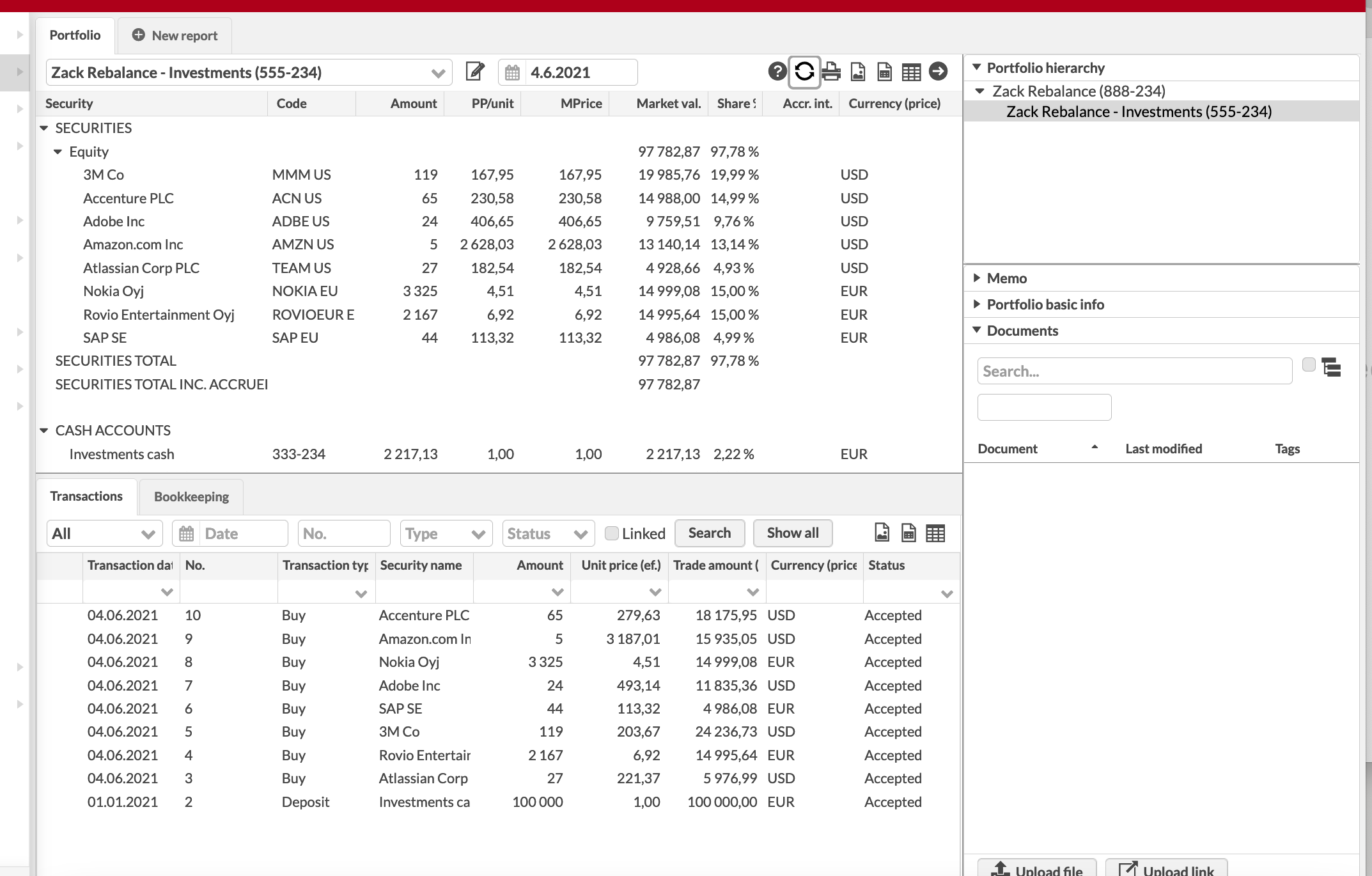

Rebalance portfolios against the model portfolio

In FA, you can create model portfolios and use these to keep your investment portfolios in balance through rebalancing the investment portfolios against a model portfolio. Rebalancing is a useful tool especially for discretionary asset management. In addition, FA supports rebalancing portfolios against a portfolio-specific investment plan - see more details through here.

