Rebalance methods

FA platform lets you set multiple rebalancing parameters to control how the rebalancing logic calculates what to buy and sell. You can combine the parameters in various ways. Below are the most common rebalance methods, with the parameters to use for each of them.

Conservative rebalance

With conservative rebalancing, you can purchase securities using only the cash in the portfolio account. You can realign the portfolio with the model in two rounds. In the first round, the system sells the excess positions above the target and buys with the available cash. After executing the sells and acquiring cash, the second round buys additional positions with the newly available cash to rebalance the portfolio fully.

Existing outstanding trade orders (all statuses except "Open") affect conservative rebalancing in the following way:

Buy trade orders with negative cash effect reduce the available cash to reserve cash for buys.

Outstanding trade orders with the same type for the same security are taken into account when the system suggests new trade orders. If you should buy something but you already have a buy trade order for that security, or if you should sell but already have a sell trade order for the security, the trade amount of the outstanding order is subtracted from the suggested order.

Example: You would need to buy Security A for 100 €, but you already have a trade order to buy Security A for 40 €. Rebalancing would create a buy trade order worth 100 € - 40 € = 60 €.

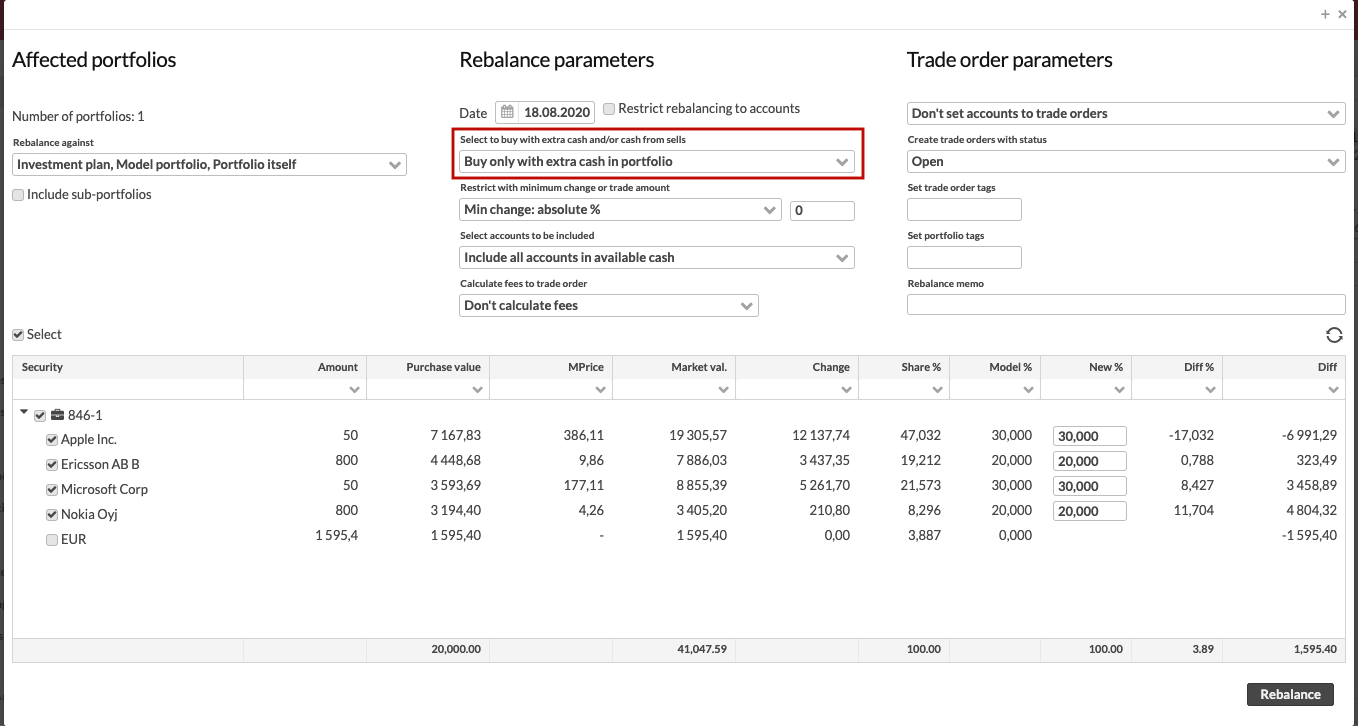

To apply the conservative rebalance method, choose "Conservative (buy only with extra cash in portfolio)" in the Rebalance method field in the Rebalance window. Do not restrict rebalancing to accounts.

|

Full rebalance

With full rebalancing, you can buy securities using both available cash and the cash expected from suggested sales. This method calculates buys based on the estimated cash you will have after executing suggested sales with the latest market prices. With full rebalance, you can realign your entire portfolio against the model in one go.

