio of security B is 10% and its market value is 50,000 euros, the collateral value of the portfolio holdings is calculated as follows:

100,000 * 0,40 + 50,000 * 0,10 = 45,000 euros

Define the credit amount for a portfolio

Add a credit account

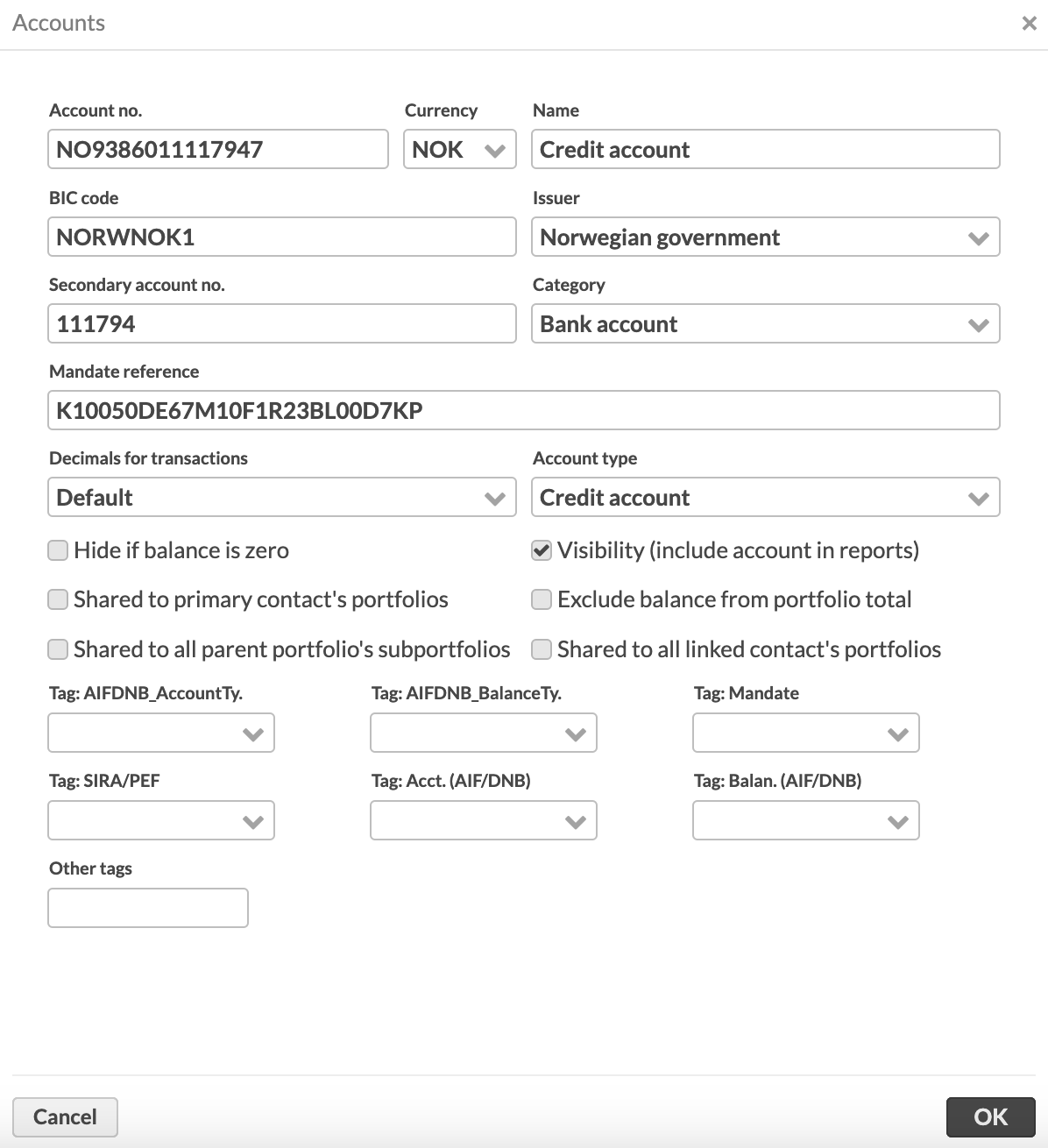

To provide credit, create a credit account linked to the client's portfolio. In Portfolio window, Accounts tab, you can add a credit account:

Click Add account.

Enter the account information in the Accounts window that opens. Select Credit as the Account type. All fields in Portfolio window, Accounts tab are described in detail in Portfolio window.