Follow the steps below to set up model portfolios and rebalancing (steps 1 and 2) and to rebalance your investment portfolios against model portfolios (steps 3 and 4).

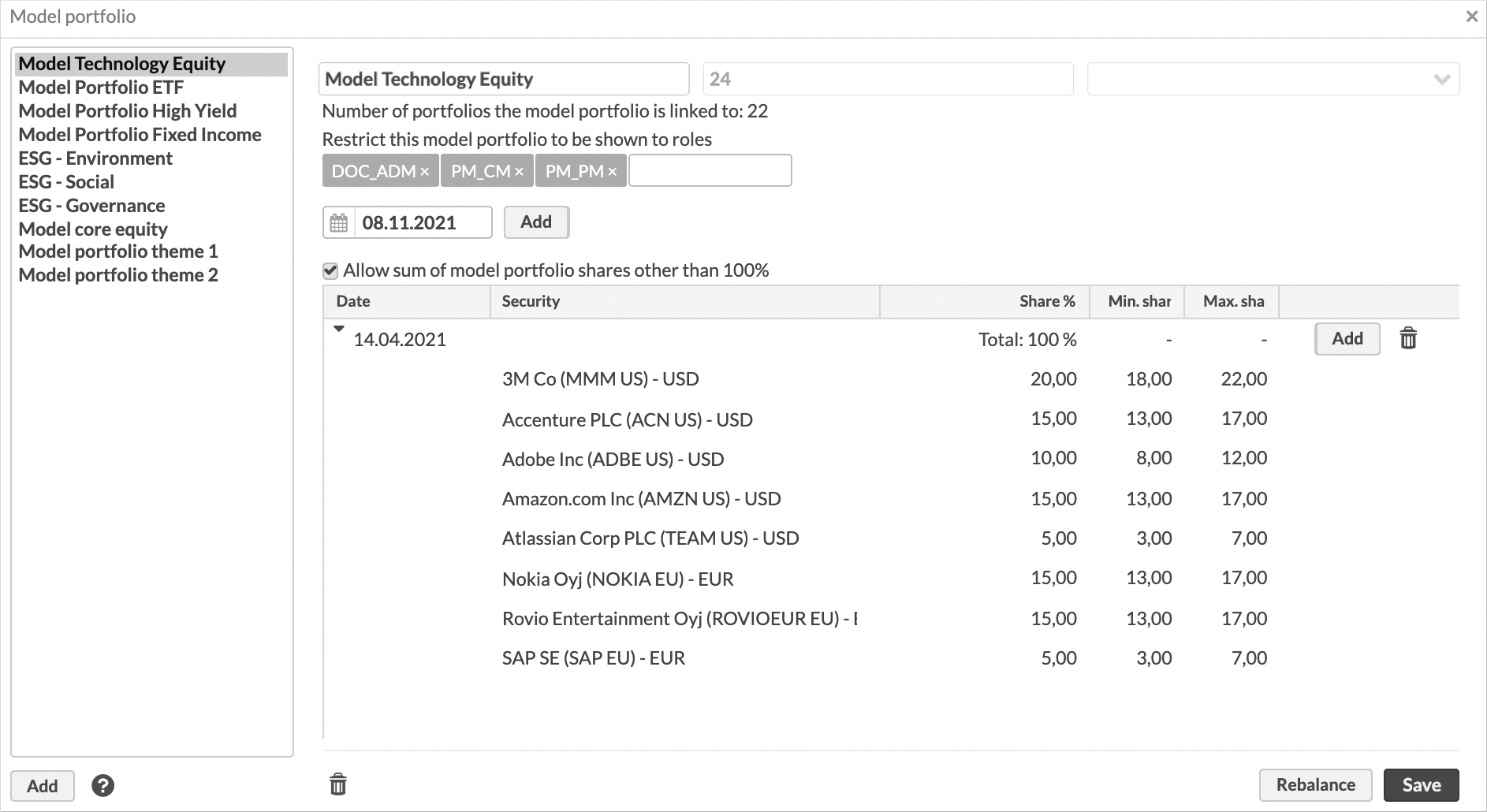

Step 1 - Create model portfolio(s)

The first step in rebalancing is to create the model portfolio(s) you want to match you investment portfolios to in terms of the securities and their shares in your model portfolio. Before starting to create a model portfolio, make sure you have created all the securities you want to include in your model as securities in FA.

