Fixed and floating rate bonds

To manage fixed or floating rate bonds, define the coupon payment information in the security properties. The system calculates the accrued interest for positions automatically. You can track key bond indicators and handle coupon payouts and expirations with corporate actions.

Create a fixed or floating rate bond

To create a fixed or floating rate bond:

Choose New → New security in the top menu. The Security window opens.

Fill in the necessary fields. The following fields are specific for fixed and floating rate bonds:

Basic info tab:

Set "Bond" type.

Note that bonds are usually valued as a percentage of par. You can make this work in FA system by entering "100" in both Multiplier fields.

Extra info tab: define the coupon payment settings:

Dates and prices at the top.

Coupon information:

For a fixed rate bond, enter the calendar, frequency and coupon rate in the Bond configurations tab.

For a floating rate bond:

Specify the calendar, frequency, base instrument and spread (if applicable) in the Bond configurations tab.

Generate the schedule and the coupon rates in the Fixings tab.

Based on the information you entered, the system calculated the payment schedule to use in the coupon payment corporate action. Also, this information is used to calculate accrued interest for the bond.

For the full list of fields in the Security window, see Security window in FA Back reference.

Mass-update fixings for floating rate bonds

To mass-update fixings for all floating rate bonds:

In the Securities view, apply the filters to show the floating rate bonds you want to update. If you generate fixings regularly, you can create a saved security view that contains all floating rate bonds.

Use the Update security data → Generate fixings option at the bottom of the Securities view.

You can schedule the mass updates to run them, for example, daily. To do this, see Scheduling processes.

Buy and sell fixed and floating rate bonds

To buy or sell a fixed or a floating rate bond, create a buy or sell transaction. Accumulated coupon with accrued interest is bought and sold together with the bond. To include it in the transaction:

Define the transaction date and settlement date.

Type "?" in the Accrued interest field. The paid accrued interest of the purchase is used as the accrued interest of the position until the settlement date of the purchase. Bought accrued interest in the Transaction window is calculated based on the settlement date of the transaction.

As a result, the system calculates the accrued interest amount up to the settlement date and includes it in the transaction's trade amount.

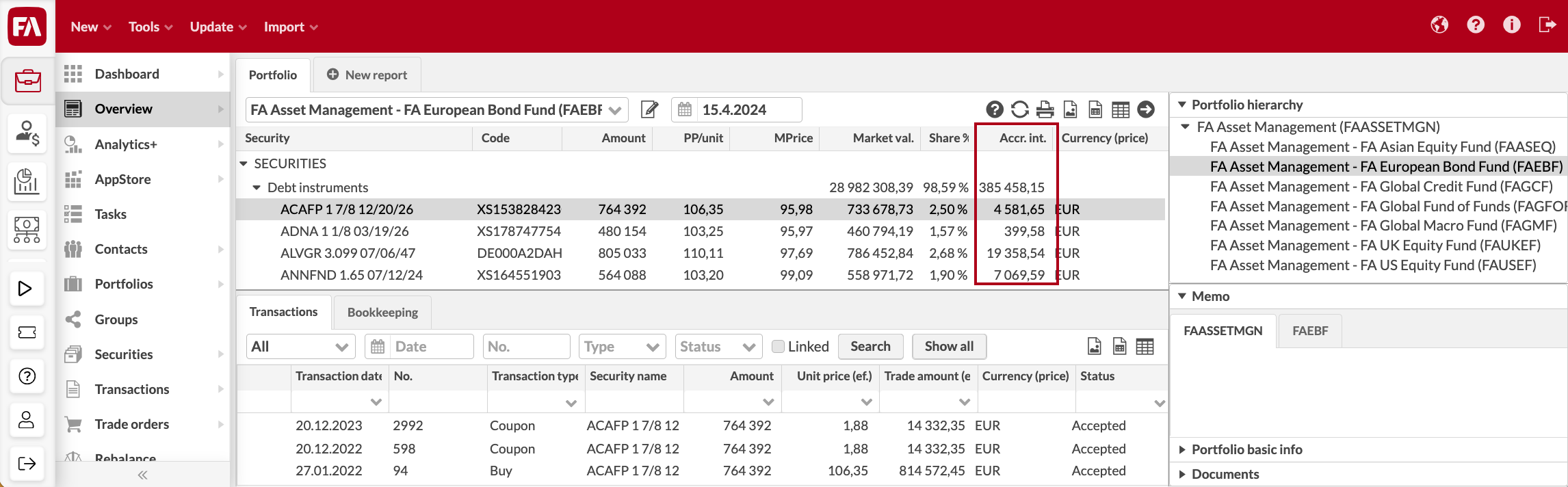

Track accrued interest on fixed and floating rate bonds

The system calculates the accrued interest for the position. You can check the accrued interest:

In the Overview and Analytics+.

In the Positions view.

Accrued interest on the position level is calculated based on the selected report date (unless you have overridden this on the portfolio level to calculate accrued interest on "settlement date", when the accrued is calculate based on a date calculated from the selected report date adjusted with bond's settlement date offset), holiday calendar and business day convention).

Note that the accrued interest between the transaction and settlement date is fetched from the transaction.

Create coupon payments and expirations

To generate coupon payments, use the Coupon payment corporate action (see Coupon payment). To generate expirations, use the Redemption corporate action (see Redemption). You can schedule corporate action runs to repeat them regularly. Use one of the tools that suits you best:

For a coupon payment on one bond, follow the steps in Record and run corporate actions to client portfolios.

For coupon payments on multiple bonds, import corporate actions in a file (see Corporate actions import) and run them from the Corporate actions view in FA Back (see Record and run corporate actions to client portfolios).

For coupon payments and expirations on all bonds in the system, use the functionality described in Automate corporate actions.

Monitor key bond indicators

You can monitor and aggregate key bond indicators, such as yield, convexity, and duration, in Analytics+. For details, see Analytics+ in FA Back reference and Monitor portfolios with debt instruments in Analytics+.