Logic of limit analysis

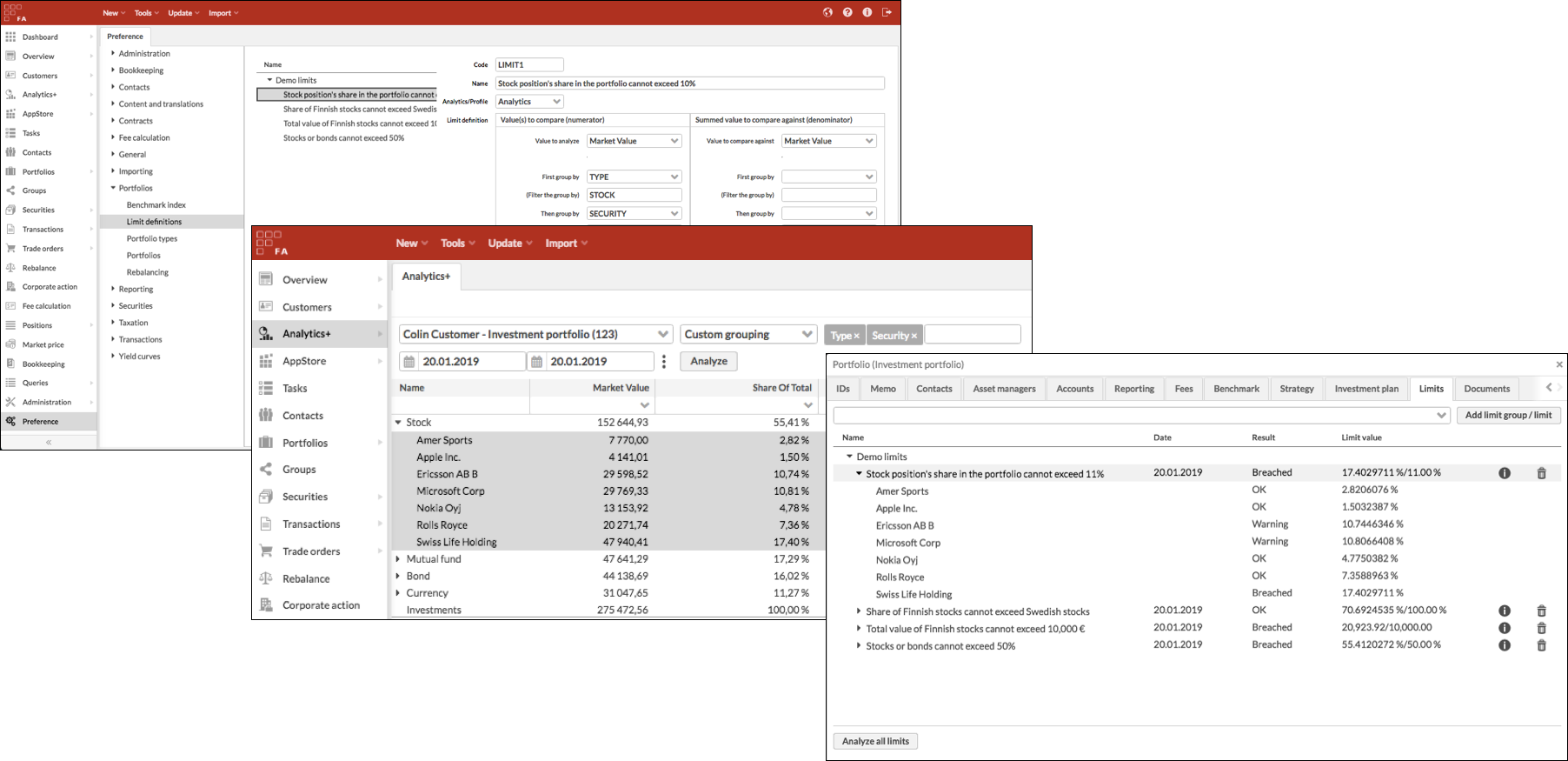

Analyzing your portfolios' post-trade limits compares your portfolio's current contents (i.e. your current investments post-trade) against the limit definitions you have linked to your portfolio, and provides you with a detailed analysis on which individual limits are OK, which induce a warning, and which limits have been breached. Limit definitions are usually based on one day's values from Analytics+, which allows you to follow up on the logic and calculation from the system yourself.

Logic of post-trade limit analysis

For each individual limit definition linked to your portfolio, you can backtrack the limit analysis done through the following steps:

Find the limit's limit definition from Preferences. The limit definition tells you how the limit has been defined, and allows you to see how the system fetches the values to analyze. For example, the limit definition tell you in detail how the system finds "Individual position in a security of the type stock" through grouping and filtering, indicated by the name of the limit.

Perform a search in Analytics Plus that corresponds with the group by values you have within your limit definition. Doing a search in Analytics+ allows you to find the values limit analysis compares against each other - after all, limits are based on Analytics+ values, thus you can find them in Analytics Plus.

Select the portfolio you want to analyze.

Set start date and end date of your analysis as the date of your limit analysis (e.g. today, yesterday, etc.). Limit analysis is done on one-day values from Analytics Plus.

Use Custom grouping to group your analysis with the same groupings as in your limit definition. For example, if your limit definitions First group by is TYPE and Then group by is SECURITY, define a custom grouping of Type and Security. This allows you to find the correct level and the value you are comparing in your limit.

To find the correct value, select the Value to analyze as a column within your analytics result - this is the value limit analysis is using.

Determine which individual values / within your analysis are taken into account. You can always find the values from the lowest level of your analysis - if you only grouped by Type, you are looking at which security types to analyze, but if you then also grouped by Security, you are looking which individual securities to analyze. If you applied a filter in your limit definition, then only consider values that match the filter, otherwise consider all values you can find from the lowest level of your analysis. For each row:

Fetch the Value to analyze and Value to compare to based on your limit definition from the corresponding column - for example, Value to analyze can be the market value of an individual security position, and Value to compare to can be the total market value of your portfolio.

For relative values, calculate the limit value as percentage with formula Value to analyze / Value to compare to. This provides you with a figure you can compare against your thresholds.

Based on the warning and breach thresholds, determine the status of your limit.

Result of your limit analysis is shown in the Limits tab. If your limit definition consists of multiple components, for example analyzed multiple individual securities within a group, determine whether your entire limit was breached. For example, limit of "No individual security can exceed 10%" consists of checking multiple securities, and if one of your securities breaches the threshold, your entire limit is breached.

Logic of pre-trade limit analysis

Pre-trade limit analysis is done in the background through similar steps as the post-trade limit analysis - in step 2, before analyzing the portfolio, the system calculates expected positions and excepted cash based on the effects of outstanding trade orders with appropriate statuses and latest available market values as described in pre-trade limits.

You cannot directly replicate the analysis in Analytics+, since Analytics+ only allows you to analyze current positions, not expected positions as the pre-trade limit analysis does. However, you can calculate the expected positions and cash based on current value and outstanding trade orders to be able to back track the situation from which the system calculates the pre-trade analysis from.