There are two ways to define a model portfolio. For both approaches, click the Model portfolio button on the Rebalance view, Add a new model portfolio and define a name for you model portfolio. After this, you can either

a) Define fluctuating content and shares. Link the model portfolio to one of the portfolios defined in the system, when the securities the model consists of and their weights come from the linked portfolio, and change every day according to the market value of the positions in the linked portfolio. If you want to change the contents of the model portfolio, record appropriate transactions to the linked portfolio in order to alter the securities or their weights within it.

b) Define fixed content and shares. Set the date from which the model portfolio is valid from and define the securities the model consists of and their weights. If you want to change the contents of the model portfolio, add a new date with new securities and weights.

|

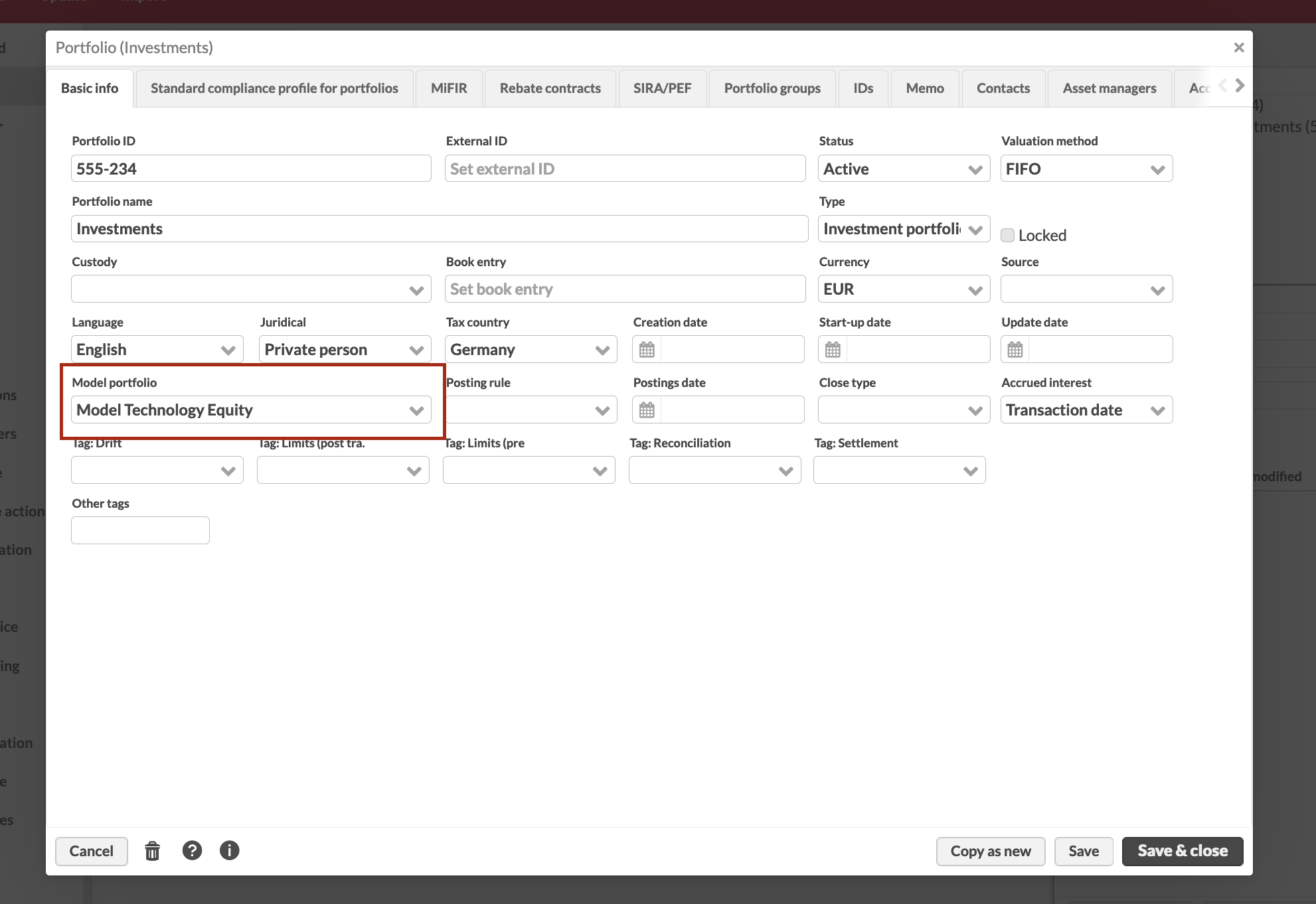

Step 2 - Link your customers' investment portfolios to appropriate model portfolio

Second, after having created model portfolios to FA, link each of your customer's investment portfolios to an appropriate model portfolio in order to rebalance the investment portfolios - each investment portfolio can only be linked to one model portfolio, and an investment portfolio can only be rebalanced against a model portfolio when the linking is done appropriately.

A model portfolio can be linked to an investment portfolio in the Portfolio window. Open the investment portfolio's information and select a model portfolio to you investment portfolio from the Model portfolio field under the Basic info tab.