This method requires careful trade order management to ensure you settle the trades promptly and have enough cash to complete the buys. To mitigate the risk, you can set a limit on the cash from sells to use for buys during a full rebalance. For example, instead of counting sell values at 100%, you can count them at 95%. If the prices drop between rebalancing and executing sales, you'll likely still have enough cash to complete your buys. See Preference - Portfolios in FA Back for details.

Existing outstanding trade orders (all statuses except "Open") affect full rebalancing in the following way:

Buy trade orders with negative cash effect reduce the available cash to reserve cash for buys.

Outstanding trade orders with the same type for the same security are taken into account when the system suggests new trade orders. If you should buy something but you already have a buy trade order for that security, or if you should sell but already have a sell trade order for the security, the trade amount of the outstanding order is subtracted from the suggested order.

Example: You would need to buy Security A for 100 €, but you already have a trade order to buy Security A for 40 €. Rebalancing would create a buy trade order worth 100 € - 40 € = 60 €.

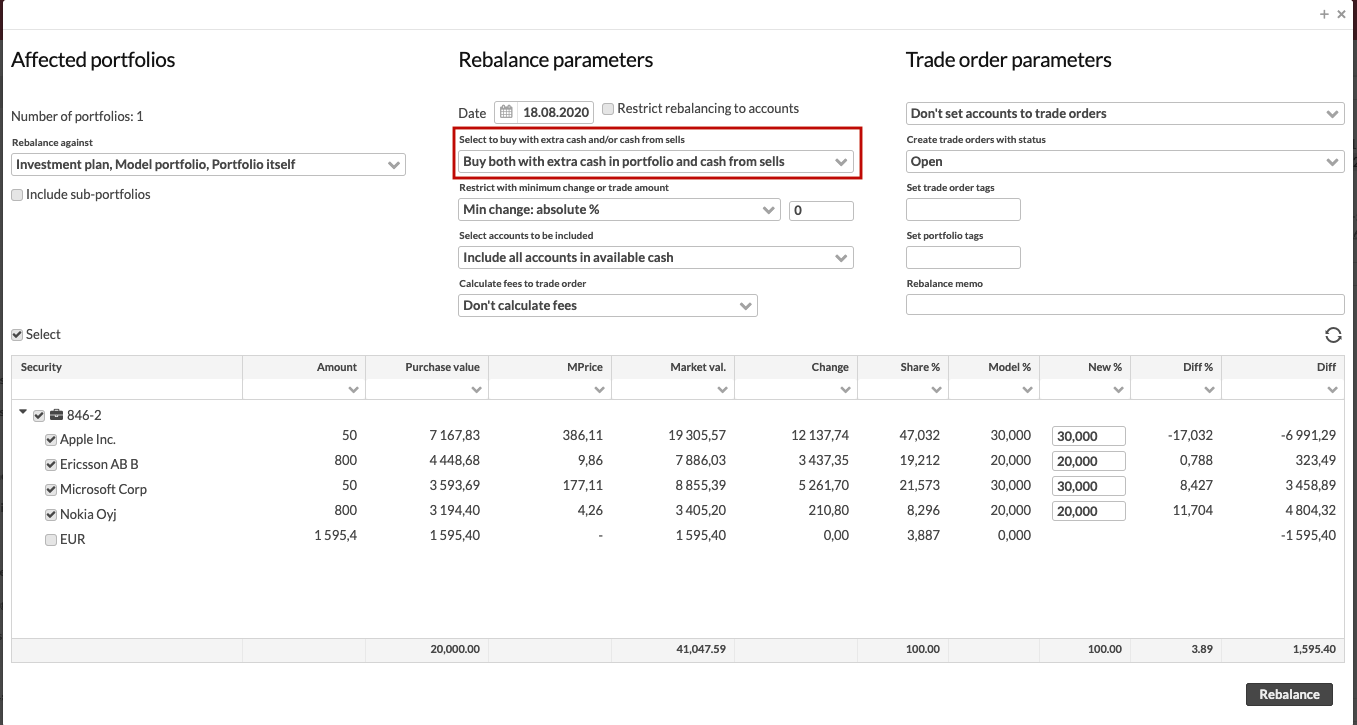

To apply this method, choose "Full (buy both with extra cash in portfolio and cash from sells)" in the Rebalance method field in the Rebalance window. Do not restrict rebalancing to accounts.