Click OK to save the changes.

|

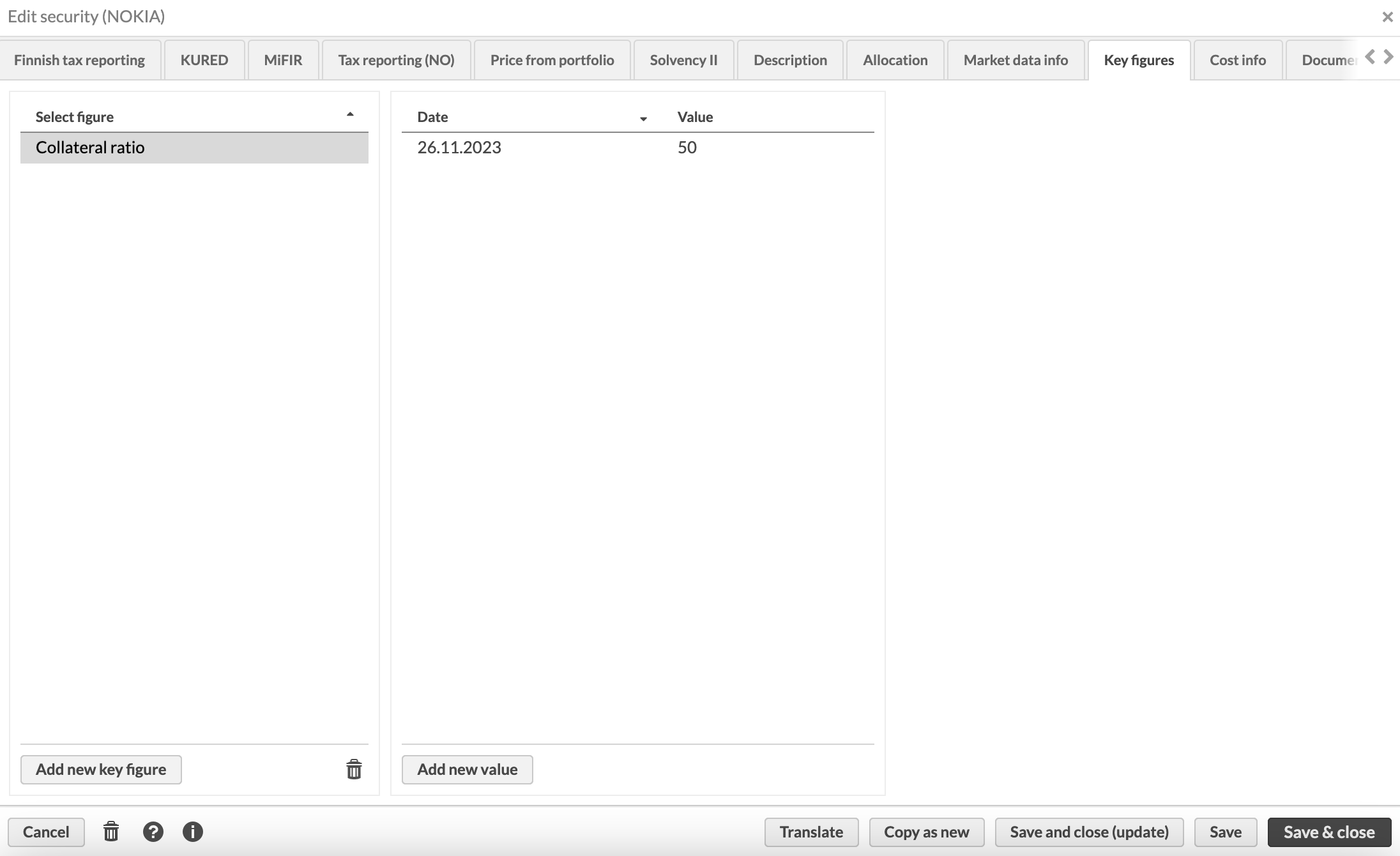

Set collateral ratio for securities

You need to set a collateral ratio per security as a percentage of the security's market value. You can either set the collateral ratio in the Security window or import it in the CSV file. To set the collateral ratio in the Security window, open the Key figures tab:

Select Collateral ratio from the list of key figures on the left or add it as a new key figure by clicking Add new key figure.

Click Add new value.

Enter the collateral ratio as a percentage without the percent sign.