|

Step 3 - Rebalance your investment portfolios in order to get trade orders to buy or sell to match your investment portfolios to their linked model portfolio

Once you have set up rebalancing in steps 1 and 2, you can rebalance your investment portfolios, or to use the rebalancing functionality to create trade orders to buy and sell securities for your investment portfolios.

There are different ways to rebalance investment portfolio(s). You can either

a) Rebalance a single portfolio through the Overview. Select your investment portfolio on the Overview, and right-click it under the Selected portfolios section on the right. From the menu available, choose Rebalancing.

b) Rebalance all investment portfolios linked to a model portfolio through the Rebalance view. Either click the Rebalancing button directly on the Rebalance view and select the model portfolio you want to use, or click the Rebalancing button through the Model portfolio window for the model portfolio you want to use. You can also restrict the investment portfolios, linked to the selected model portfolio, to be rebalanced by selecting the appropriate portfolio(s) from the corresponding field.

c) Rebalance selected portfolios against the model portfolio defined for each through the Portfolios view. Search the portfolios you want to rebalance on the Portfolios view (use quick searches, filtering or saved searches to search for the portfolios you want to rebalance), and click Rebalance at the bottom of the view and select one of the options including Model portfolio. This option allows you to simultaneously rebalance multiple investment portfolios even with different model portfolios linked to each.