|

Full rebalance including outstanding orders

With full rebalance including outstanding orders, you can purchase securities using available cash, expected cash from recommended sells, and cash from outstanding trade orders with a positive cash effect (all statuses except "Open"), such as deposits and sells. Full rebalancing estimates available cash that will be received after executing all sells with the latest market prices. This method requires careful trade order management to ensure sufficient cash is available to complete your buys.

Before rebalancing, the system calculates expected positions. It sells any expected excess positions and buys with the cash expected to be available after executing these orders.

With full rebalance including outstanding trade orders, you can realign your entire portfolio at once, considering the effect of outstanding orders.

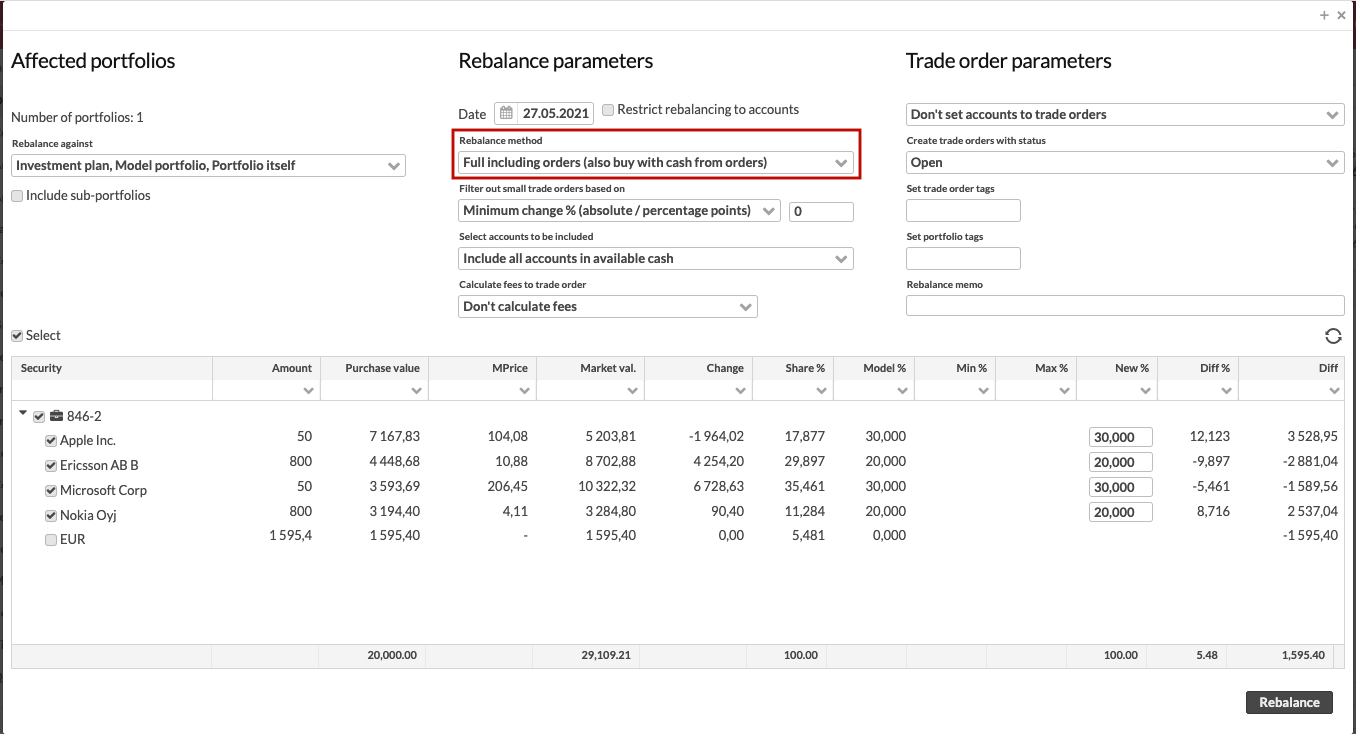

To apply this method, choose "Full including orders (also buy with cash from orders)" in the Rebalance method field in the Rebalance window. Do not restrict rebalancing to accounts.