To import the collateral ratio in the CSV file, see Securities and market prices import.

|

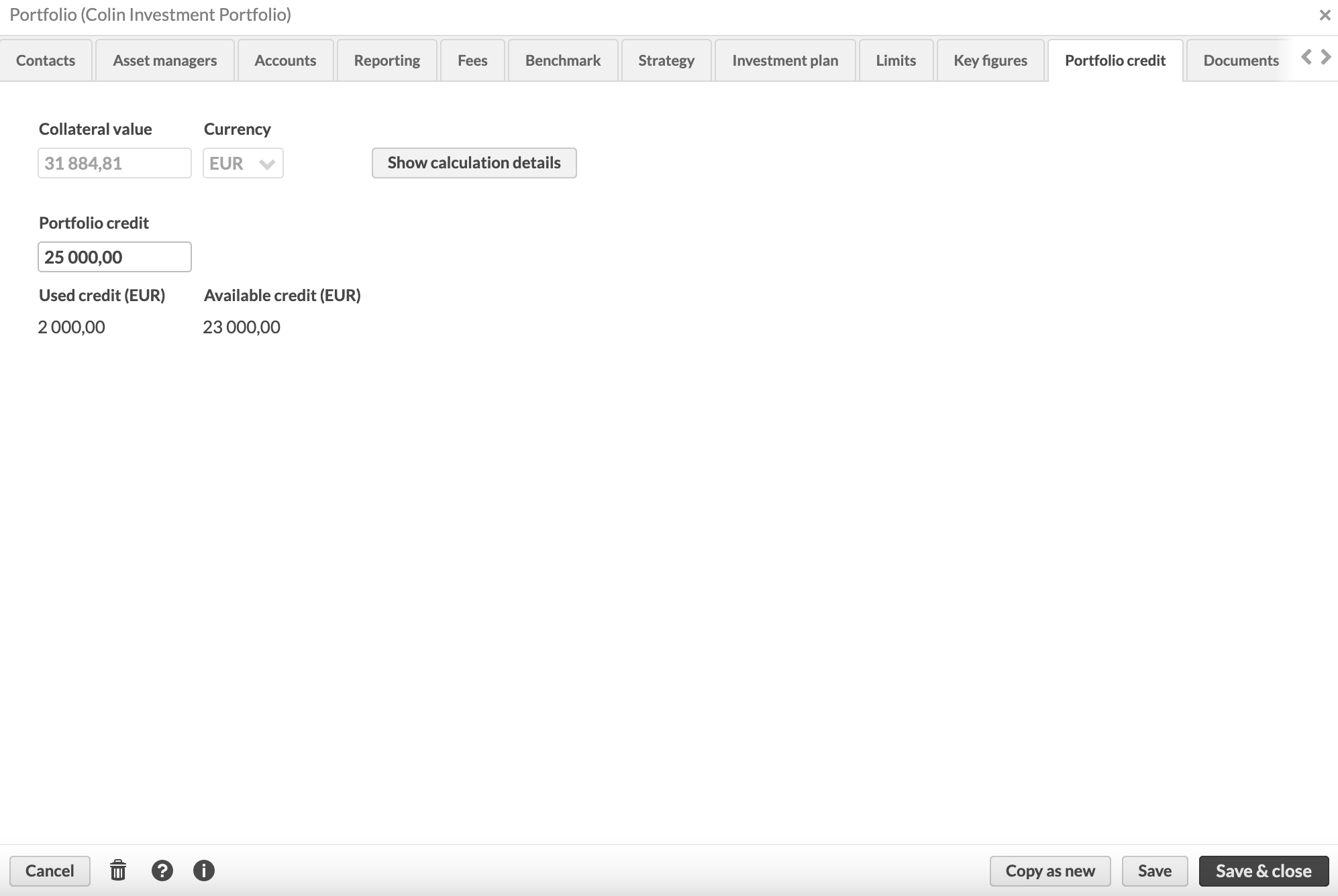

Define portfolio credit

You can view the collateral value for the portfolio that the system has calculated and enter the total amount of credit you want to provide to your client in Portfolio window, Portfolio credit tab.