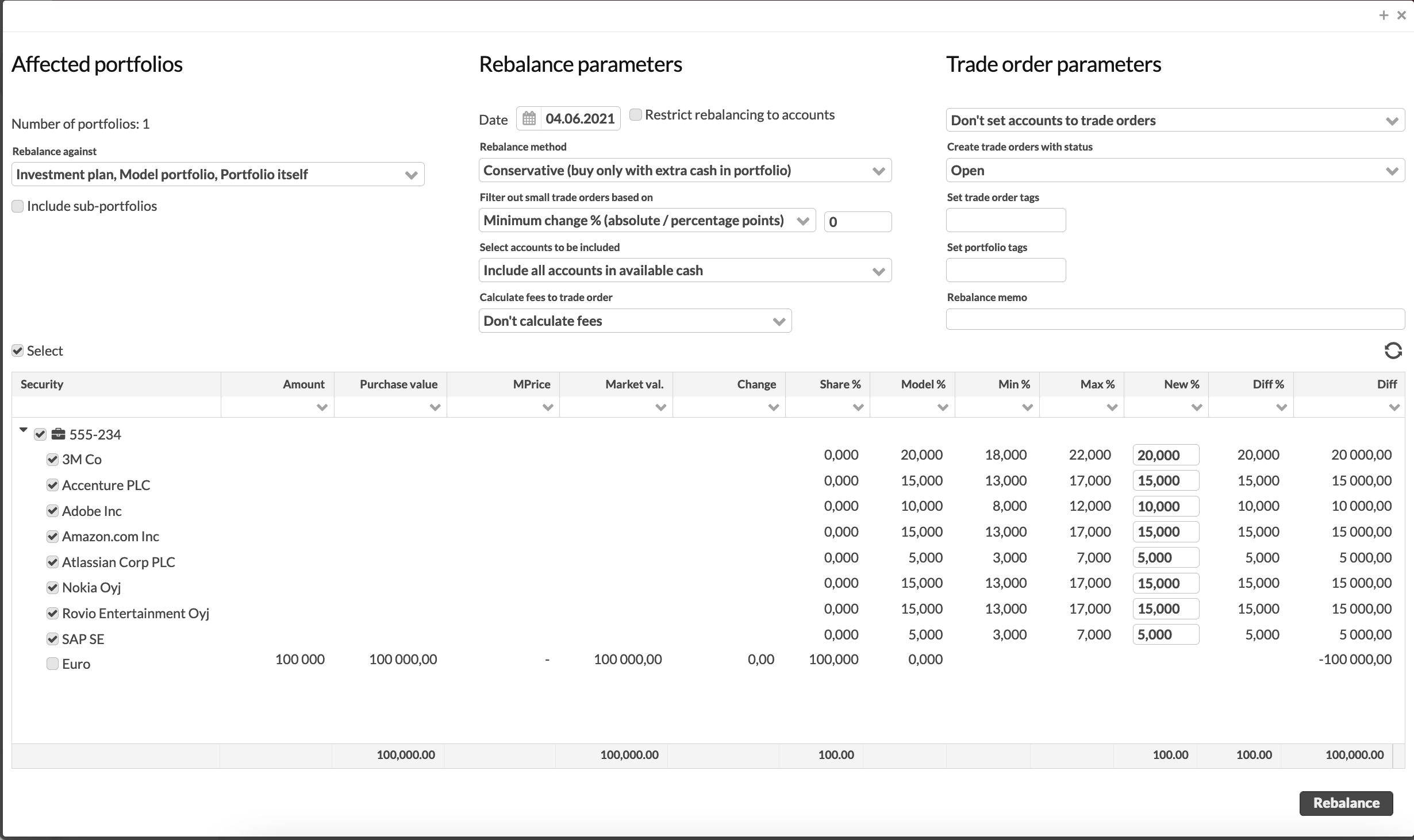

In all cases, after having initiated rebalancing, the rebalancing process goes through the same steps within the Rebalance window. To rebalance your investment portfolios

Define the rebalancing parameters in the rebalance window by making appropriate selections for affected portfolios, rebalancing parameters and trade order parameters. In addition, you can manually adjust the new share percentages of each security fetched from the model portfolio.

Click Rebalance in order for the system to rebalance you investment portfolio(s) and suggest trade orders. The trade orders to be created is determined by the rebalancing logic.

If necessary, restrict the list of suggested trade orders. Restricting the trade orders allows you to only create some suggested trade orders: utilise the search fields to search for trade orders within the suggestion, or filter the trade orders shown with the columns available to restrict the trade orders to be saved.

Save the trade orders visible in the trade orders window. Note that only the trade orders visible will be saved as trade orders to the portfolio - if you want to save all suggested trade orders, clear all filters and search criteria before saving.