|

Exchange

With exchange, you can sell a portfolio position that is above the target and buy a position that is below the target with the cash you expect to get from selling. The cash received from sells is estimated based on the latest market prices, putting pressure on your trade order management to ensure you settle your sell so that you have enough cash available to execute your buy.

Existing outstanding trade orders (all statuses except "Open") are considered in the exchange.

Buy trade orders with negative cash effect reduce the available cash to reserve cash for buys. (However, exchange will not use the your cash balance for the suggested trade orders).

Outstanding trade orders with the same type for the same security are taken into account when the system suggests new trade orders. If you should buy something but you already have a buy trade order for that security, or if you should sell but already have a sell trade order for the security, the trade amount of the outstanding order is subtracted from the suggested order.

Example: You would need to buy Security A for 100 €, but you already have a trade order to buy Security A for 40 €. Rebalancing would create a buy trade order worth 100 € - 40 € = 60 €.

You can swap one position for another without rebalancing your entire portfolio. This process sells positions above the target and uses the proceeds to buy positions below the target. The weights of the positions ensure the new position matches the investment weight of the old one.

To apply this method:

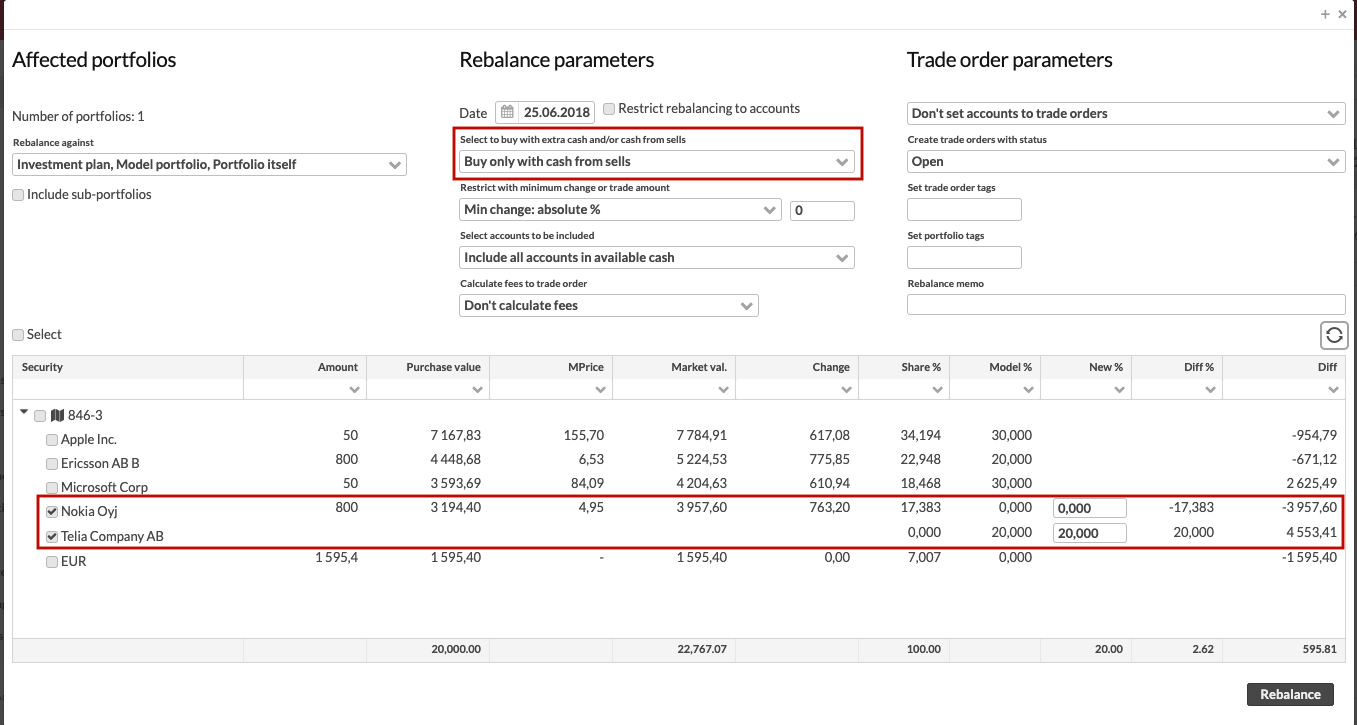

Choose "Exchange (buy only with cash from sells)" in the Rebalance method field in the Rebalance window. Do not restrict rebalancing to accounts.

Select the positions you want to exchange.

|

Invest cash

With the invest cash method, you can only use the excess cash in your account to buy securities, without making any other changes. It calculates purchases based on the available cash but does not involve selling any positions.

To apply this method:

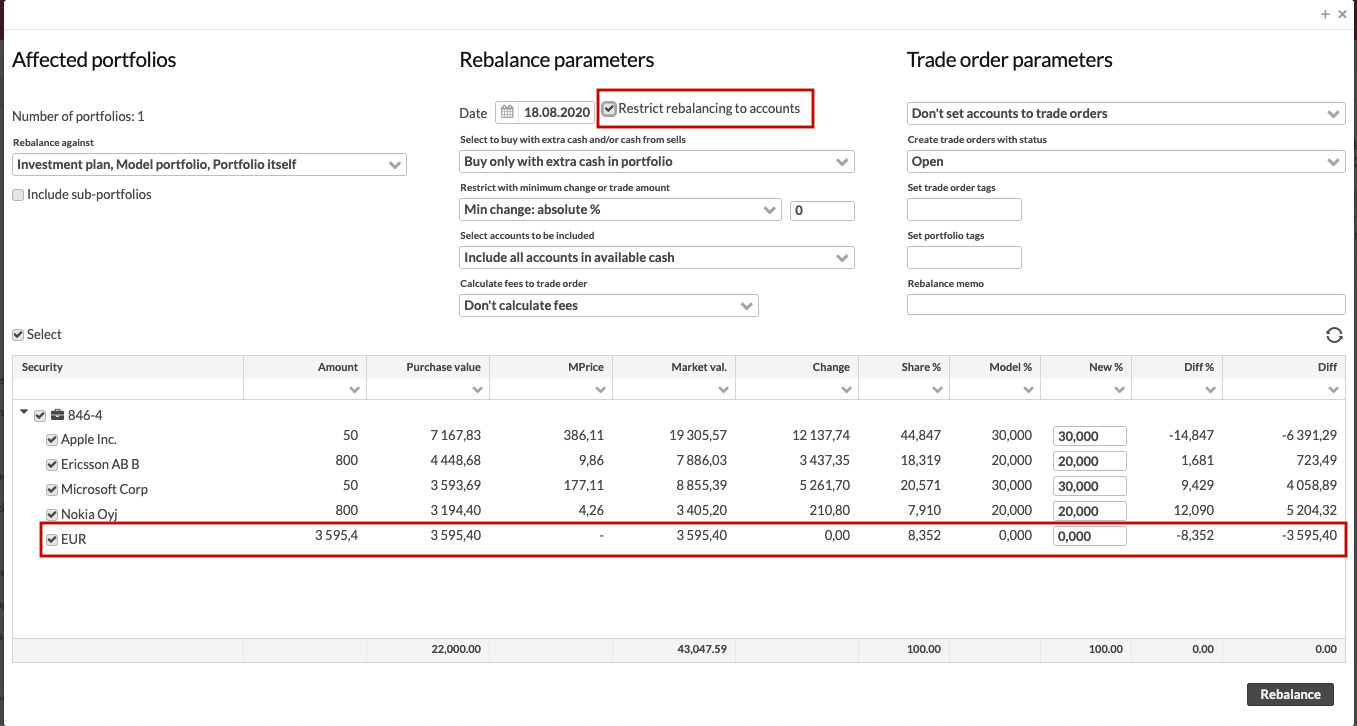

Choose Restrict rebalancing to accounts in the Rebalance window. This ensures that rebalancing will only buy with the excess cash you have, but will not sell anything.