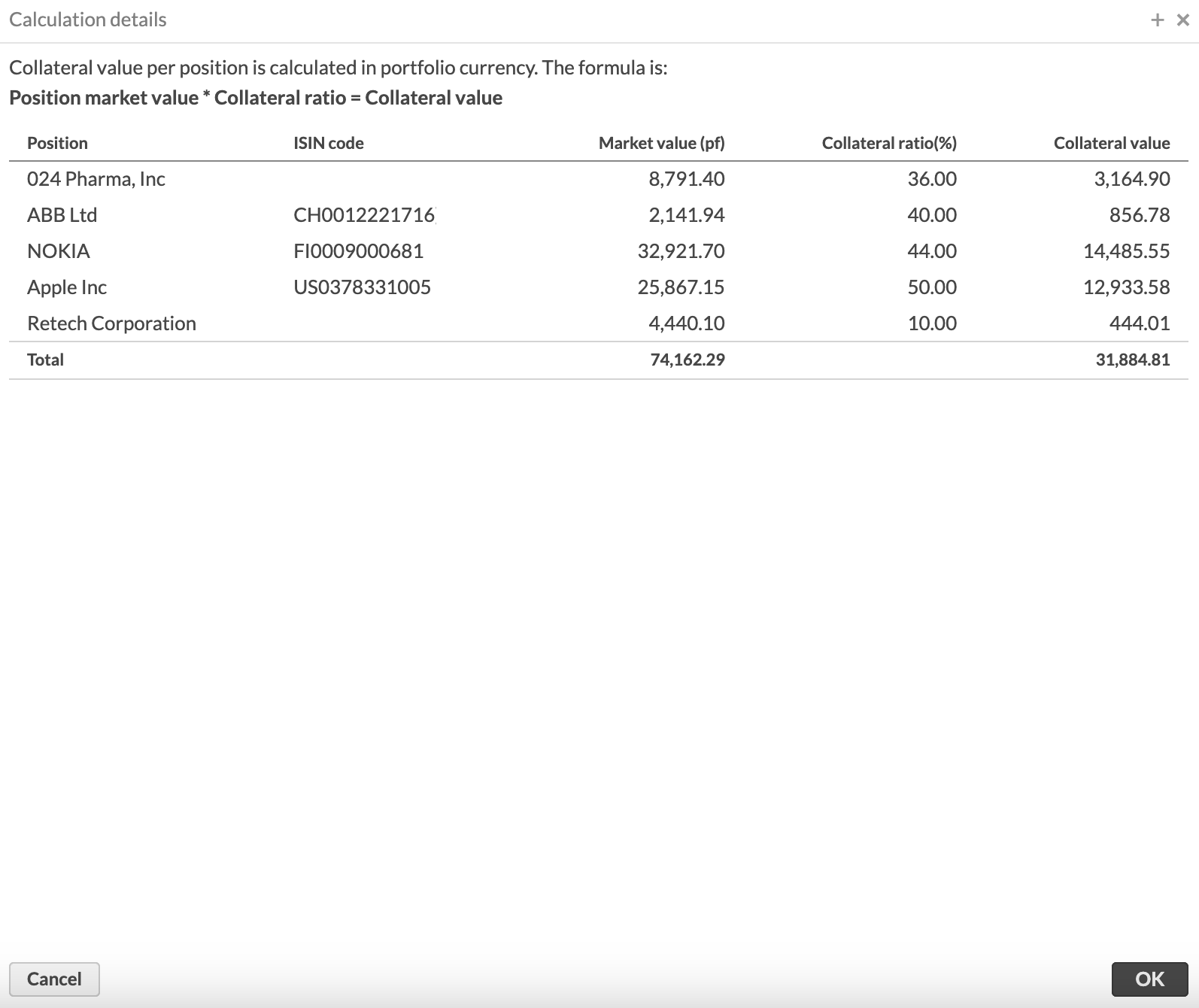

To see how the collateral value is calculated:

Open the Portfolio credit tab in the Portfolio window.

Click the Show calculation details button to open the Calculation details window.

The calculation details show you a table with the market value, collateral ratio, and collateral value of each security, and totals for each column in the bottom row.

|

To define the amount of credit you want to provide and make available to your client:

Enter the total amount of credit you want to assign to the portfolio in the Portfolio credit field. You can base this value on the collateral value for the portfolio.

Click Save to save your changes.

View the updated amount of credit available to your client under Available credit.

|

After you give portfolio credit to your client, you can view the portfolio in Overview and see the credit account.