Step 4 - Execute the trade orders in order to create transactions in your investment portfolios

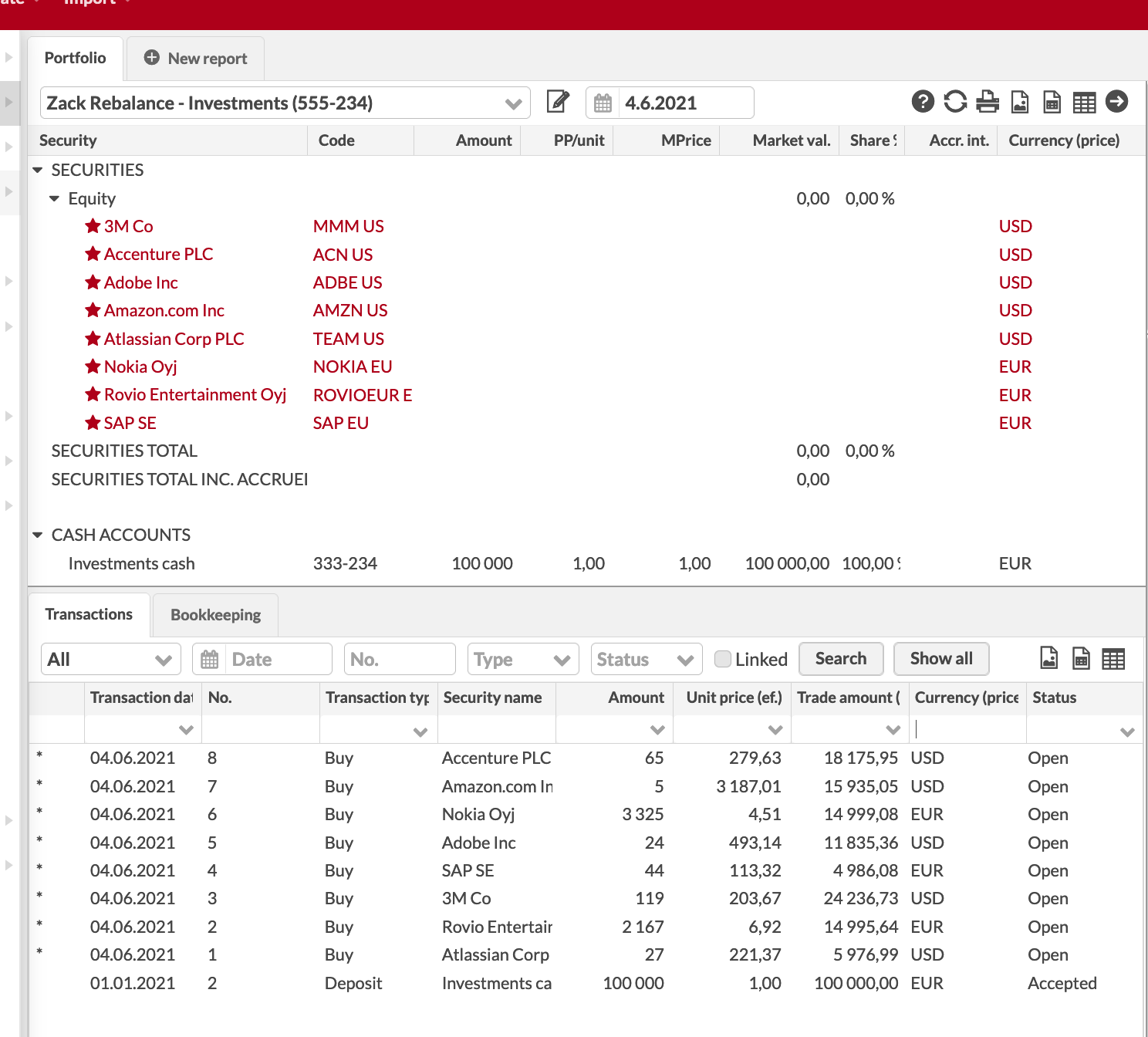

After rebalancing an investment portfolio against a model portfolio, trade orders to buy and sell securities are created to the investment portfolio. In order to fully rebalance an investment portfolio and to match its contents to the linked model portfolio, the trade orders should to be executed in order for them to have an effect on the contents of the investment portfolio.

To execute trade orders

Search for the created trade orders in the Trade orders view and set their status to be Executable. Send the executable trade orders forward, and buy and sell securities to your investment portfolio(s) based on the suggested trade orders.

Once the trades have been implemented in the market, execute trade orders in FA with the realized values in order to create transactions to your investment portfolios.