Choose "Conservative (buy both with extra cash in portfolio" in the Rebalance method field in the Rebalance window.

|

Cover for cash

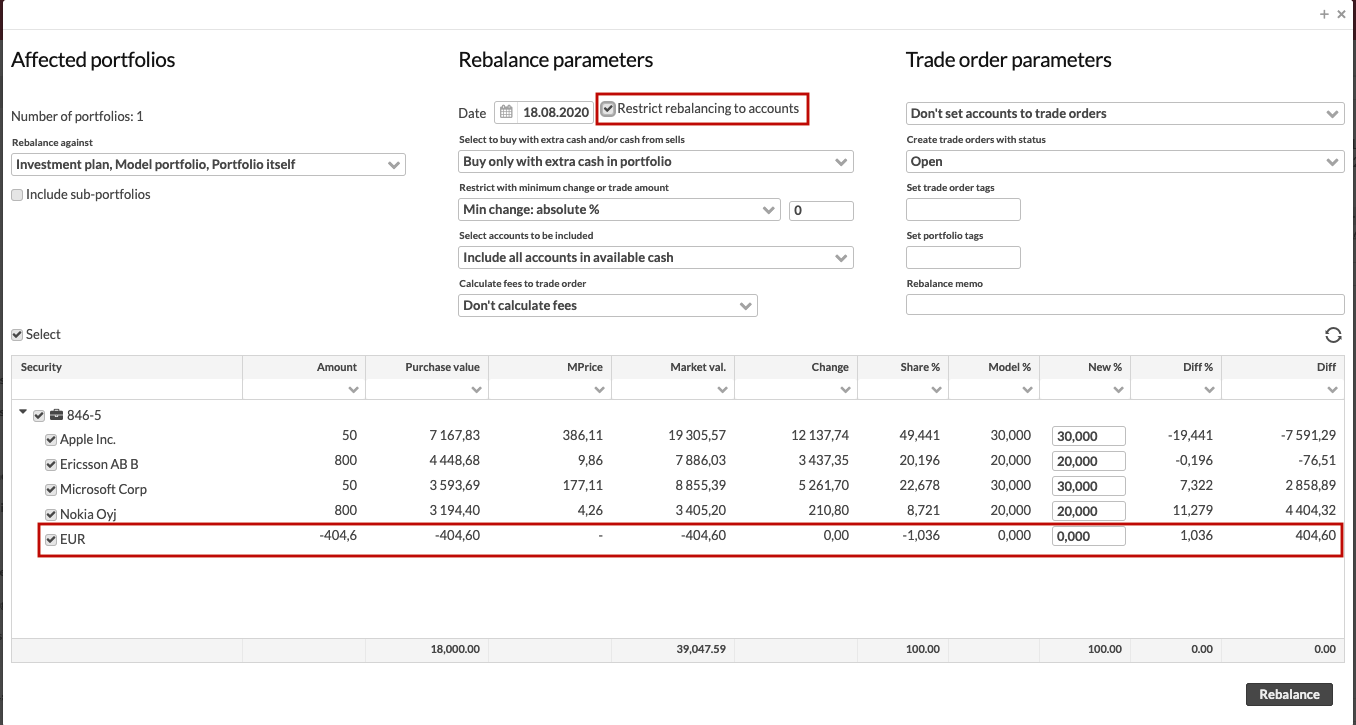

With the cover-for-cash method, you can only use sells to address a negative account balance without making any other changes to your portfolio. It calculates the necessary sells to reach your target cash level without generating additional sells or making any purchases. The rebalancing process only sells enough to cover the negative balance, preventing excess cash in the account, which this method aims to avoid.

This method lets you sell a portion of your holdings to cover for a negative account balance, for example after withdrawing fees from the portfolio, without realigning the entire portfolio.

To apply this method, choose Restrict rebalancing to accounts in the Rebalance window. This ensures that rebalancing will only sell to cover for the negative cash you have, but will not buy anything.

|

Model change

With the model change, you can update your portfolio model by selling the securities from the old model and investing everything into the securities in the new model.

You have an option to execute a model change either as Conservative rebalancing or Full rebalancing, depending on whether you prefer to do it gradually or all at once. Regardless of the method chosen, rebalancing will sell off your old positions entirely and reinvest the proceeds into the new positions.