Calculate account interest to client portfolios

You can calculate interest to accounts for which you provide portfolio credit. Interest is calculated separately for each account. If an account is using portfolio credit, you can calculate negative interest for it. You can also set up thresholds so that the account balance determines the interest rate applied. If no valid thresholds are defined, the market rate of the base instrument is used to calculate account interest.

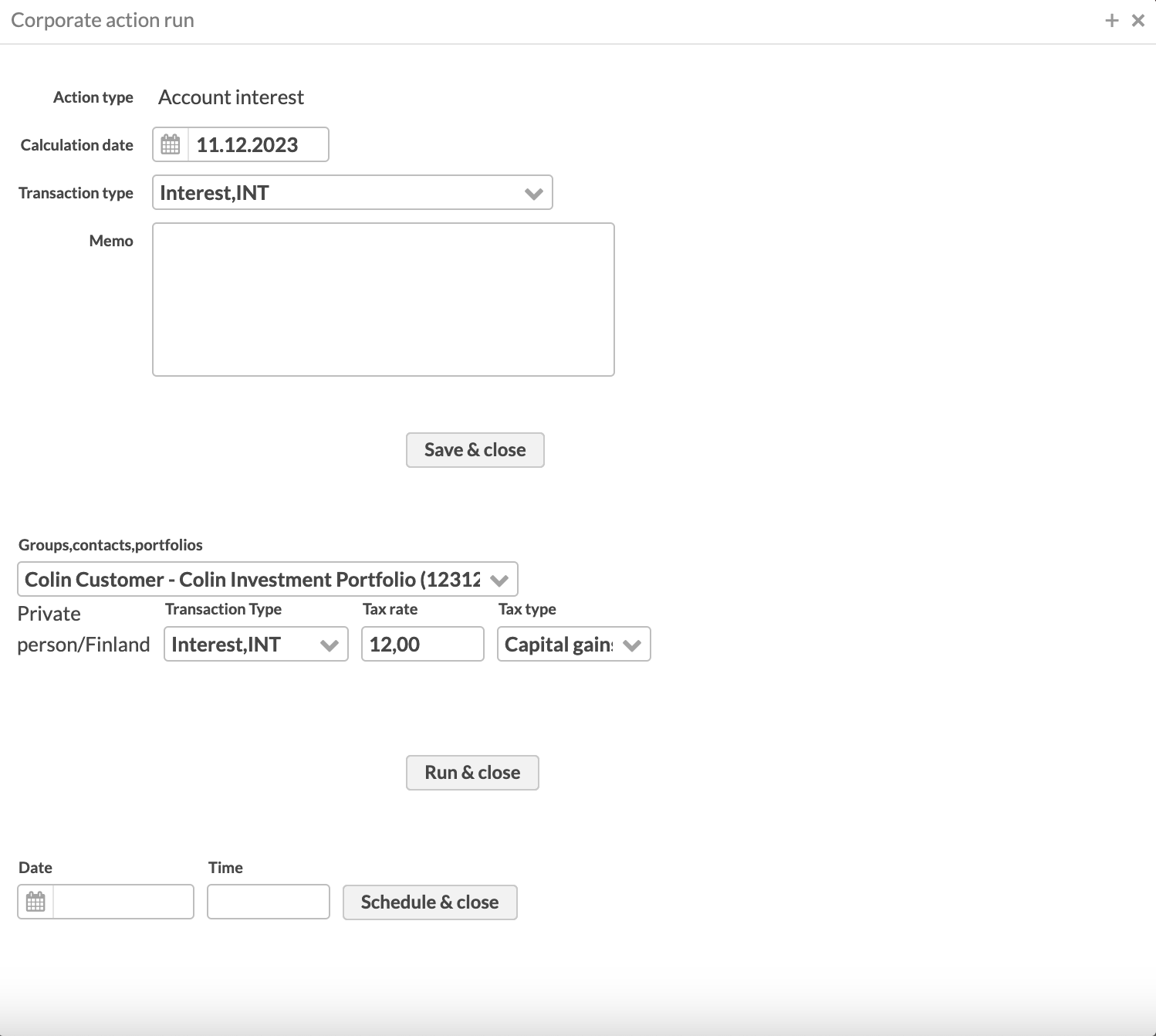

To calculate account interest, you first need to set up interest details for an account in the Portfolio window, Accounts tab. You can then execute the interest calculation in the Fees and interests view or by creating an account interest corporate action through the New menu. For details on how to set up and calculate account interest, see Set up and capitalize accrued interest on account.

|